This judgment will be handed down by the Judge remotely by circulation to the parties' representatives by email and release to The National Archives. The date and time for hand-down is deemed to be 10:30 am on Thursday 8 September 2022.

Introduction

1. This is a claim by Elizabeth May Ramus (“Mrs Ramus”) under the Inheritance (Provision for Family and Dependants) Act 1975 (“the 1975 Act”) for reasonable financial provision from the estate of her late husband, Christopher Stewart Ramus (“Mr Ramus”).

2. The First Defendant, Claire Louise Holt (“Mrs Holt”), is the daughter of Mr and Mrs Ramus. She is both an executor and trustee of the estate of her late father under his will and a beneficiary under it. The Second and Third Defendants, Anthony John Armitage (“Mr Armitage”) and John Wilkinson Wardle (“Mr Wardle”) are both executors and trustees of Mr Ramus’s will. Although both Mr Armitage and Mr Wardle have professional expertise which is relevant to their role as trustees (the former as an accountant and insolvency practitioner and the latter as a director of a wealth management company), they were also longstanding friends of Mr and Mrs Ramus. The Fourth Defendant, Alistair Stewart Ramus (“Alistair”), is the son of Mr and Mrs Ramus and a beneficiary under the will of his late father.

3. Mrs Ramus was represented by Miss Nicola Phillipson of counsel, Mrs Holt in her capacity as beneficiary by Mr Duncan Heath of counsel and Mrs Holt, Mr Armitage and Mr Wardle in their capacity as executors and trustees by Mr Thomas Entwistle of counsel. Alistair, although a party to the action, took no part in the trial of the action. He did not appear before me and was not represented.

4. Mrs Holt has 3 children and Alistair has 2 children, all of whom are minors.

Background

5. Mr Ramus died by his own hand in tragic circumstances on 23 June 2020. Mrs Ramus is his widow. She was born on 14 November 1944 and is now 77. They had been married for 48 years, although in 2019 Mrs Ramus had decided to end the marriage.

6. Mr Ramus made his last will on 30 April 2014. In its original form it appointed Mrs Holt and Mr Armitage as executors and trustees. However, Mr Ramus made three codicils, on 15 September 2015, 13 July 2017 and finally on 20 September 2019, changing the identity of the executor and trustees. By his third codicil he appointed Mrs Holt, Mr Armitage and Mr Wardle as his executors and trustees.

7. By his will Mr Ramus provided that his sporting equipment was to go to Alistair and his personal chattels to Mrs Ramus. By clause 7 he provided that a fund of £50,000 be set aside for his 5 grandchildren in equal shares, contingent on attaining the age of 25. By clause 8 he gave further pecuniary legacies in a total sum of £9,000. He had 5 grandchildren: Reggie Ramus (13) and Ellery Ramus (10), Alistair’s children, and Rock Holt (7), Axel Holt (5) and Hunter Holt (5), Mrs Holt’s children.

8. By clause 11 Mr Ramus provided that

“MY TRUSTEES shall hold my residuary estate upon the following trusts:

11.1 if my Wife shall survive me my Trustees shall pay the income of my residuary estate to my WIFE during her life

11.2 provided that my Trustees (being at least two in number) shall have power in their absolute discretion from time to time so long as my Wife is entitled to be paid the income (if any) of all or any part of the capital of my residuary estate

11.2.1 to pay transfer or apply the whole or any part or parts of such capital to her or for her benefit in such manner as they shall in their absolute discretion think fit and

11.2.2 to terminate by declaration contained in any deed or deeds her right to be paid the income (if any) of all or any part of the capital of my residuary estate from a date not earlier than the date of any such deed and so accelerate the trusts hereinafter contained or appointed under the powers hereinafter contained and in any such deed my Trustees may also declare that my Wife shall thenceforth cease to be among the Discretionary Beneficiaries (defined below) and be excluded from all benefit of any kind whatsoever in relation to the capital and income of such part of my residuary estate

11.2.3 subject as aforesaid my Trustees shall hold my residuary estate upon the trusts and with and subject to the powers and provisions of clause 12 below”.

9. By clause 12, so far as material, he provided that

“12.1 IN THIS clause the following expressions have the following meanings namely:

12.1.1 'the Trust Fund' means:

12.1.1.1 my residuary estate

12.1.1.2 all money investments or other property paid or transferred by any person to or so as to be under the control of and in either case accepted by the Trustees as additions

12.1.1.3 all accumulations (if any) of income added to the Trust

Fund and

12.1.1.4 all money investments and property from time to time

representing the above.

12.1.2 'the Discretionary Beneficiaries' means:

12.1.2.1 my children and remoter issue and

12.1.2.2 (subject to clause 1[1].2.2 above) my Wife

12.1.2.3 the said Royal National [Life]boat Institution and

12.1.2.4 such persons or Charities as are added under sub- clause 12.5.

12.1.3 'the Trust Period' means the period of 125 years commencing on my death

12.1.4 'Charity' means any Entity established only for the purpose regarded as charitable under the law of England a transfer of value to which would qualify in its entirety for exemption under section 23 of the Inheritance Act 1984

12.1.5 'Entity’ means any company partnership trust foundation

establishment association or other body established or resident in any part of the world and whether or not it has a separate legal personality and/or corporate identity

12.2 My Trustees shall hold the Trust Fund and the income thereof upon trust for all or such one or more of the Discretionary Beneficiaries at such ages or times in such shares and upon such trusts for the benefit of the Discretionary Beneficiaries as [my Trustees] (being at least two in number) may by deed or deeds revocable or irrevocable executed at any time or times during the Trust Period appoint and in making any such appointment my Trustees shall have powers as full as those which they would possess if they were an absolute beneficial owner of the Trust Fund …”.

10. Thus, in summary, clauses 11 and 12 provided for Mr Ramus’s residuary estate to be held on trusts under which:

(a) Mrs Ramus has a life interest;

(b) the trustees have power to apply capital for Mrs Ramus’s benefit;

(c) the trustees also have power to terminate the life interest;

(d) subject to the life interest, the residuary estate (“the Trust Fund”) is held on flexible discretionary trusts for a class of “Discretionary Beneficiaries”, including Mr Ramus’s children and remoter issue and Mrs Ramus (but subject to the trustees’ power to exclude her from benefit).

11. On the same day as he made his third codicil, altering the identity of his executors and trustees, Mr Ramus also signed a letter of wishes by which he gave non-binding guidance to the trustees as to how he wished them to exercise their discretions. That guidance included the following:

“DISCRETIONARY TRUST OF RESIDUARY ESTATE: GENERAL AIM OF THIS GUIDANCE

1.1 In my Will I have appointed you as trustees of my residuary estate, which subject to the life interest for my wife, Elizabeth May Ramus (‘Liz'), you hold on discretionary trusts. I am writing this letter so you will know my wishes and motivations in leaving my estate in this way. I hope you will take my wishes into account and carry them out wherever possible.

1.2 This letter is intended as general guidance only. It does not create any obligation on you, nor does it give any beneficiary of my estate any rights. It does not curtail or override the discretionary powers given to you by my Will. I am confident that you will exercise your discretions appropriately in the circumstances after my death and in the light of your own views.

2 WISHES ABOUT THE PRIMARY BENEFICIARY

2.1 My current matrimonial circumstances are uncertain. If my wife survives me I still wish that she will have a right to income from the Trust Fund to the extent that it prevents hardship and enables her to maintain her lifestyle. I would like this to continue for as long as you feel necessary.

If her own resources are such that she does not require that income then you should consider exercising your powers to remove her right to income in all or part of the Trust Fund.

2.2 I do not wish for my wife to receive capital payments from the Trust Fund in order to protect the fund for future generations.

2.3 If the trust contains my share of the family home and my wife wants to continue living in the house, then she will have the right to do so, subject to Liz keeping the property in repair and paying the usual outgoings and insurance premiums. If Liz wants to sell the family home and buy another house I would like you to co-operate with that sale and to buy another property for my wife to occupy as the family home.

2.4 If my wife remarries or enters into a civil partnership or cohabits as if she were married or in a civil partnership, I ask that you consider making no further distributions from the Trust Fund to her and preserve the remaining funds for my children and grandchildren.

3 WISHES ABOUT BENEFITING MY CHILDREN AND GRANDCHILDREN

3.1 If my wife's circumstances allow, and in any event after her death, I would like you to consider exercising your powers to benefit my children and grandchildren.

3.2 Distributions between children and grandchildren

Whilst Alistair's financial and business circumstances are not settled and do not have a firm footing, I do not wish for Alistair to receive capital payments from the Trust Fund. I would like you to consider making income payments to Alistair to prevent him from living in hardship, but not to fund an extravagant lifestyle.

In regards to my daughter Claire I would like you to consider exercising your powers to benefit Claire, about whom I do not have the same concerns.

In regards to my grandchildren, in principle I would like them to be treated equally per head, but if one should have an extraordinary need (for example, health issues or suffering a serious accident), I would be happy for provision for that child to be greater than that of his or her siblings”.

12. The trustees took out a grant of probate to Mr Ramus’s estate on 24 November 2020 (having previously taken out a grant ad colligenda bona on 3 September 2020 to allow the sale of the former matrimonial property to proceed). The net value of the estate was sworn at £1,082,818. Mrs Ramus commenced proceedings on 21 May 2021, just within the primary 6 month period provided for by the 1975 Act.

Mrs Ramus

1st Witness Statement

13. Mr and Mrs Ramus met in 1967 and were married in 1972. They had two children together, Mrs Holt (born in 1976) and Alistair (born in 1978). When Mrs Ramus met her future husband she was a nurse, but in 1973 she gave up her nursing career to start a seafood business with him. She was an active participant in the business, in particular in the office and financial management. They ran the business jointly until they sold it in 1999. The business was very successful and they enjoyed a financially comfortable lifestyle.

14. Her personal relationship with her husband was, at times, difficult. He could be controlling and overbearing and matters came to a head in 2019 when she decided that it was time to leave him. There had been a history of difficulties between Mr Ramus and Mrs Holt and, for around six months in 2017, she would not let her father see his grandchildren. Mrs Ramus was instrumental in rebuilding the relationship between her daughter and her husband, but once the relationship was restored, he began putting Mrs Holt above his wife, which caused problems between husband and wife. There was then an incident in which Mrs Holt called her mother an “absent grandparent”. Mrs Ramus was deeply hurt and upset by the remark and felt that it was entirely unjustified as she had frequently travelled up and down the motorway to see her daughter and assist with her grandchildren. Mr Ramus agreed that it was wrong of Mrs Holt to make such an accusation, but he refused to offer his wife any support in the face of her daughter’s criticism of her. After the efforts which Mrs Ramus had made to restore the relationship between father and daughter, she felt that the time had come to end the marriage and she therefore told her husband that she was leaving.

15. The breakdown of the marriage came as a great shock to Mr Ramus - he even telephoned his wife’s GP to suggest that she had dementia. He became depressed and Mrs Ramus accepted that her daughter provided a lot of support to her father at the time.

16. As part of the separation, they put their marital home in Duchy Road, Harrogate on the market in March 2020. It sold very quickly for around £1.1 million, with a completion date of September 2020. (The executors of the estate completed the sale with an ad colligenda bona grant, as mentioned above.)

17. Mr and Mrs Ramus continued to live together in the marital home during that time and she continued to care for her husband as she had throughout their marriage. On 23 June 2020 he viewed a furnished flat to move into and she offered to help him with his move. Mrs Ramus was also moving into rented accommodation until she could find a replacement property. She left her husband on that day for around an hour to visit a friend and upon her return to Duchy Road she found her husband, who had committed suicide.

18. Mrs Ramus was very concerned that the trustees had the absolute power to terminate the payment of income to her and it was for that reason that she had made this application under the 1975 Act. She did not believe that the will as drafted made reasonable financial provision for her, as the trustees could stop payment of the income to her at any time and could refuse to advance any capital. She had referred to details of difficulties which she had previously had with her daughter and would characterise their current relationship as strained. She also had concerns over the way in which she had been treated by Mrs Holt and the other executors since the death of her husband.

19. The day after he died, Mrs Holt attended her home and took possession of his Defender vehicle, Rolex watch, telephone and wallet and subsequently arranged for the hard drive of their computer, which was in the repair shop, to be sent to her instead of to her mother. As executor, Mrs Holt was aware that all of her father’s chattels, including his car, passed to Mrs Ramus under the will and in any event the computer was part owned by Mrs Ramus.

20. The seafood business which the couple ran had commercial premises on Kings Road in Harrogate. Following the sale of the business, the property was providing them with rental income of around £50,000 annually. However, the premises became vacant in April 2020 and they had discussed putting the property on the market. Following the death of Mr Ramus, Mrs Ramus felt pressurised by the executors into putting the property on the market and she had occasionally experienced difficulties in being reimbursed by the estate for 50% of the running costs of the empty property. She had also felt pressurised by the executors in relation to the sale of the property; the executors had unnecessarily brought in a second set of estate agents from Leeds, were attempting to agree a reduction in price, despite advice from the estate agents that there was interest in the property and they unilaterally obtained an asbestos report for the property without reference to her, without obtaining comparable quotes, and at a price three times that which her estate agent would have charged.

21. Mrs Ramus also felt that she was misled by the executors over the date on which probate was granted. She was told by the executors that probate was granted ‘at the end of January’ and also that it was obtained on 8 January 2021. Probate was, however granted, on 24 November 2020. She did not find that out until 19 March 2021, which left her with very little time to issue a claim under the Act within the relevant limitation period. Had she relied on the executors’ information that probate was obtained in January 2021, she would have missed the limitation period.

22. Mrs Ramus did not have confidence that she would receive the income and/or capital from the trust which she needed to maintain her lifestyle and, as her future financial security was solely in the hands of the trustees, she did not consider that the will made reasonable financial provision for her.

23. At the time of her first witness statement, when the proceedings were launched, on 21 May 2021, Mrs Ramus was 76 years old, her date of birth being 14 November 1944. By the time of the trial she was 77.

24. Following the sale of the former matrimonial home which she shared with her husband, she was currently renting. That was, however, always intended to be a temporary arrangement and she was currently looking for a property to purchase.

25. Her current cash assets were high as they included £520,000 received following the sale of the former matrimonial home. However, they would be significantly depleted once she had bought a new property.

26. As at the commencement of proceedings, her assets included

|

Half share in business premises: (agreed sale price of £670,000; thus her half share would be in

the region of £335,000 - although she was advised by her financial

adviser that that sum would be reduced by the payment of CGT

on her share)

|

£335,000 |

|

Premium bonds: |

£50,000 |

|

Direct ISA: |

£10,755 |

|

Income bonds: |

£500,000 |

|

ISA portfolio: |

£264,954 |

|

Cash in various bank accounts: |

£64,707 |

|

Total: |

£1,225,416 |

|

(subject to amendment following sale of property and CGT

calculation) |

|

27. She also had a Volvo which she believed currently had a re-sale value in the region of £27,000 to £30,000.

28. She had income of around £1,800 per month, made up of pension income of around £1,000 per month and £800 per month in capital drawdown from her pension.

29. Her current expenditure was around £5,113 per month. That was an average of her expenses during the previous year whilst England was under COVID- 19 restrictions. She anticipated her expenses would increase as restrictions lessened. A schedule of her current monthly outgoings, prepared by her solicitors from information which she had provided, was tabulated as follows:

|

Rent |

£1,400.00 |

|

Council tax |

£223.95 |

|

Water |

£10.00 |

|

Electricity |

£80.00 |

|

Telephone |

£36.81 |

|

Property and household insurance |

£34.22 |

|

Home maintenance, cleaning and repair |

£20.00 |

|

Life and endowment insurance |

£34.00 |

|

Food and household |

£500.00 |

|

Domestic help |

£200.00 |

|

Clothing |

£100.00 |

|

Hairdressing and personal care |

£250.00 |

|

TV licence/ hire/ video rental |

£13.15 |

|

Newspapers and journals

|

£25.00 |

|

Medical, dental, optical & pharmaceutical |

£53.30 |

|

Dry cleaning, laundry, cleaning, shoe repairs |

£20.00 |

|

Road tax |

£40.00 |

|

Car insurance |

£20.00 |

|

Petrol, parking, running and repairs for vehicle |

£100.00 |

|

Provision for replacement vehicle / lease costs |

£520.00 |

|

Financial planner's fees |

|

|

Osteopath/chiro fees |

£60.00 |

|

Accountants fees |

£25.00 |

|

Eating out and takeaway |

£120.00 |

|

Sports and leisure |

£98.00 |

|

Books, music, video hire/purchase |

£10.00 |

|

Drinks and tobacco |

£20.00 |

|

Holidays and breaks |

£420.00 |

|

Computer (incl. ink) and internet |

£20.00 |

|

Memberships and subscriptions |

£5.00 |

|

Charities and covenants |

£5.00 |

|

Gifts (birthdays, Christmas, etc) |

£650.00 |

|

Total |

£5,113.43 |

30. She accepted that, once she had purchased a new property, she would no longer need to pay rent. However, there would then be higher expenses associated with the upkeep of the property.

31. As to her future needs, she intended to purchase a new property. She anticipated that that would cost in the region of £700,000. She would also have to pay stamp duty on the property, legal fees and removal fees and it was highly likely that she would incur costs in relation to decoration of the new property.

32. She was currently only able to meet her monthly expenditure by using her capital and savings. However, that was clearly not a long-term solution and she therefore required a monthly income to enable her to pay her outgoings without using the capital which would be left after her purchase of a new home. She would need the remaining capital both to generate an income and to provide her with a capital cushion should she have medical or care needs in the future.

33. She believed that her husband had an obligation to make financial provision for her. Had he not died, she believed that an arrangement would have been reached whereby he paid her a monthly sum to enable her to pay her outgoings. Although that would hopefully have been agreed between them, she understood that it was then common to have such agreements made into orders of the Court so that she could have enforced such an agreement against her husband.

34. She considered that the relationship between her and her daughter and between her and the other executors was likely to be of relevance as she was dependent upon the trustees to receive an income from the trust.

35. The letter of wishes written by her husband was a relevant document for the Court to consider. It was written after she had told him that she was leaving, but he still wished for her to have a right to the income from his estate. She also relied on a letter written to her by her husband and dated 16 June 2020, shortly before he died in which he said:

“My dearest Liz

Time suddenly feels so short and I just want to say thank you for your kindness to me when I really don't deserve it. You are a wonderful wife and partner in life. I don't deserve your kindness. You deserve better than the way I have been in recent times. I'm very proud that you are handling the current situation better than I am. You have been the best wife any man could wish for. You are loving and kind, always putting the needs of others before yourself. You have been a "one in a million" wife to me. I have been so lucky to have you beside me. I have come up short far too often in recent years!!

I just want you to know that I will do all I can to support you going forward and I hope we can get this house sorted out for you. I'm so sorry that the last year has been so awful. Whatever happens going forward from today, I just want you to know that I have always loved you with all my heart. There has only ever been you in my heart!!

Thank you for everything you have done for me. Thank you for being a wonderful mother to Claire and Alistair. Thank you for being my best friend and the one who has tried to always make our home the best it can be. I hope the next few weeks can be as good as possible. Thank you for just being there during the last year, and holding everything together.

The best of luck in your new home — best wishes for the future.

Love Chris

Xx”

36. She also considered that it was relevant that, following the death of her husband, she was advised that he had amended the name of his pension nominee to Mrs Holt and that she therefore received his pension lump sum of £500,000. Mrs Ramus did not seek to interfere with that nomination or request that the pension trustees consider paying some or all of the lump sum to her, as she wanted to respect her late husband’s wishes, but clearly such a lump sum would have given her financial security, rather than the financial difficulties which she now faced in maintaining her lifestyle.

37. As to the particular considerations under the Act where the application for provision was made by a spouse of the deceased, she reiterated that she was currently 76 years old (now 77), her date of birth being 14 November 1944. At the date of the death of her husband, they had been married for 48 years. She had made a full contribution to the marriage, the build-up of wealth within the marriage from their jointly run business and the raising of their family. Had the marriage ended in divorce rather than death, she believed that the settlement which they would have reached would have been that they each kept their own assets, but that her husband would have paid her a monthly amount to enable her to discharge her monthly outgoings.

38. Mrs Ramus did not seek a large capital lump sum from the estate or seek to break the trust. Her financial circumstances were such that her capital was required to purchase a new home and to provide a capital cushion and her monthly income was not enough to pay her monthly outgoings. She was the named income beneficiary under the trust, and the letter of wishes prepared by her late husband in September 2019 made it clear that he wanted to ensure that the lifestyle which she had enjoyed for many years could be maintained. She was, however, very worried by the fact that the executors, as trustees, had absolute discretion as to whether or not that income was in fact paid to her, or how much of the income was paid. She was uncomfortable that her financial security was in the hands of the executors, particularly given the difficult relationship which she had had with the executors subsequent to the death of her late husband.

39. She therefore sought an order which enabled her to be satisfied that she would receive sufficient income and/or capital from the trust to enable her to discharge her outgoings and which did not leave her subject to the unfettered discretion of the trustees. She was aware that it had been suggested by the executors that, as a beneficiary under the trust, she could always issue trust proceedings if she were unhappy about the way in which the trust was being administered. She accepted that she would have that right, but the purpose of the proceedings was to ensure that she did not have to. She was also aware that such litigation would be expensive and could be protracted, with the risk that there would be many months where she did not have the benefit of income from the trust, placing her in a difficult financial position.

2nd Witness Statement

40. Mrs Ramus amplified her concerns as to her financial position and the reasons why she had made an application for reasonable financial provision under the Act in her second witness statement. Mrs Holt had confirmed that she intended to take her up role as trustee. It was therefore clear that, going forward, her financial security would be in the hands of her daughter. That caused her concern to the extent that she did not believe that reasonable financial provision had been made for her by her late husband’s will. Although she said that her overriding concern was to honour the wishes of her father, the tone of her daughter’s witness statement and the words used in it led Mrs Ramus to believe that there would be significant difficulties between her as a discretionary income beneficiary and her daughter as a trustee with absolute discretion.

41. The letter of wishes referred to her maintaining her lifestyle. She had enjoyed a comfortable standard of living and now lived in a house which enabled her to entertain visitors and have family and friends to stay. Mrs Holt appeared to query her lifestyle choices, stating that her “alleged expenditure is highly exaggerated” and that her claim was “entirely without merit” as she was “a millionaire and [has] sufficient income and capital to live comfortably”. Mrs Ramus confirmed that her outgoings were not exaggerated, as could be seen from her schedule of average monthly outgoings which was based on her average monthly expenditure. It also appears to be Mrs Holt’s opinion that her outgoings were excessive and that she already had sufficient income to cover her expenses. In those circumstances, she was very concerned that, although her daughter stated that she would honour her father’s wishes, her willingness to provide her mother with the income from the trust would be coloured by her views as to her needs and lifestyle, particularly her stated opinion that her mother did not require any additional income to meet her monthly outgoings and maintain her lifestyle.

42. It was also clear that Mrs Holt and her mother were in disagreement as to the type of property which Mrs Ramus intended to purchase. During the course of her marriage, Mrs Ramus lived in a large six-bedroomed house with a large garden. She currently rented a property with four bedrooms and no proper garden. As she had explained, she wanted to live in a house with sufficient bedrooms to enable friends and family to come and stay, including her children and grandchildren. She had a large circle of friends who liked to visit and, now that restrictions had eased, she wanted that to continue. Gardening was also a passion of hers and she therefore wanted a property with a garden. She did not want constantly to worry if she could afford it. Again, her daughter was critical of her choices, referring to her desire to continue to live in a comparable property as a “demand to live in a property valued at £700,000”. Property in Harrogate was expensive and Mrs Ramus believed that a property of the type for which she was looking for cost in the region of £700,000. At the current time property for sale in Harrogate was very scarce and there did not seem to be any which met her requirements. She did not want to live in a small house or flat which her daughter deemed “suitable for a lady of advanced years who lives on her own” and again Mrs Ramus foresaw difficulties ahead with her daughter as trustee if she believed that her mother had unnecessarily spent money on a home which she considered to be too big.

43. Mrs Holt criticised her for not considering the minor beneficiaries. However, Mrs Ramus did not seek to interfere with the pecuniary legacies or the legacy fund established by the will for the benefit of her minor grandchildren. She had also confirmed that she did not seek a large capital sum from the trust or seek to break the trust. She simply sought an order which enabled her to be satisfied that she would receive sufficient income from the trust during her lifetime to enable her to continue her current lifestyle. As she was the income beneficiary under the trust, she failed to see how her claim adversely affected the interests of her grandchildren or threatened the capital within the trust. Her daughter’s concern actually appeared to be that Mrs Ramus was seeking a capital sum for the benefit of Alistair. That was simply not the case. She was seeking monthly income from the trust, not a capital sum. However, Mrs Holt’s comments and her suspicions as to her mother’s motives for bringing the claim and seeking income from the trust gave Mrs Ramus very real concern about her future financial security being in her daughter’s hands, particularly if her daughter believed that any income given to her mother would find its way to Alistair.

44. Mrs Ramus’s claim was based upon her financial needs and her financial security for the remainder of her life and she was not seeking a capital sum from the estate to give to Alistair or for any other reason. She confirmed that she had not been pressurised by Alistair to bring the claim. She emphasised that her son did not play any part in the breakdown of her marriage and she also noted that the £65,000 given to Alistair was his share of a property which his parents had purchased in the names of both of their children as an investment for them. Mrs Holt also received the sum of £65,000 at the same time in 2002 as a result of the sale of Mrs Ramus’s mother-in-law’s house.

45. When Mrs Ramus received the hard drive of her computer back, Mrs Holt had deleted and/or amended some of the files. She did not recall receiving her husband’s telephone back from her daughter and she did not know where it was.

46. Mrs Ramus said that she issued her claim as she was concerned that there would be friction between her and the trustees going forward and that the trustees would be able unilaterally to decide not to pay her the income from the trust, which would cause her financial hardship. Having read her daughter’s witness statement, she was even more concerned. It was clear from that witness statement that Mrs Holt believed that her mother did not need any income from the trust to maintain her lifestyle and that any money which she did receive from the trust will be given to Alistair, either voluntarily by Mrs Ramus, or by Alistair manipulating or threatening her. In those circumstances she was very strongly of the opinion that she needed an order which would ensure that she received the income which she needed to maintain her lifestyle and that her financial security was not dictated by Mrs Holt. One solution would be for all of the named trustees to be replaced with independent professional trustees, as that would ensure that the difficulties between Mrs Ramus and her daughter did not colour the exercise of the trustees’ discretion and she confirmed that that would be an acceptable outcome to her.

47. In response to the assertions of Mr Armitage and Mr Wardle that her current assets were able to generate sufficient income to cover her outgoings, Mrs Ramus relied on the letter dated 5 October 2021 from her long-term financial advisor, Richard Eaden in which he stated that

“I was first introduced to Mr Christopher and Mrs Elizabeth Ramus by a client in 2010, in my capacity as an appointed representative of SJP. They initially instructed me in relation to Mr Ramus' SIPP, however their instructions expanded and in the last couple of years I have also taken care of Mrs Ramus' SIPP. Mr Ramus ran most of the financial side of their business and marriage, however both he and Mrs Ramus attended every meeting. I saw them at least once a year, and had regular contact with them outside of this. I consider that I had a good relationship with Mr Ramus.

Mr and Mrs Ramus enjoyed a comfortable lifestyle, they enjoyed entertaining friends and family as well as more luxurious holidays. I recall that their last holiday included flying business class to Australia. Their lifestyle was largely funded by the rental income from a commercial property on Kings Road, which has recently been sold. Mrs Ramus will be unable to maintain this lifestyle with her assets alone, and in light of the fact that her only income currently comes from pension payments, Mrs Ramus will need to receive income from alternative sources to maintain her

lifestyle.

I believe there have been suggestions that Mrs Ramus already has sufficient capital to generate an income sufficient to maintain her lifestyle. I am aware that Mrs Ramus' priority is to first buy a property which meets her needs. The capital remaining after the purchase will not be sufficient to generate an income which would effectively support her for the rest of her life. This is particularly the case when we take into account the current low expected investments yields, which do not provide a significant return and certainly not compared to the income Mrs Ramus was receiving from the Kings Road property.

To be able to generate an income at a rate which matches the income received from Kings Road, for example, Mrs Ramus would be forced to deplete her capital and accept an unnecessarily high-risk profile, which is not advisable to clients of her age with no certain income. Should she choose to invest her own capital she would then have few funds to meet future capital expenditure, be they expected (such as replacing her car or renovations on her property) or unexpected costs which commonly arise and can be expensive, and which she now must meet the cost of herself.

A final factor which I do not believe the executors have sufficiently considered is inflation. Inflation is currently, and expected to remain for some time, higher than the cash rate. This is an important financial planning consideration for retired clients such as Mrs Ramus.

In the light of the above, I consider Mrs Ramus requires additional income in order to supplement her personal assets and maintain her lifestyle.”

48. Mrs Ramus noted that Mr Armitage and Mr Wardle said that they intended to pay the trust income to her and therefore her claim was unnecessary. However, she remained concerned that that would not remain the position going forward. She was also aware that both Mr Armitage and Mr Wardle were of a similar age to her and it was therefore entirely foreseeable that they would wish to retire as trustees during her lifetime, being replaced with a trustee or trustees chosen by the existing trustees.

3rd Witness Statement

49. Mrs Ramus updated her financial position in her third witness statement dated 11 March 2002.

50. She was still living in rented accommodation at a cost of £1,400 per month plus property outgoings. She had been actively looking for a property to purchase for the last year or more and was registered with Verity Frearson estate agents in Harrogate, as well as for Rightmove alerts. However, property for sale in Harrogate was very scarce at the moment and she had not been able to find anything suitable. There were new builds on offer, but they would not be suitable for her. During her married life they did not live in a new build and it would not suit her furniture either.

51. Her wish was to buy a house comparable with the house in which she lived when her husband was alive and with the house which she was currently renting. She had previously said that she believed that such a property would cost in the region of £700,000. She produced sale particulars of a house similar to the type of house which she wished to purchase, but in an unsuitable location and with a small garden. That property sold for £650,000, but was not in a suitable location and did not have a suitable garden. She anticipated that a similar property in Harrogate, with a suitable garden, would cost more than that. Given the scarcity of property available at the present time, there were no examples in the location in which she wished to live which would be suitable for her. It seemed to her that prices had increased over the past year and that £700,000 was likely on the low end for the type of property which she required. She had also budgeted around £50,000 to cover stamp duty, legal and removal fees and the cost of redecorating the property. Nothing suitable had come up recently and her last viewing was 3 months ago. That property was on the market for £695,000 and needed gutting and new windows. The estate agent had laughed when she asked whether there was any leeway on the price and a lot of people had put in offers over and above the asking price.

52. She explained her position in relation to the house purchase in more detail in her oral evidence. She accepted that she held an unusual amount of cash, but she needed to be a cash buyer, since in her view cash buyers received preferential treatment. She had been advised not to rent on a long-term basis. She had been renting for nearly 2 years and could break the tenancy, as to which 3 months’ notice would be “fine”, although she knew the landlord and he was very amiable. Nothing had been said as to whether she could stay after 3 years. She would otherwise have put the money into NS&I income bonds, but had been advised not to because she was hoping to buy a house and so held a large sum in cash on the basis of that advice. She did not expect to buy a large house, but one of similar standard to her matrimonial home and the house which she was currently renting. She did not want a new build or a bungalow (since she liked the exercise of going up and down stairs). She loved gardening, cooking and entertaining. They were what she was used to. She did not like the proposal to downsize and did not want to live in what she described as a “poky place”. She wanted space to entertain guests. She shopped in the butcher’s, supermarkets, tea shops and farm shops. She bought good food as she had always done. She ate out in restaurants, more some weeks than in others, but did not buy takeaways. House prices had gone up 11% in the previous year and her capital was diminishing. She filled up the car with petrol every 10 days or so, certainly twice a month, and that cost her £120 to £150 twice a month. She had not led an extravagant lifestyle. As she put it:

“I want to do what I want without worrying. My top priority is finding a house.”

53. She received Rightmove updates on her computer. The filters were set between £500-£600,000 and £800,000, but excluded new builds. The filters were also set for 3 bedroomed properties with a radius of 5 miles of the centre of Harrogate. The property in Pannal, of which the sales particulars were in the trial bundle, was not suitable because of its proximity to the main Leeds-Harrogate Road, although the inside was perfect. She confirmed to Mr Heath that she did not need 4 bedrooms or 3 bathrooms; two reception rooms would be better. Mr Heath asked her whether, if her husband had not died, she would have limited herself to a budget of £525,000 (being her half share of the proceeds of sale of the matrimonial home). She replied

“I would have considered the style of house rather than pricewise. A year of cooling off to decide what I wanted. Travelling to Harrogate would also have to be taken into consideration. I hadn’t got round to looking at values.

Q. Did you consider £750,000 when your husband was still alive?

A. It never entered my head. I never intended to divorce. I didn’t want to divorce. It was just that I couldn’t live with him any more.”

54. By the time of her third witness statement, the business premises on Kings Road which she owned jointly with her husband had been sold. Her net share (£312,440) of the proceeds of sale was transferred into her NatWest account ending in *893 on 6 August 2021. She had been advised by her accountant that she would have to pay CGT on that sum, but did not know how much that was at the present time. Those funds remained in her NatWest account for the time being, save what she had spent in the months since and she intended to use that cash towards the purchase of her new house once she found a suitable one.

55. Mr Entwistle explored with her in more detail the potential CGT liability on the Kings Road property. Mrs Ramus said that she had contacted her accountant as recently as last week. He had told her that the top line was a liability of £64,000, but that he was hoping to get that reduced. It might be between £40,000 and £60,000. It could end up at £50,000, but she did not know. She was hoping to get the figures completed shortly. The property had been purchased in about 1980 or 1981; it had cost about £45,000 to buy it, but she was not sure.

56. Her updated asset schedule was therefore as follows (including her half of the business premises proceeds, but subject to the payment of CGT):

|

No. |

Description |

Amount |

|

1 |

Cash - RBS Bank Account ending in *888 |

£517.28 (as at 30 Dec 2021) |

|

2 |

Cash - RBS Bank Account ending in *896 |

£273,769.90 (as at 30 Dec 2021) |

|

3 |

Cash - NatWest Select Bank Account ending in *893 |

£287,681.38 (as at 24 Dec 2021) |

|

4 |

Cash - NatWest Premium Saver Bank Account ending in *850 |

£33,112.50 (as at 24 Dec 2021) |

|

5 |

Cash - YBS Bank Account ending in *207 |

£2,000 (as at 22 Dec 2021) |

|

6 |

Cash - Aldermore Bank Account ending in *330 |

£750 (as at 22 Dec 2021) |

|

7 |

Investments - NS&I Direct ISA |

£10,755.89 (as at 16 Dec 2021) |

|

8 |

Investments - NS&I Premium Bonds |

£50,000 (as at 16 Dec 2021) |

|

9 |

Investments - NS&I Income Bonds |

£200,500 (as at 16 Dec 2021) |

|

10 |

Investment - St James’s Place Unit Trust (ending in *307) |

£0 (account to be closed) |

|

11 |

Investment - St James’s Place Unit Trust (ending in *780) |

£7,092 (as at 8 March 2022) |

|

12 |

Investment - St James’s Place Retirement Account (ending in *094)

This fund was ring fenced to provide a monthly income. |

£488,326 (as at 8 March 2022) |

|

13 |

Investment - St James’s Place ISA (ending in *469) |

£263,073 (as at 09 March 2022) |

|

14 |

Outstanding loan owed by Alistair |

£47,000

|

|

15 |

Personal vehicle (Volvo) |

27,000 - 30,000

(estimated) |

Total - £1,664,625.95 (excluding the Volvo).

57. She still had a monthly income of around £1,800, which was made up of her statutory pension, income from Scottish Widows and Clerical Medical and a payment of £816.80 from SJP which was capital drawdown from her pension. For example, in the month of December 2021, she received the following income:

|

Statutory pension: |

£634.80 |

|

Scottish Widows: |

£98.66 |

|

Clerical Medical: |

£181.83 |

|

SJP: |

£816.80 |

|

Total: |

£1,732.09 |

58. She was aware that the trustees had suggested that she could generate additional income by investing her cash. That was not a long-term solution because she was allocating the sum of £750,000 towards allowing her to be a cash buyer once she found a suitable property. She had her financial adviser, Richard Eaden, who helped her manage her investments and all her funds which were not held in cash (on the basis that she would be buying a house as soon as she found a suitable one) were invested in accordance with his professional advice.

59. She was asked about her ability to generate more income by Mr Entwistle. He put it to her that if she paid £750,000 for a house and kept her ringfenced £500,000 retirement fund, she would still have £450,000 of assets which could be invested. Mrs Ramus wondered how much income that would generate. Would interest rates warrant a big income? She was in good health, but who could say as to the future? She had always been confident of having capital there if needed. She accepted that the balance of her assets could provide at least some income and that her investment ISA of £263,000 was accessible if she wanted it. She thought that the income of £16,000 derived from that asset had probably been reinvested since it had not been paid to her directly. She left everything to her financial adviser, Mr Eaden.

60. Mr Heath also explored that question with Mrs Ramus. If she paid £750,000 for a house and kept her ringfenced £500,000 retirement fund, she would still have £420,000 of assets which could be invested. If her income were guaranteed, she would not need to touch that sum. What, then, would happen to that sum? Mrs Ramus replied that it would be to provide for hardships and for basic expenditure. It would not be for holidays. Mr Heath pointed out that £4,800 had already been earmarked for holidays. Would she spend £420,000 on other holidays. Mrs Ramus said that she did not know:

“Q. Yes or no?

A. I don’t know. Probably not

Q. So you don’t know what the £420,000 is to be spent on?

A. I don’t know. Perhaps I might need surgery. I have always had a cushion in case of emergencies.”

61. Her outgoings also remained in the region of £5,000 per month, excluding the significant legal fees which she was incurring (which varied month-to-month). As at 10 March 2022 her schedule of outgoings was tabulated as follows:

|

|

Current |

Expected |

|

Rent |

£1,400.00 |

|

|

Council tax |

£234.95 |

|

|

Water |

£14.00 |

|

|

Electricity |

£59.23 |

|

|

Gas or oil

|

£150.00 |

|

|

Telephone |

£46.75 |

|

|

Property and household insurance |

£30.89 |

|

|

Home maintenance, cleaning and repair |

£25.00 |

|

|

Life and endowment insurance |

£34.00 |

|

|

Food and household |

£600.00 |

£750 |

|

Domestic help |

£220.00 |

|

|

Clothing |

£120.00 |

|

|

Hairdressing and personal care |

£250.00 |

|

|

TVlicence/hire/video rental |

£13.15 |

|

|

Newspapers and journals |

£25.00 |

|

|

Medical, dental, optical & pharmaceutical |

£53.50 |

|

|

Dry cleaning, laundry, cleaning, shoe repairs |

£25.00 |

|

|

Window cleaner |

£30.00 |

|

|

Road tax |

£40.00 |

|

|

Car insurance |

£39.81 |

|

|

Petrol, parking, running and repairs for vehicle |

£170.00 |

Increase

expected as

petrol prices rise |

|

Provision for replacement vehicle/lease costs |

£250.00 |

|

|

Financial planner’s fees |

|

|

|

Osteopath/chiro fees |

£25.00 |

|

|

Accountants fees |

£25.00 |

|

|

Eating out and takeaway |

£200.00 |

|

|

Sports and leisure |

£110.00 |

|

|

Books, music, video hire/purchase |

£10.00 |

|

|

Drinks and tobacco |

£15.00 |

|

|

Holidays and breaks |

£400.00 |

|

|

Computer (incl. ink) and internet |

£15.00 |

|

|

Memberships and subscriptions |

£5.00 |

|

|

Charities and covenants |

£10.00 |

|

|

Gifts (birthdays, Christmas, etc)

|

£650.00 |

|

|

Total |

£5,296.28 |

|

62. She anticipated that her outgoings would rise given the increased cost of living. Already her electricity direct debit was going up and her expenditure on petrol had increased considerably due to increased petrol prices. She had noticed a generalised increase in prices for food and purchase. As an example of her outgoings, in the month of December 2021 they were as follows:

Outgoings from NatWest Select Account *893: £3,875.32

(including a cheque of £3,395 towards legal fees, which were variable)

Outgoings from RBS account *888: £4,504.67

(including rent of £1,400, which would not be required after she purchased a new house)

63. Her total outgoings over the 7 month period from June 2021 - December 2021 were as follows:

Outgoings from NatWest Select Account *893: £24,834.80

Outgoings from RBS account *888: £37,776.28

Total £62,611.08

64. That showed average monthly outgoings of £8,944.44 over the period. That included cheque payments totalling £23,335.00 towards legal fees, which were variable month-to-month. Her average monthly outgoings, excluding legal fees, were £5,610.87

65. Mr Heath asked her about the insurance premiums of £34 per month which she paid for life and endowment insurance. She explained that the policy had been taken out by her husband and that she had not known about it. After his death she had found it in the safe and gave it to the executors. It was a policy with Aviva, which was transferred to her. The trustees were Mr Wardle and her daughter. She had passed it to Mr Eaden and he advised her that to cash in the policy was not worth it: she should just carry on paying it. In other words, she was led to believe that it was not cost effective to cancel it.

66. Her monthly income did not cover her monthly outgoings and she was currently paying the shortfall each month from her savings. However, that could not continue long term as she needed to ensure that she had sufficient savings to purchase a house and retain a capital cushion.

67. Those monthly outgoings did not take into account that she would like to resume going abroad on holiday like she and her husband used to, with the same standard and quality of air travel and accommodation as they used to. She intended to resume travelling as soon as possible. She and her husband always flew business class, which was the biggest element of their holiday costs (they had spent £2,500 on Etihad flights to Qatar and £4,000 to fly to Australia, a direct 17 hour flight from Heathrow to Perth; flights to South Africa had cost them £2,800 each.)

68. She confirmed that she had not received any payments from the estate to make up the income shortfall which she had. She had not at that stage been provided with estate accounts so could not comment further on the financial position of the estate, save to say that she expected that there would be enough funds to generate a substantial income.

69. However, when asked by Mr Heath how much she needed from the estate to supplement her income, she said that there had been no mention of a figure and that nothing was ascertained. She needed to safeguard her interest and needed additional income to help her.

Gifts

70. She was aware that the trustees had asked questions about gifts which she had made since the death of her husband. She confirmed that she had given his Rolex watch to her brother. Whilst she appreciated that the watch could have been sold and the proceeds invested, the watch had sentimental value and she wanted her brother to have the watch both as something to remember her husband by, and as a thank you for all the love and support he had shown her since her husband’s death.

71. She also gave Alistair the sum of £2,000 as a belated gift for his 40th birthday in May 2018. She and her husband did not give him a gift at the time because he did not yet know what he wanted. The cheque was cashed on 30 December 2020. The reason that she gave him that sum was because she and her husband had spent around £2,000 on an aquamarine ring which they gave to Mrs Holt for her 40th birthday in July 2016 and she tried to treat her children equally. The aquamarine ring was also a belated birthday gift (given about a year after her daughter’s birthday).

72. Mr Heath asked her about the £650 for gifts each month, which amounted to an annual sum of £7,800. Mrs Ramus explained that she had 5 grandchildren who would receive £200 each for birthdays and at Christmas (she always gave them that) and she also had a large circle of friends. For example she had paid £3,000 for a group of 10 people from the family to take over a 5 bedroomed barn conversion in March 2022 in which a chef had come in and cooked meals for the party. She had also given Alistair £1,000 for his recent birthday in May (he had already paid her part of the loan monies before his birthday).

Alistair

73. Mrs Ramus had included as one of her assets the sum of £47,000 which she loaned to Alistair in October 2021. He had made regular repayments of £1,000 per month since December 2021. He was committed to paying her back as quickly as possible and she expected him to increase the amount of those monthly repayments as soon as he was able. She and her husband loaned him in the region of £65,000 in or around December 2017 and Alistair paid them back in full by May 2019, which she understood was as soon as he was able. She therefore considered the sum of £47,000 to be an asset and had no concerns about it being paid back in full.

74. Alistair had obtained the wherewithal to pay them back as a result of a business buy out after several months of negotiation and the amalgamation of two businesses. The money had never been a gift to Alistair, a point which she reiterated when pressed by Mr Heath. She appreciated, however, that when you loan something to someone, there was always the risk that you would not be repaid. She and her husband had not said anything to Alistair about that, but they had agreed that if he did not repay them they would give their daughter £65,000 so that they were treated equally. They did not tell anyone else about their decision. It was always better to help family when they needed it than leave it to them when you died. Alistair had been in a situation where a company had been paying him every month and he had been knocked for 6 when the source of the funds was ended. He was then desperate and his own business would have folded. Nevertheless her husband wanted payment back very quickly.

75. Mr Heath put to her the email from Mr Ramus to Mrs Holt on 19 October 2019 in which he had said to his daughter

“He is furious at having to repay the £65,000 to me in May, especially since Liz had made it clear that she didn’t want Claire to know about the loan and she wanted to make a gift to Alistair of the money.

Where the £65,000 came from to repay me in May 2019 is unclear. Various possibilities exist. Including the idea that he has taken a loan from shark lender and Liz has guaranteed to repay it. Or he has debts, which Liz wants to cover for him. In any event it is clear that Liz wants to get her hands on cash quite quickly.

…

He now knows further loans or gifts are NOT possible from me. So, the only way is to get Liz and I divorced and then he systematically sets about parting Liz from large amounts of cash.

He has now brain washed Liz into hating me. This is my punishment, for wanting my £65,000 back.

Alistair doesn’t want Claire anywhere near Liz as he knows there are 2 people who won’t put up with his lies. Myself and Claire.

By causing Liz to cut Claire and her family [out] of her life, it makes his route to cash even easier.

The situation now looks like this.

Alistair has created a situation where the Ramus family has been divided into 2 fractions.

Claire and I, Alistair and Liz. He is now firmly in the driving seat at Ramus Seafoods and he has brought about Liz wanting to divorce me, presumably with the idea of targeting Liz’s wealth.

With Claire and I without any influence on Liz - Alistair is left with a clear path to her wealth”.

76. In cross-examination the exchange between Mr Heath and Mrs Ramus was as follows:

“Q. Your husband was under the impression that you wanted to gift it?

A. No. This is between Claire and my husband. “Brainwashed [me] into hating him”? Rubbish.

Q. He said it was a gift. Was that wrong?

A. No, I never said that. No, no, no. It was between my husband and me. We wouldn’t tell anyone else. In October we told Claire - she was so angry.

This is totally wrong.

I said to my husband “You do know it’s wrong.”

He said “Yes, I know it’s wrong. [But] I won’t support you. Fight your own battles.”

I said “ there is no future in this marriage.”

Q. I am not asking you about who initiated the divorce, just about the £65,000.

A. Rubbish. I knew nothing [about the email].

The money to repay us came from the amalgamation of his business …

I have no idea where this came from. The loan was a joint decision, not just mine. It is rubbish that I wanted to make him a gift.

Q. Was there a time when you doubted repayment?

A. I had no reason to think that he wouldn’t.”

77. She appreciated that the Court might wonder why she was loaning a large sum of money to Alistair whilst also maintaining a claim for reasonable financial provision under the Act. Her current position was cash rich as she was looking to purchase a property. However, after she had purchased a property and paid CGT on the sale of the Kings Road property, her cash and investment assets would not be sufficient to provide her with enough monthly income to cover her monthly expenditure. Given that he repaid his previous (and larger) loan in full within two years and that he was repaying his current loan, she was confident that Alistair would repay her current loan quickly enough that it would not significantly affect her medium- or long-term finances. She never asked him to create a charge to secure repayment; it never entered her head to ask, although she accepted that , since he had been made bankrupt before, it would have been sensible to ask for security.

78. Mr Heath put it to her that she could afford to be generous, to which she replied

“No, so much had been going on it didn’t cross my mind to ask”

Q. The £50,000 might not be seen again?

A. It would be deducted from any benefit under the will. You help your family when you can. If the need is now, you help when you can.

Q. You could walk out of here and release Alistair?

A. No, he was explicit that it was not a gift. A lot of businesses were struggling because of Covid. He was struggling with working from home.”

79. Mrs Ramus confirmed that she had made a new will in August 2019 before her husband died. She had not looked at it since then. Under it her grandchildren all received lump sums (they were the main beneficiaries) and there were charitable and other legacies. Other family members also benefited under it, including her nephews, brothers and son, although she could not remember the details; a lot had happened in the last 3 years. She could not remember who received how much, although she confirmed that her daughter did not benefit since she had received £500,000 from her father’s pension. Whether her daughter would benefit under her intended future dispositions she could not say at this moment in time. She had recently asked the solicitor who had drafted it to make amendments to it, but he had been ill. She had not definitively decided on the new dispositions:

“I may change my mind again even if I told you now.”

80. Her daughter had received nearly £500,000 from her father’s pension and Alistair had not been treated equally in that respect. Mr Heath put it to her that she wanted to even things out, to which she replied

“Not through him; through his children.

Q. One way to even it out would be to write off the £50,000 loan and leave the £420,000 to Alistair and his children?

A. I would not write it off. He would keep paying me.”

81. Alistair had always told her to spend her money. She wanted to go on holiday (she had friends in Canada, South Africa and New Zealand) -

“I just want that freedom”

82. She did not necessarily want to leave money to anyone, although it would be nice to leave it if there were some:

“Q. If there is capital to leave, so be it?

A. So be it.

Q. If it is all gone, so be it?

A. So be it.”

Mr Armitage

83. Mr Armitage is a chartered certified accountant and insolvency practitioner by profession. He set up his own business, Armitage & Co, in 1982. It continues in existence, although he no longer takes formal insolvency appointments, but acts as an insolvency consultant.

84. He first met Mr and Mrs Ramus in 1983 as near neighbours with their respective children attending the same schools. The relationship between all of the family members was close and happy, enjoying many social and leisure occasions together. He and Mr Ramus would often discuss business generally, but he had never acted for Mr or Mrs Ramus in a professional capacity. During the last year of Mr Ramus’s life he and Mr Armitage met regularly for a day’s walking during which they discussed his problematical personal and family relationships and the likely investment returns from the Kings Road premises, which were of considerable importance to him for future income. Mr Armitage accepted in cross-examination that the Kings Road property was a significant investment, resulting in a rental income of some £50,000 when tenanted and that the investment income was important to both Mr and Mrs Ramus. Although he was aware that Mr Ramus was very troubled by his personal and family issues, Mr Armitage was nevertheless shocked to hear of his suicide.

85. He confirmed that a grant of probate to Mr Ramus’s estate was issued on 24 November 2020 which declared a net value of the estate of £1,082,818. Since that time, he confirmed that the commercial property (which was jointly owned by Mr and Mrs Ramus) at 132-136 Kings Road had been sold for £640,000, realising a gain and the net proceeds had been divided equally between the estate and Mrs Ramus, her share being £312,000. With the exception of Mr Ramus’s fishing timeshare, now valued at only £1,000, all of the assets of the estate had now been realised. As at the date of his first witness statement on 2 September 2021 the estate had cash funds of £1,016,243.80, but £50,000 of that was to be set aside and held on trust for the benefit of Mr Ramus’s grandchildren on attaining the age of 25 in accordance with the terms of his will. The estate’s tax affairs also needed to be agreed and settled. At that point there was an estimated liability of about £6,000.

86. Mr Armitage was quite clear that it remained the position of the trustees that the monies held within the will trust should be invested and the income paid to Mrs Ramus and that that was their intention. The only matter which had prevented the establishment of the will trust, the making of investment decisions and the payment of income to Mrs Ramus had been waiting for completion of the sale of the Kings Road property on 6 August 2021 and the current pending claim. He accepted, however, in answer to Miss Phillipson’s questions, that Mrs Ramus had no guarantee of income, that the trustee’s discretion remained throughout and that they must exercise their discretion at the relevant time.

87. However, Mr Armitage said that it was the view of himself and his fellow trustees that it was unrealistic of Mrs Ramus to expect some form of guaranteed income. To the extent to which Mrs Ramus suggested otherwise, namely that the events which had happened demonstrated a heightened risk that either he or his fellow trustees would act in breach of their obligations, he regarded that situation as misplaced. He had no intention whatsoever of acting in breach of his obligations as an executor or a trustee and he was very conscious of Mr Ramus’s wishes as expressed in the letter of wishes.

88. Nevertheless, he and his fellow executors and trustees did not see the present application as an obvious one under the 1975 Act. Primarily, Mrs Ramus disclosed assets as at the date of her first witness statement of just over £1,250,000 (including the Volvo car). Further, she disclosed a monthly income of approximately £1,800 from her pension. However, she had not provided any credit for the income which could be

generated by her investments.

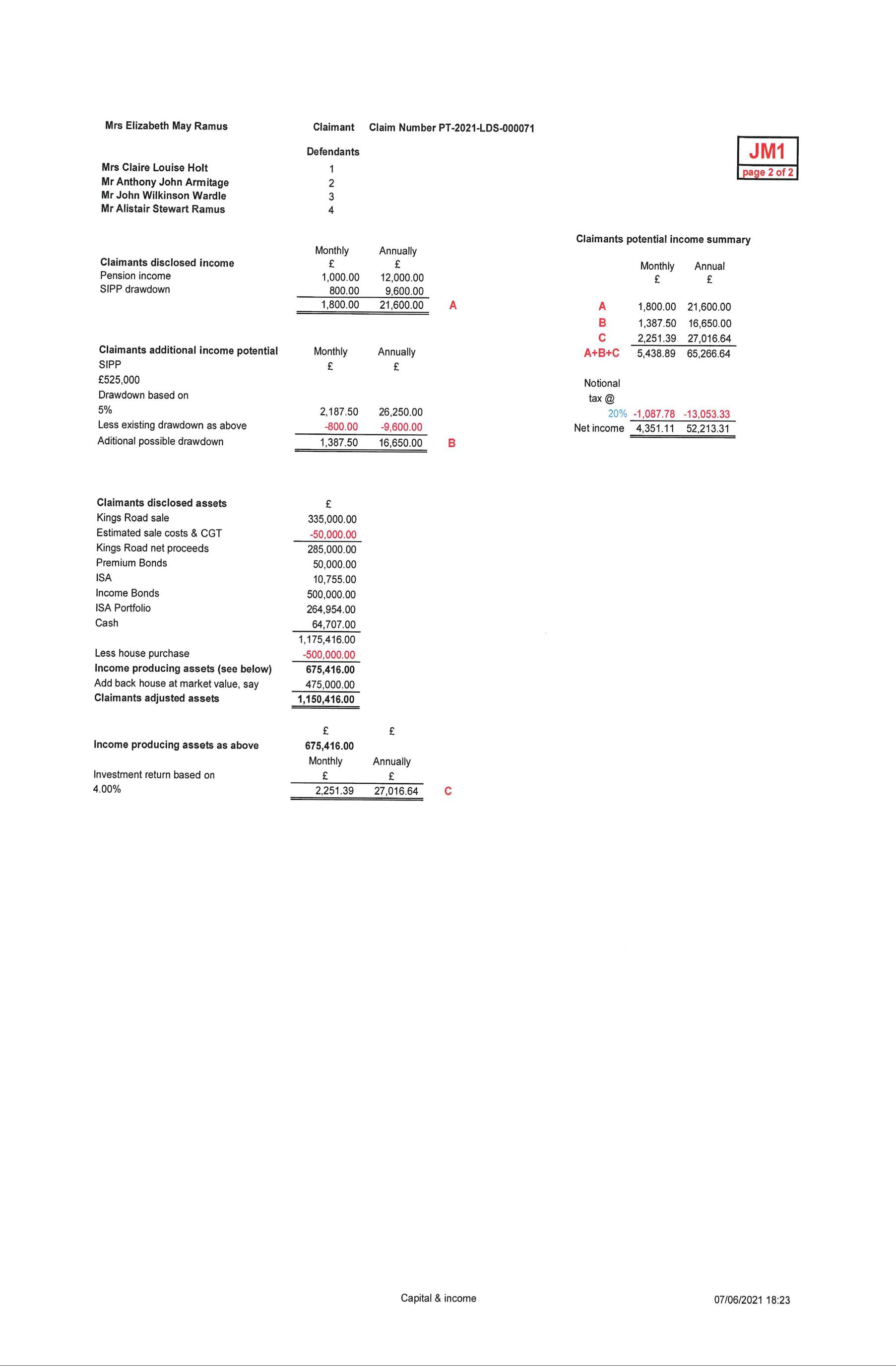

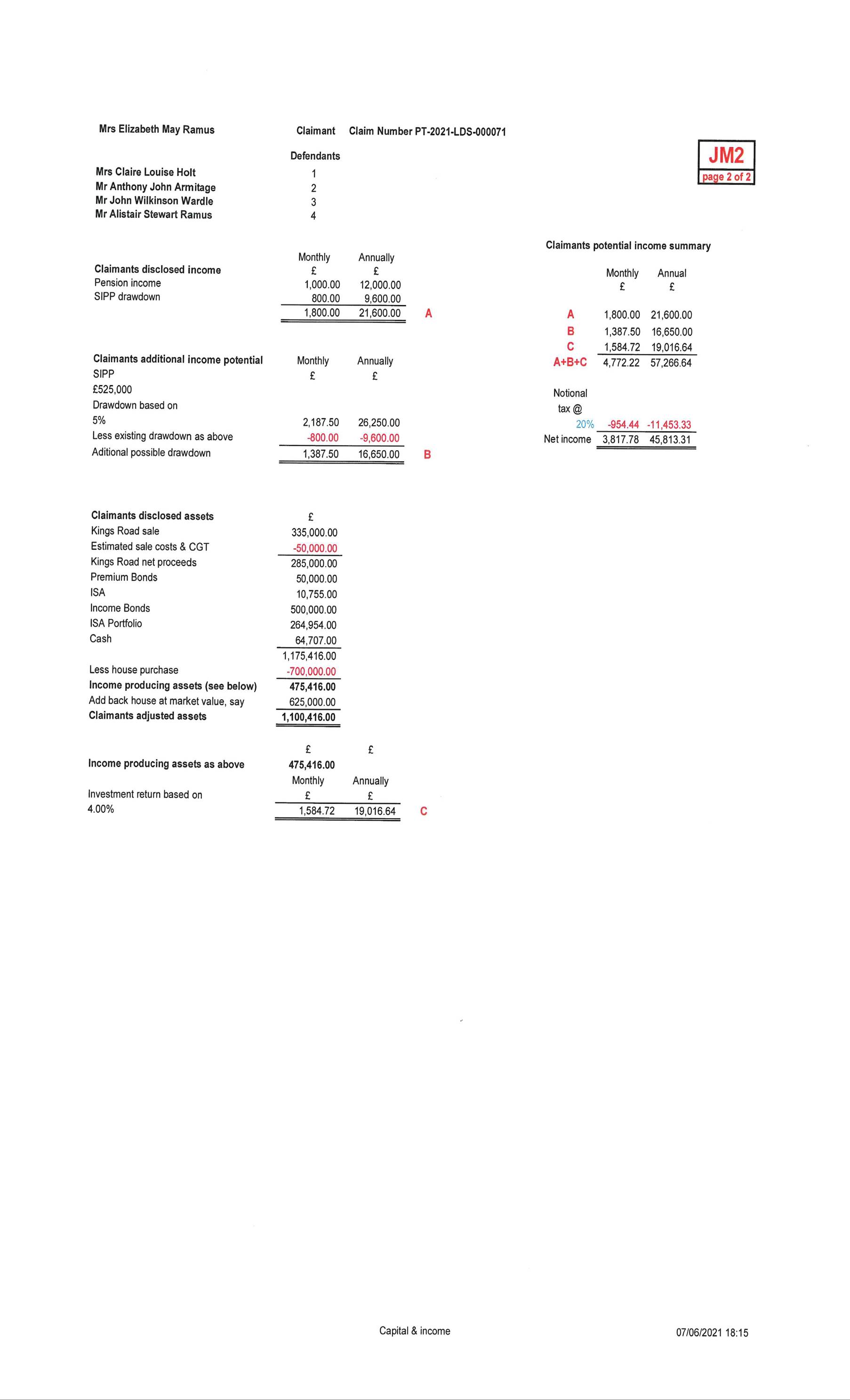

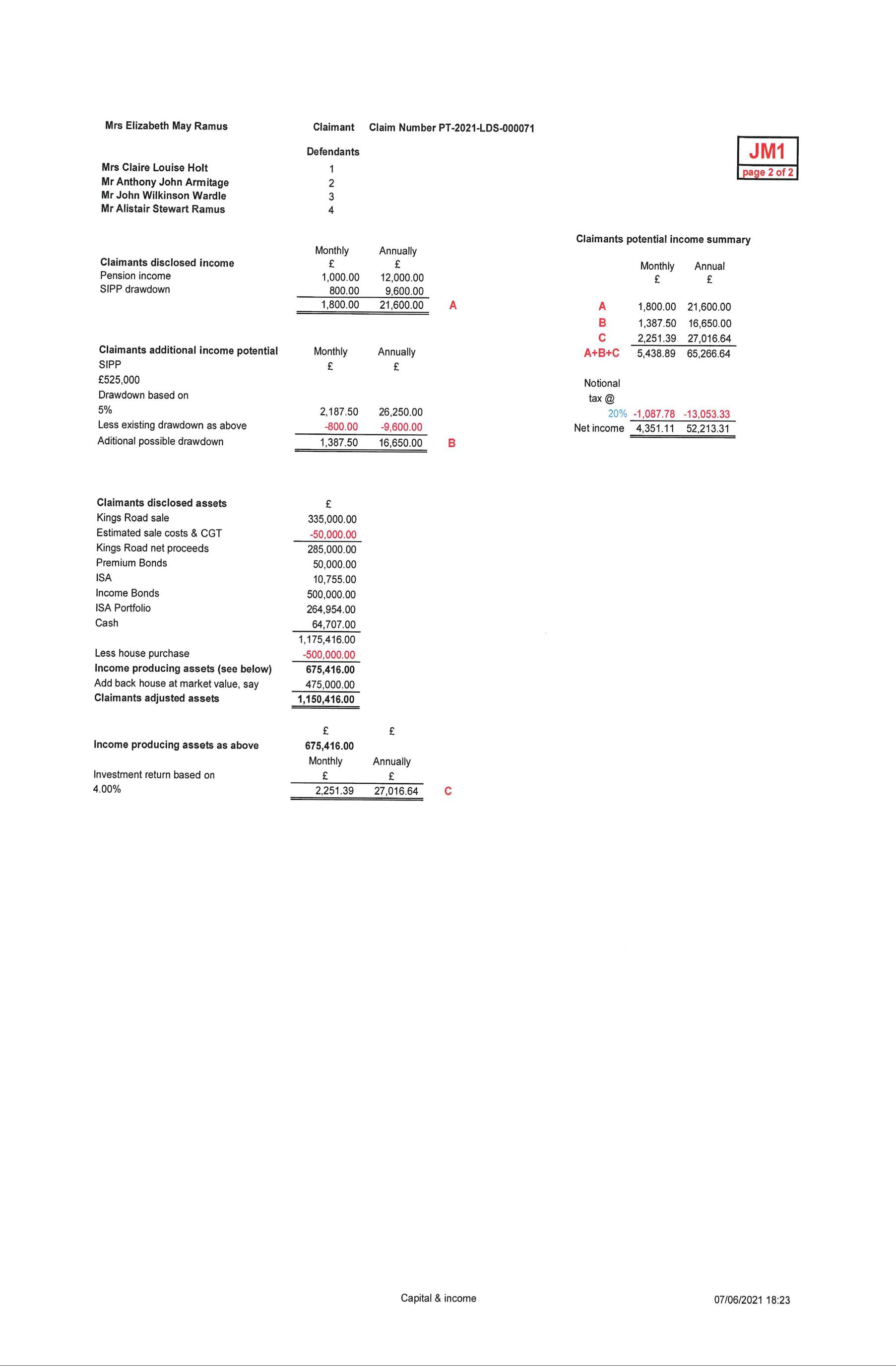

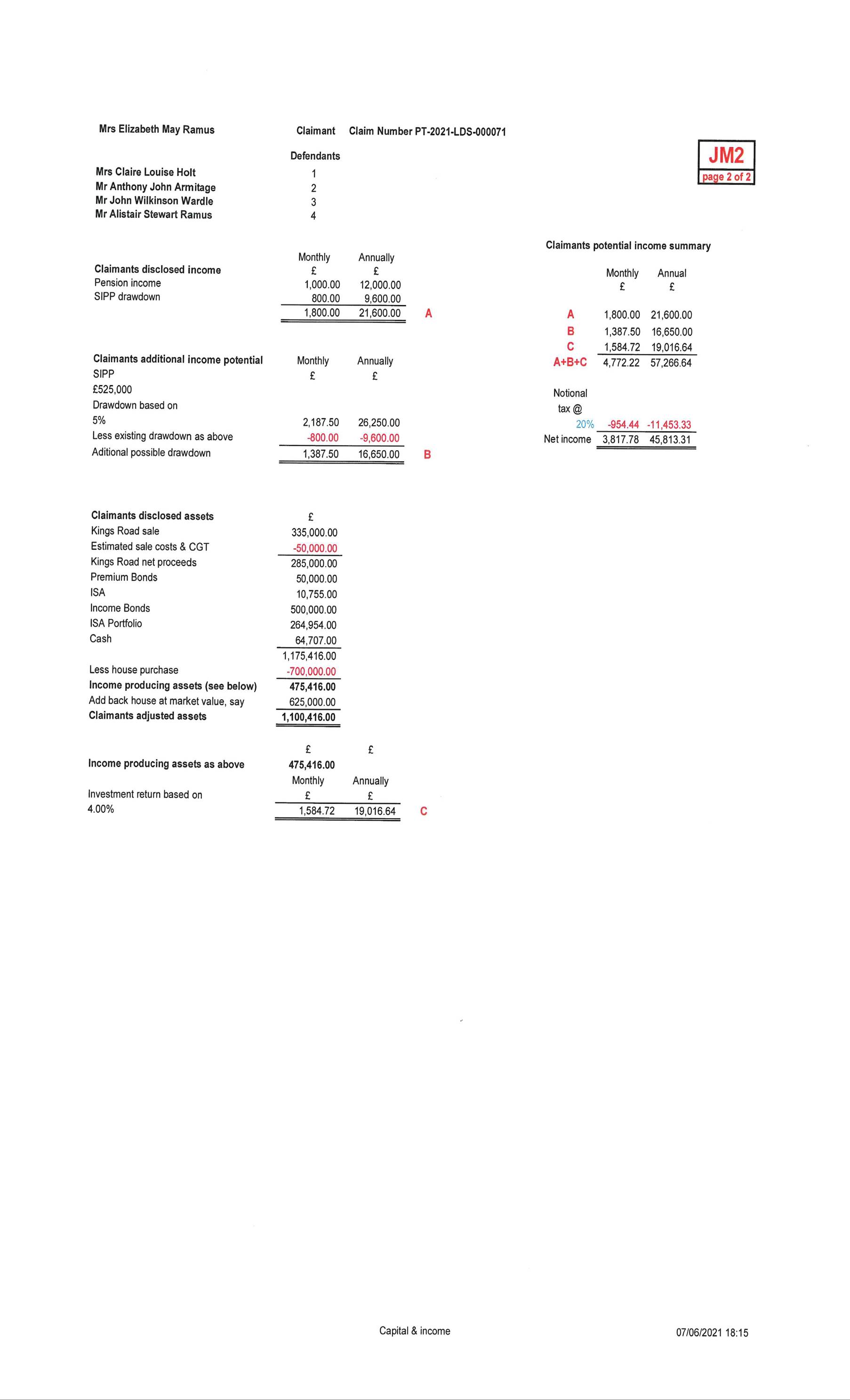

89. During the earlier inter-solicitor correspondence, being mindful of the concerns expressed by Mrs Ramus that she would be in financial difficulties and also being mindful of her late husband’s wishes that she was adequately provided for, the trustees had considered in some detail the financial information provided and had carried out a number of calculations as to the additional income which her assets could generate. In particular, Mr Armitage referred to two documents setting out a number of calculations which in his view clearly demonstrated that, even if the Court were to accept that Mrs Ramus needed to spend £700,000 on a property at the age of 76 (now 77) and her stated income need was reasonable, she could manage her investments to produce further income to support her pension income to meet all her stated needs and would not therefore be reliant on the will trust. The income which she would receive from the will trust would therefore be a welcome addition. (So as not to disturb the flow of the narrative, I have included these schedules, marked JM1 and JM2 respectively, as appendices to the judgment. To be clear, the schedules were not tendered as expert evidence, nor did Mr Entwistle seek to rely on them as expert evidence.)

90. In the first of those documents, Mr Armitage had taken Mrs Ramus’s schedule of outgoings as at 21 May 2021, which she said were £5,113.43. From that figure he had deducted sums and added in one by way of proposed adjustments. The four items of expenditure eliminated from the expenditure schedule were (1) rent of £1,400 per month (which would be eliminated on the purchase of a house by Mrs Ramus), (2) the £34 per month spent on the Aviva life and endowment insurance on the basis that that was a discretionary sum (although he accepted that he knew little about the Aviva policy and had not seen the policy document), (3) the provision of £520 per month for the replacement of her car (because in accounting terms that was depreciation rather than an outflow of funds; the replacement would come out of capital rather than from monthly payments) and (4) the sum of £650 per month for gifts, again on the basis that it was discretionary and not a necessity like food or fuel. He added in a figure of £400 per month for home ownership costs in place of rent. That reduced her expenditure figure from £5,113.43 per month to £2,909.43; on an annual basis that reduced her expenditure from £61.361.16 down to £34,913.16. He thought that those figures represented a reasonable compromise and that was still his opinion.

91. In answer to Miss Phillipson, Mr Armitage accepted that Mr and Mrs Ramus always drove new cars. She probably replaced hers every 4 or 5 years; her husband had done so more often. He agreed that they were high value cars or good cars.

92. He did not dispute her updated expenditure schedule which showed a monthly expenditure of £5,610.87.

93. It was Mrs Ramus’s case that she did not require a large capital sum from the estate or to seek to break the trust in some way. Given that stance, Mr Armitage was unclear as to the purpose of the proceedings or the order which she was asking the Court to make and which it had power to provide.

94. He was asked by Miss Phillipson about his understanding of the terms of the will, the obligations laid on the trustees and Mrs Ramus’s position under the will and the letter of wishes. He understood that Mrs Ramus had no absolute right to the income and that under clause 11.2.2 the trustees could terminate her interest in the capital; the trustees had the power to pay her, but they also had the power to decide to terminate her interest and not to pay her. He understood that termination of Mrs Ramus’ interest in the income of the trust would accelerate the interests of the class of discretionary beneficiaries. Equally, he accepted that the trustees had the discretion to remove Mrs Ramus from the class of discretionary beneficiaries. He agreed that it was up to him and his co-trustees when they retired and that it was for them to appoint their successors. He confirmed to Miss Phillipson that he intended to follow the terms of the will and the letter of wishes.

95. Miss Phillipson put it to him that, when Mrs Ramus wanted to fly abroad and see friends, she would not know whether she would actually be in receipt of income under the terms of the will. Mr Armitage said that he would think that it would be right to tell her in advance if that were the decision taken, although he accepted that she could not be assured of the income. It was put to him that when the trustees exercised their discretion, they would so on the basis of the schedule which he had provided setting out what the trustees regarded as being reasonable expenditure. He agreed, but pointed out that they would also take into account the capital sum available to her to meet her expenditure rather than to take it from the estate.

96. So far as the cost of a new house was concerned, Mr Armitage had produced his schedule on the basis of a new property costing Mrs Ramus £500,000. Miss Phillipson put it to him that in reality it was not possible to buy the sort of house for which she was looking in Harrogate for £500,000. Mr Armitage said that that was very subjective, but that he understood Mrs Ramus’s expectations and that the market had gone up since 2021. Miss Phillipson put it to him and if she wanted a 3 bedroomed house with a garden, she would not get it for £500,000 in Harrogate, to which he replied “Not now.” She put it to him that £750,000 was a reasonable sum. He said that that was very subjective, but he had no strong views. That could be what she would have to pay, though it would be a big effort to maintain an old house. He thought that a reasonable property would cost £600,000 to £700,000. Indeed he had produced his second schedule on the basis that the new property would cost her £700,000. He had not put back into that second schedule a sum of £400 per month to cover household costs after purchase of a new property because Mrs Ramus had not put such a figure in her updated schedule, but he had no objection to putting it back in to his second schedule.

97. He accepted that her income was £1,800 per month, but believed that she could obtain further money from her pension. Based on her disclosed assets of £1.175 m, she would have £475,000 surplus cash available for investment to obtain a return. From her £525,000 SIPP, from which she currently drew down £800 per month, she could in fact draw down £2,187.50 per month on a 5% drawdown (or £26,250 per year), making a net increase of £1,387.50 per month or £16,650.00 per year. He considered that it was reasonable to draw down more at her age and with her life expectancy. What her advice was on that matter from her own financial adviser was for her to decide; that was between her and her adviser.

98. Miss Phillipson put it to him that the relevant figures were as set out in Mrs Ramus’s most recent witness statement. They disclosed assets in the region of £1.6m, of which £488,326 was ringfenced as her retirement fund. Her new house would cost her £750,000, leaving a balance of £426,000, from which she might have to pay about £50,000 in CGT. That would leave a balance of £76,000. Mr Armitage responded that it depended on what was meant by “free capital”. He accepted that she needed a capital cushion, but believed that she had that. If she bought a property she would then have a £700,000 asset in lieu of cash.

99. Miss Phillipson put it to him that given her actual spending, she had a shortfall of £45,700 per year, which he accepted, but he said that she would then have the asset of a house as well. Many people could produce further funds through equity release. In any event, the trustees had not made any decision not to end her interest in the trust fund. They would make that decision on the facts at the time. As a result Mrs Ramus’s financial position could be better or it could be worse.

100. Mr Armitage said that he could not express an opinion as to whether she needed an emergency fund of £130,000; he could not tell her what cash reserve she ought to have.

101. Miss Phillipson put it directly to him that

“Mrs Ramus is not living the life which you are putting forward, is she?”,

to which he replied

“Yes, I do see the tension; I put the figures in there because we though them to be reasonable; we had no further information to change our opinion.

…

If she wishes to put a request to us, we will consider it at the time it is made, but we cannot consider a hypothetical situation.

Q. Would you pay her the income?

A. Yes, we have said we would pay income as and when it arises; I accept that we have a discretion as long as that situation goes on.

She is entitled to an interest in the trust; if circumstances change, we will look at that.”

102. As to the investment of the fund Mr Armitage was adamant that the trustees ought morally to maximise the return on their investment. They would certainly take advice to get the maximum return, particularly with interest rates changing rapidly.

Mr Wardle

103. Mr Wardle was now retired, but his occupation just before retirement was that of a director of a wealth management company, Brewin Dolphin Limited.

104. He first met Mr and Mrs Ramus on a purely social basis approximately 35 years ago. The relationship which developed and was sustained was one of friendship with both of them by Mr Wardle and his wife. In later years, Mr and Mrs Ramus became clients of Brewin Dolphin, although Mr Wardle did not involve himself directly in the day to day management of their investment assets. Although he was aware that Mr Ramus had suffered with depression for some time, Mr Wardle was saddened to hear of his suicide.

105. For his part Mr Wardle was sorry if Mrs Ramus believed that she had reason to question his role or indeed the role of any of the executors/trustees. For the avoidance of any doubt, he had no intention whatsoever of acting in breach of his obligations as an executor or a trustee.

106. Furthermore, it was his intention and that of his fellow trustees to pay the income generated by the will trust to Mrs Ramus even though it appeared to him that, by careful management of her finances, Mrs Ramus was financially self sufficient.