Covid-19 Protocol: This judgment was handed down by the Judge remotely by circulation to the parties' representatives by email and release to BAILII. The date and time for hand-down is deemed to be 3:00pm on Friday 18th September 2020

Mr Justice Stuart-Smith :

Introduction

- The Defendant ["MW"] engaged the Claimant ["Premier"] to provide labour, plant and materials to a large construction project in Hull known as the Energy Works Hull Project ["the Project"]. Premier started on site in a small way in late 2017 but was required to increase its involvement substantially in the course of early to mid-2018. Premier ramped up its involvement as requested by MW and soon became key to MW's efforts to get the Project over the line. MW described Premier's role as "essentially brokering labor to [the Project] and providing supervision to go with the labor.". This does not fully describe the arrangement, but is a reasonable general description: it captures the essential quality that Premier did not bid for a set of sub-contract works which it was then responsible for carrying out. Instead, MW would decide (usually on a weekly basis) how many men (including trades and supervisors) it required to be supplied to carry out the work it wanted done on site, Premier would supply them, and the men would be employees of and paid by Premier at hourly rates. Overall design and programming responsibility rested with MW, though on-site decisions (such as, for example, workarounds made necessary by site conditions) might be made by Premier's men in conjunction with MW. In addition, MW would require Premier to provide materials that were required for the works, though there is a dispute about whether some of the materials so provided should be treated simply as Premier's overhead costs or are otherwise irrecoverable.

- The parties are unable to agree Premier's final account. Premier asserts that it has been under-paid by about £1.3 million. MW says that it has already substantially overpaid Premier and counter-claims substantial sums based on various alternative calculations. The sums counterclaimed reduced significantly before, during and after trial as errors were identified or points conceded from the original calculations.

- The major issue of fact is about the number of hours worked by non-supervisory operatives supplied by Premier for which Premier is entitled to charge MW. This in turn involves detailed consideration of the terms on which Premier was engaged to act. There are also various contractual disputes that are largely due to an absence of formality in making contractual arrangements. That lack of formality is at least partly attributable to the fact that, when in 2018 Premier was asked to step up its operations, the Project was in delay and in trouble. MW had fallen out with and lost a previous sub-contractor, Engie Fabricom UK Limited ["Fabricom"] and had an urgent and compelling need for Premier's subcontract services to assist it in accelerating progress. In MW's words, by early 2018 it had a failing project on its hands.

- The parties have compiled a list of issues for determination by the court. I address the list of issues after setting out the factual background.

The Relevant Factual Background

- The Project had a value of over £150 million. MW was contracted pursuant to a design and build EPC contract which carried heavy penalties for delay. Premier's initial involvement with the Project was pursuant to a small sub-contract for the supply of support steelwork having a value of £2,445 commencing on 4 September 2017. By then, for reasons that do not matter, MW was falling out with Fabricom and the Project was in delay. It was therefore financially imperative for MW to accelerate its works at or about the time that it was to lose one of its major subcontractors.

- It is common ground that Premier's initial works were satisfactory to MW and that MW began to look to Premier to fill some of the gap left by Fabricom. Premier was described in one internal MW email sent on 9 January 2018 as "an Excellent Piping Company" who were able and willing to do whatever MW required in the light of Fabricom's departure. I accept the evidence of Mr Warren (the company's owner) that Premier was a small company with a good reputation which had supplied labour and management on similar projects, albeit on a much smaller scale than ultimately developed at the Project.

- The parties did not enter into a sub-contract for all or part of the outstanding works (or additional works that might be required). Instead, MW engaged Premier from time to time to provide manpower and materials, usually specifying their requirements on a weekly basis for the week ahead. One consequence of this arrangement was that Premier was not committed to a contract period or periods for the carrying out of works. Another was that it was for MW to allocate work for Premier's men to do from time to time. I accept the evidence of Mr Rumsey, who was employed by MW from March 2018, initially as a Construction Superintendent with responsibility for subcontractors doing mechanical works, that at daily personnel meetings he would tell Premier's Site Manager, Mr Chestney, what was needed and he would tell the Premier foremen and so on. Mr Rumsey would tell Mr Chestney of new line items that could be allocated to Premier's men as they came to the end of their current jobs. MW also operated a permit to work system which would identify what work was to be carried out, by whom, when and where. The effect of this system was also to enable MW to identify and control the work that the men supplied by Premier were required to carry out.

- A third consequence was that Premier neither had nor could have responsibility for the overall design of the works they were asked to carry out from time to time. There was a dispute about the allocation of responsibility for design. I find that the design of the Project works was incomplete in early 2018 and that primary responsibility for design rested with MW although some decisions at the workface might have to be and were from time to time taken by Premier's trades and supervisors in conjunction with MW. MW retained overall control of the works, their design and who they should be done by. This finding disposes of another minor factual dispute, namely who was responsible for supervision of the works carried out by Premier. There is no doubt that Premier were asked to supply supervisors and did so and that they will have supervised Premier's men. But at a higher level the responsibility for the overall carrying out of the Project works rested with MW who exercised effective control when required, whether by giving direct instructions (as Mr Rumsey accepted) or by their general oversight of the works that had been allocated to Premier's men. This reflected the fact that (as MW submit in their closing submissions) "this [was] a sophisticated workplace, involving hundreds of operatives across different subcontractors, in the construction of a complex plant." Mr Chestney gave a long answer in the course of his cross-examination about how MW interacted with different trades supplied by Premier and the extent of their and Premier's supervision of Premier's men. I accept that evidence as a general account of how things worked.

- Premier were not in any respect operating a conventional sub-contract package of works that defined the scope of their works and allocated all responsibility to them within the sphere of their sub-contract. They could not possibly integrate with the other trades and subcontractors without detailed supervision and direction from MW. Typically, Mr Rumsey would "spend a considerable amount of time walking across the whole [Project] and being available to assist with the works, for example by looking at drawings and providing solutions to issues being flagged by Premier operatives and Premier's supervisors and foremen." They would go to him with a clash on an issue where an aspect of the job would not work and he would discuss the issue with them until a suitable solution was found. That would then be implemented by Premier. An email from Mr Meakin, MW's Director of Energy Projects, to Mr Chestney on 9 May 2018 provides some insight into how things worked. He stated as his requirement that "Premier must ensure that all staff fulfil their obligations, i.e. are in attendance for all shifts, and not two out of three" and that "I require [Premier's] supervision to work alongside the [MW] supervision and proactively drive the completion of the works." This does not provide a full account of how things were organised, but it includes the clear recognition of MW's involvement in the day to day supervision of the works. It also provides a reasonable explanation why Premier did not maintain records of what activities its labour was carrying out on a day to day basis.

12 February 2018 Meeting

- On 12 February 2018 there was a meeting between representatives of MW, including its Site Engineering Manager (Mr Lettice) and its Commercial Manager (Mr Goundry) and Mr Warren, all of whom gave evidence. The purpose of the meeting was to discuss Premier taking on further works. Mr Warren presented a document setting out the terms on which he was prepared to increase Premier's site presence. It included rates for all site working hours and in addition provided that (a) all breaks were to be paid by MW at 1 hour per day, (b) all hours were to be recorded on signed timesheets for invoicing, (c) bonuses were to be site led (i.e. led and authorised by MW), (d) "MATERIALS + 15%", (e) "Small tools and equipment +15%", (f) "Hired plant + 15%", (g) "Notice Minimum 1 week", and (h) "Travel costs (blue book).

- I accept the evidence of Mr Lettice that MW confirmed at the meeting that the rates being proposed by Mr Warren were broadly comparable with other mechanical trades on the Project. I also accept the evidence of Mr Warren that those in attendance for MW were "very happy" about the rates he was proposing and that they were keen to get Premier's labour on site quickly. Mr Warren accepted that the MW representatives would have to go off and get things sorted and, in the same vein, that Mr Warren should leave it with them. MW did not, then or subsequently, propose any alterations to the rates and terms proposed by Mr Warren. Though they were not formally accepted during the meeting, MW accepted Premier's terms by placing subsequent orders for labour, materials and plant. The contractual analysis is simple: Mr Warren made an offer to contract on the terms set out in his document which MW accepted either at the meeting or by placing the orders without anything that could be described as a contractual counter-offer.

- After trial, on 24 July 2020, MW launched an attack based on data that Premier had disclosed late in response to increasingly pressing requests. The rights and wrongs of the lateness of the disclosure are irrelevant to the outcome of the case. The substance of MW's attack was an attempt to show that Premier did not in fact pay its men by reference to their timesheet hours. Premier responded on 31 July 2020 with detailed rebuttals. The end result of this supplementary skirmishing is that I am not persuaded that MW have identified any discrepancy which undermines the basic proposition that Premier paid its men based on their timesheet hours.

- Certain things follow from this. First, MW and Premier knew and agreed that all hours were to be recorded on timesheets for invoicing and those timesheets were to be signed. The purpose of signature is obvious and is to vouch for the accuracy of the timesheets. The importance of the timesheets is equally obvious and is that the timesheets would be used not only as the basis for Premier invoicing MW but also as the basis for Premier to pay their men, who would themselves be on hourly rates hence the timesheets. I reject any suggestion that MW did not know that Premier paid its men on the basis of their timesheets. Not only is it obvious, it was expressly recognised to be the case in the 12 February 2018 document and in an internal MW email on 14 April 2018. Second, the provisions in relation to materials, small tools and equipment and hired plant were comprehensive: they did not exclude any subcategories or make provision for different rates or no rate at all in particular circumstances.

- Premier thereafter invoiced for both labour and materials in accordance with the 12 February 2018 document, thereby implementing the agreement from their side. The scale of the orders that started to come through in the wake of this agreement is shown by the escalation in Premier's invoicing. By the end of February 2018, Premier had invoiced a mere £41,810. By the end of March 2018 the figure had risen to £533,365. In terms of men required by MW, the increase was from about 12 men in late February 2018 to about 140 at one point in May 2018. On 20 March 2018 Mr Meakin described Premier as "key to our success". To similar effect, on 19 April 2018 Mr Meakin wrote to Mr Schoenhofer, MW's group commercial director, that MW was "entirely reliant on Premier for the next few weeks. We will not hit our dates without them." The evidence indicates, and I find, that this remained MW's view at all material times until the end of June or early July 2018, when Premier became dispensable with the approaching completion of the mechanical works with which they were involved.

Timesheets, checking and invoicing

- The parties were in broad agreement about how the invoicing process was intended to work, but important differences remained about the significance of timesheets and the applicability of turnstile gate data. I deal with each in turn.

- The system that was operated was that, normally at the end of each week, Premier presented timesheets to MW setting out the hours that their men had worked plus other items such as allowances for travel. Premier initially maintained a sheet for signing in and out to support the hours that would be entered on the timesheets, though this paper system was later superseded. Also included on the timesheets would be incentive hours where MW had offered an incentive in particular circumstances: a typical example would be that if a man worked a particular number of hours or shifts he would be paid an additional bonus. The timesheets would almost always be signed by a representative of Premier to vouch for their accuracy. On presentation of the timesheets to MW, a responsible person (for example, Mr Rumsey) would sign them off. They would then be used by Premier as the basis of their invoicing, as contemplated by the agreement between the parties.

- Two points were raised. The first was the suggestion by Mr Rumsey that he would be presented with bundles of timesheets covering a number of weeks and that the dates he would put on them when he signed them off were sometimes unreliable. His evidence on the former point is not borne out by the documents, because the dates on the sheets are closely allied to the periods in respect of which they claim and invoices did not cover multiple weeks. This is because Premier was pushing for cash-flow and, in general, was billing promptly to achieve it as quickly as possible. It had to because it was expanding rapidly to meet MW's requirements and did not have the balance sheet to sustain payments to ever-increasing numbers of men without prompt payment from MW. Even when Premier bunched invoices on 1 June 2018, Mr Rumsey's annotations on the timesheets indicate that they had been presented to him shortly after each relevant period of work and not all in one go. Mr Rumsey's evidence on the second point was convoluted and confusing, particularly in his oral evidence where he oscillated between saying that the dates he had written on the timesheets were reliable and saying that they were not. The documents do throw up some quirks: for example, Premier's timesheets for the week commencing 30 March 2018 were signed off by Mr Rumsey and dated by him 24 March 2018. This seems doubly unlikely since (a) it precedes the date to which the worksheets relate and (b) according to Mr Rumsey he did not start working for MW until 26 March 2018. However, I am not satisfied that Mr Rumsey routinely applied false dates to timesheets when he signed them off and prefer the version of his evidence which supports a finding that he generally attempted to apply genuine dates.

- Mr Rumsey asserted that he simply signed off Premier's timesheets without checking them in order "to keep the peace." To similar effect Mr Goundry, having told his superiors (Mr Schoenhofer, Mr Lakeman, its commercial manager, and Mr Meakin) at the time that checks of timesheets were being made and on another occasion (answering a question about gate records) having told Mr Schoenhofer that MW's site supervisors "had signed off against timesheets as accurate", said in evidence that those signing the timesheets were in fact pushing them down the line for checks to be made later and by others. This in due course opened up a more wide-ranging enquiry, to which I will return after introducing turnstile gate data.

- For the moment it is sufficient to record that one of Mr Rumsey's responsibilities as MW's signing representative was to check and authorise incentive payments, and he did so. I do not accept that he merely waved incentive bonuses through without checking whether they were properly to be paid. Since the incentive bonuses were usually contingent upon completion of certain shifts or hours, it follows that Mr Rumsey could not properly authorise those bonus payments as he did without being satisfied that the qualifying shifts or hours had been worked. Viewed overall, I reject any suggestion that he simply rubber stamped those entries where he was required to endorse bonus payments; and I do not accept as a generality that he was simply rubber stamping, though sometimes he may not have been as rigorous as he should have been.

- In closing submissions MW make the point that Mr Rumsey was not on site all the time and therefore could not personally verify the hours for the time that he was not around. That is true, but in a properly working system it was for MW's signing representatives to satisfy themselves that it was right to sign, which could and should be done by reference to supervisors or others who had been present. The fact that they might not have personal knowledge provides no justification for signing without making enquiry or in any way merely rubber stamping the timesheets.

- The result of signing off of the timesheets would be that Premier raised an invoice based upon the hours they recorded. It is common ground that the invoices were checked by MW on receipt, as is shown by contemporaneous annotations writing down specific items to which it will be necessary to return later. The system operated by MW was that it would then raise an internal Sub Contract Payment Request which would specify the amount for payment to the subcontractor. That document was counter-signed by two senior employees and finally authorised for payment by another, yet more senior employee, typically Mr Tim Lakeman. There would be a supporting sheet which would show the extent of reductions that had been made to Premier's invoice and where the reduction had been made. In some (but by no means all) cases, MW would then issue a Payment Notice with the supporting sheet, which would state:

"We hereby give you notice of the sum that we consider to be, or to have been, due at the payment due date in respect of the above payment being £X and the basis on which that sum is calculated is attached. The payment will be made on account and subject to final checks."

- The Payment Notices sometimes carried a heading which stated that they were made under paragraph 9 of Part II of the Scheme under the 1996 Act as amended. However, neither party submitted that their dealings were in fact subject to the Scheme. In cases where no Payment Notice has been identified or disclosed, it is not clear why MW failed to generate one or, if they did, what has become of it. Premier say, and I accept, that MW did not issue all of the Payment Notices to it. It appears from Premier's final account, and I find, that MW did issue to Premier the Payment Notices covering invoices 959, 960, 961, 962, 964 and 965. When it did so, it provided a copy of the supporting document and the relevant invoice; but the invoice was not marked with the contemporaneous annotations that are to be found on MW's internal copies. Where MW produced Payment Notices covering other invoices but did not send them to Premier, it is not clear why MW produced them except as an internal record of its views on Premier's entitlement. As such they would retain some evidential interest. Although it would be possible to speculate about why MW did not issue them to Premier at the time, there is no valid basis for making a finding about their reasons. I therefore make no finding and do not speculate.

- It is also convenient to record here that I accept without reservation Mr Meakin's evidence that, at least in a properly functioning signing-off process, a Payment Notice such as the one above is meant to be the signer's (and therefore MW's) honest belief as to the value of the work and the sum due to be paid for it. A system such as described above, from timesheets to payment, is universally intended to guard against corruption and to ensure that sub-contractors are paid those sums to which they are genuinely thought to be entitled. Both the signing off of timesheets and the checking of the submitted invoice are integral to that process. The purpose of having timesheets signed off by the employer's representative on site is clear: it is to signify knowing agreement and to prevent disputes later. Signed timesheets are therefore the primary (and should be the best) evidence for the parties and the Court. The idea that timesheets should be rubber-stamped without any meaningful check subverts the purpose of the system. Similarly, deliberate overpayment (i.e. payment of more than is believed to be justified) of a subcontractor's submitted invoice for ulterior reasons strikes at the basis of the system just as much as deliberate underpayment because, as MW expressly recognised, it stores up possibly existential trouble if attempts are made later to claw back the deliberate overpayment. But that is what happened in this case, as I shall explain.

- Finally, a notice such as was included in MW's Payment Notices, cannot reasonably be interpreted as meaning or implying that the paying party is knowingly paying more than it believes to be the receiving party's genuine entitlement at that stage. The reference to the payment being made "on account and subject to final checks" is to provide protection for the paying party in case "final checks" reveal new material which casts doubt on the interim valuation. Where the paying party has carried out a full analysis of the receiving party's entitlement, "final checks" will reveal nothing new that justifies a change in its position. The statement in the Payment Notice represents that the normal system of checks and approvals has been carried out and that the paying party genuinely believes that the sum being paid on account is the sum to which the receiving party is properly entitled.

Turnstile data, working off site and excessive breaks/productivity

- On many construction sites, entry to the site on arrival and exit on departure will be through turnstiles that record who has been on site for how long. Where a claim for payment is made on the basis of timesheets, turnstile data may be useful evidence against which to check a contractor's claimed hours. On the Project, Premier distrusted the turnstile data for two main reasons. First, they had reason to believe that the turnstiles did not always function and record workers' movements properly; and second, some part of their men's working days were spent outside the turnstiles for a number of reasons including that the office and facilities for food and relaxation were outside the perimeter controlled by the turnstiles. Thus, for example, there would be a safety briefing before the start of each shift which took place outside the turnstile perimeter, which was chargeable but would not be accounted for by turnstile data; and Premier carried out some work outside the perimeter including in an area called Rix's Yard.

- There was a dispute about how much time Premier's men might reasonably spend during their working day outside the turnstile perimeter. Premier maintained that, as well as carrying out work outside the turnstile perimeter its men were often kept waiting there for permits to work or other instructions for which MW were responsible. MW responded that Premier's men spent too much time in the canteen for no good reason. By trial Mr Meakin tended to speak about this issue all in terms of productivity, meaning rate of progress per time spent on site, but the objective evidence does not support a finding that Premier's men were particularly unproductive or, if they were, that the reason for their lack of productivity was that they were not within the turnstile perimeter for excessive periods or were working within the turnstile perimeter but unproductively. The turnstile data, even if admitted, does not provide sufficient detail to support such findings because it provides no evidence about what was being done by men outside the turnstile perimeter and no measurement of their productivity either outside or inside it.

- I accept that at an early stage Mr Lakeman had a conversation with Mr Warren about productivity. But what is, to my mind, significant is that there is otherwise no substantial evidence of MW complaining during the key period from March to July 2018 either that Premier's men were absent when they should have been present, or that they were slacking on the job, or even that they were being unacceptably unproductive. The first real complaint about lack of productivity and excessive breaks that has been identified is an email on 5 July 2018, less than a week before Premier were asked to reduce their presence on site.

- It is a commonplace that attempts to accelerate a very large project in its later stages may lead to inefficient allocation of work and working. No programming evidence was put forward that might have enabled firm conclusions to be drawn about the success or otherwise of MW's programming and planning or the effectiveness of Premier (or other subcontractors) in carrying out the works that were allocated to them. The absence of such evidence was proportionate and reasonable given the scale of the disputes in these proceedings. MW disclosed one or more documents recording Premier's progress (e.g. for week 11) and occasional other documents which set out targets and achievements for subcontractors. Where Premier featured on these other documents, the relevant line on the document would usually cover the work of more than one subcontractor. They are inadequate evidence on which to draw conclusions about Premier's productivity or the reasons why subcontractor's targets were not achieved where that was shown on the sheets. Neither those documents nor any other evidence that has been brought to the attention of the Court would enable a judgment to be made about the effectiveness of Premier's work that gave rise to that progress or whether there were reasons extrinsic to the quality of Premier's workforce and work which contributed to or determined the level of progress from time to time. MW also relies upon sporadic documents in support of a submission that Premier were "in delay" e.g. an email from MW to Mr Warren and others dated 12 March 2018. In my judgment, the documents do not enable any valid judgment about the scale of delay (if any) or the reasons for it.

- More importantly, given the need for MW to try to accelerate and the substantial sums that they were incurring to Premier for its supply of labour, supervision and materials and the level of supervision and control being exercised by MW, I am confident that MW would have known if Premier's men were simply not working (or available to work) significant proportions of the times that they had been requisitioned by MW and should have been working and for which they were billing week by week. And, if they had known any such thing, MW would have been on Premier's back in no uncertain terms because of their financial need to accelerate. Similarly, if Premier's men had been unproductive because of incompetence or inadequate supervision by Premier, MW would have complained and there would be documentary references to such complaints: but there is not. Mr Cawkwell, who was MW's top scaffolding supervisor at the Project before becoming site manager in July 2018, said that he kept a close eye on all workers and took his responsibilities seriously. I accept that evidence. He described various supervisory activities, including daily site walks, one purpose of which was to observe Premier's workers to see, in general terms that they were doing what they were supposed to be doing. There is no evidence of complaints arising from this or other forms of supervision by MW, as there would have been if there had been serious problems of absenteeism or unproductive workmanship. The absence of evidence of this sort is therefore evidence in support of Premier's assertion that its men were present as required and worked reasonably productively within the constraints of a project on which MW was attempting to accelerate and to prevent it failing. Another pointer is the observation of Mr Schoenhofer in an email on 14 April 2018 where he said: "I also question the working hours we dictated (more or less 2 shifts, 12 hours each). Their people work 14 days in a row, 4 days free. Can anybody really work productive such long hours for consecutive 14 days. I dare to doubt

." So do I.

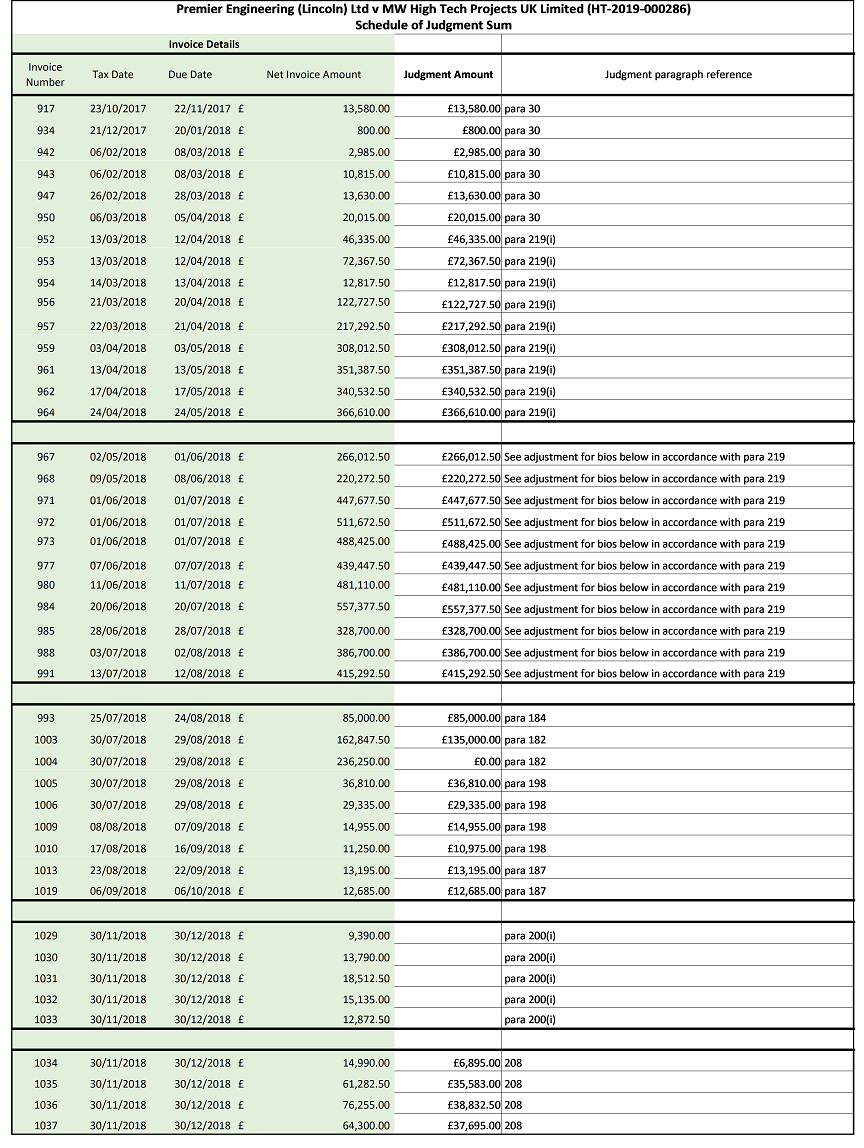

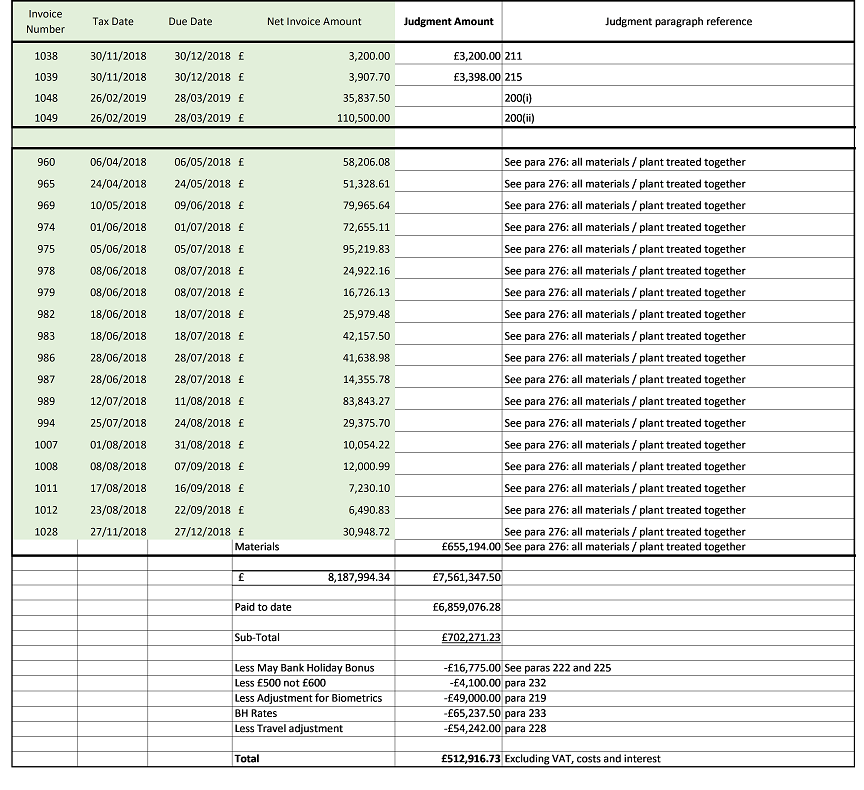

Early invoices

- Premier's earliest invoices (917, 934, 942, 943, 947, 950) are not in dispute in the present proceedings and I need say no more about them.

- The invoices that are in dispute commence with Premier's invoice number 952, which was issued on 13 March 2018. It is convenient to summarise the first four disputed invoices here. They are invoices 952, 953, 954 and 956, which were issued between 13 and 21 March 2018.

- Invoice 952 was dated 13 March 2018 and was in the sum of £46,335 for labour during the week ending 2 March 2018. It was supported by timesheets signed by Mr Chestney that were signed on behalf of MW on 5 March 2018. It appears from the invoicing and certifying documents (collected together in MW's disclosure as Payment Certificate 5) that the invoice was checked at the time as there are contemporaneous annotations that would reduce the invoice total to £25,212.23. An initial Sub Contract Payment Request and summary document indicated a payment of £59,152 but not how this payment was calculated as it is greater than the sum claimed by invoice 952 and no other invoices are collected together under Certificate 5. The initial Sub Contract Payment Request was annotated with the words "Amended to £150k on account". The payment of £150,000 was approved for payment by Mr Goundry and Mr Purcell, MW's contract manager signing as Project Manager. It was authorised for payment by Mr Lakeman on 21 March 2018 with a final date for payment being stated to be 23 March 2018. £150,000 was in fact paid on 22 March 2018. The Court has seen no evidence to indicate how the payment of £150,000 was calculated, computed or made up other than the annotation within Certificate 5 that it was to be a payment on account.

- Invoice 953 was dated 13 March 2018 and was for labour during the week ending 9 March 2018 in the sum of £72,367.50 It was supported by timesheets signed but not dated on behalf of Premier and signed but not dated on behalf of MW on 5 March 2018. This invoice appears in MW's certifying documentation under Payment Certificate 6. It is subject to contemporaneous annotations which would reduce the invoice total to £45,136.88. It is apparent from its inclusion under Payment Certificate 6 that it contributed to the payment of £91,430 that was made on 5 April 2018. Certificate 6 also included invoices 954 and 956, as to which see below.

- Invoice 954 was dated 14 March 2018 and was in the sum of £12,817.50 for labour during the weeks ending 16 February, 23 February and 2 March 2018. It was supported by timesheets that were signed on behalf of Premier and MW. The MW signatures were dated 7 March 2018. There are no contemporaneous annotations on the copy of the invoice disclosed by MW as part of its Payment Certificate 6 documentation.

- Invoice 956 was dated 21 March 2018 and was in the sum of £122,727.50 for labour during the weeks ending 9 and 16 March 2018. It was supported by timesheets that were signed on behalf of Premier and MW. The signatures are not dated. There is evidence of scrutiny of the timesheets because (a) hours are adjusted with the adjustment being initialled by "PG" and "ITC", which is probably Mr Goundry and Mr Chestney while (b) other timesheet entries are ticked on the MW Payment Certificate 6 copy but not on the copy included by Premier with its final account, which leads to the inference (which I draw) that MW scrutinised and (in general) approved the timesheets. One Payment Certificate 6 copy of the invoice has contemporaneous annotations which would reduce it to £67,206.95.

- On 21 March 2018 Mr Goundry had written to Mr Schoenhofer and Mr Lakeman asking whether MW was "able to either make payment of 5 & 6 today, or make a £200k on account payment today to Premier Engineering?" This fits with the amendment to the certification documentation and the payment of £150,000 on 22 March 2018. Mr Goundry's reference to "payment of 5 & 6" is evidently a reference to the payments that were being processed under what are now called Payment Certificates 5 and 6.

- I therefore summarise the position with these invoices as follows:

i) The aggregate sum claimed by invoices 952, 953, 954 and 956 was £254,247.50;

ii) If the reductions shown by the contemporaneous annotations had been made, the reduced aggregate total of the invoices would have been £150,373.56;

iii) The combined total of the payments under Payment Certificates 5 and 6 was £241,430, some 95% of the aggregate sums claimed for the four invoices;

iv) The internal evidence to which I have referred leads to the inference that the timesheets were scrutinised by MW before the payments were approved.

Turnstile difficulties and the introduction of Biometric data

- Mr Schoenhofer was wedded to turnstile data. On 21 March 2018, when Mr Goundry had emailed him and Mr Lakeman requesting either a payment of two Premier invoices or £200k on account, he had added "We are going to have weekly issues with keeping cash flow into them based on their increase labour to meet out demands. I would suggest the only way to move away from last minute urgent requests is going to be a £200k on account." Mr Schoenhofer replied: "have you checked against gate records?" On 4 April 2018 when given the heads up about invoices 959 and 960, which had a combined value of £366,218.58, his immediate reaction was to ask for checks to be made against the gate records, with the added instruction "Do the same on all of their applications."

- Premier's distrust of the turnstile data for the Project dated back to Mr Warren's experience in 2017 when carrying out work for Siemens. It came to a head when MW challenged some of Premier's timesheets for the period covering the Easter weekend 2018. Premier then tried to pass on the reduction to an unspecified number of its workers who protested that they had been working despite the apparent evidence to the contrary from the turnstile data. One particular employee, a welder called John Bell, satisfied Premier that he had been on site and carrying out welding on a day for which he had been paid but in relation to which the turnstile data suggested that he was not present and therefore should not have been. The consequence for Premier was a significant deterioration in labour relations, as they had paid their men on the basis of timesheets, then tried to deduct, and finally had to give way. I accept Mr Warren's evidence that some men accepted that they had gone home early and accepted the deduction but others did not. I also accept Mr Warren's evidence that Premier was warned by the Union that it was illegal to make deductions on the basis of turnstile data. Whether what the Union said was correct or not does not matter: it was a threat of future industrial trouble if Premier did it again. MW rely upon Mr Warren's acceptance that, in this instance, Premier made deductions based on turnstile data. It did so initially though I accept Mr Warren's evidence that it stopped doing so and paid back the sums that had been deducted (whether for all employees or those who had not accepted the deduction). That temporary practice of making deductions seems to me to pale into insignificance when compared with the furore that it provoked and Premier's subsequent deep-rooted antipathy to the use of turnstile data on the Project.

- The specific rights and wrongs of this episode, or of Premier's distrust of the turnstile data, do not matter. What matters for the purposes of this judgment is that, from then on, Premier were resolutely opposed to having their timesheets verified by reference to the turnstile data which they now believed (rightly or wrongly) to be unreliable. I have no hesitation in accepting Premier's evidence that this was a genuine issue for them and that they developed and thereafter maintained an implacable opposition to turnstile date being used in relation to their works for MW, whether for verification or otherwise. It coincided with problems relating to Premier's invoice 957, which related to an earlier period, as I detail below.

- One outcome of Premier's opposition to turnstile data was that the parties agreed that Premier would install a biometric clock which their men would use on signing in and signing out and that the data from that clock would be used for verification of timesheets. I accept the evidence of Mr Warren that the motivation for this came from MW and that Premier was instructed to install the clock: it would have been a sensible response in the face of Premier's opposition to the turnstile data and MW's wish for objective data to assist them with verification. The clock was ordered on or about 10/11 April 2018 and installed later that month.

April 2018 discussions

- I have referred at [17] above to Premier not having the balance sheet to sustain payments to ever-increasing numbers of men and therefore needing prompt payment. MW knew this: on 21 March 2018 Mr Goundry wrote to Mr Schoenhofer: "the issue is, M&W have instructed a Sub-contractor without a heavy financial backing behind them to man up to levels which they cannot maintain without weekly payments." To similar effect, on 13 April 2018 Mr Demase, MW's construction director, wrote to Mr Schoenhofer and others that "Premier is a small contractor

. He indicates that he is out maybe £700,000 and he's too small a player to carry that much debt. We almost had a walk out this afternoon because there was a rumor spread that he was not going to make payroll." In the same email, Mr Demase referred to turnstile data problems saying "I know there were clock issues but I believe they have been resolved. The net being he lost recovery of £30,000." This appears to be a reference to a deduction of £30,000 from Premier's invoice 957, which was submitted on 22 March 2018 in the sum of £217,292.50 and paid on 12 April 2018 in the sum of £187,292.50.

- The basis for the deduction from invoice 957 does not appear from the invoicing and certifying documents (collected together in MW's disclosure as Payment Certificate 7). Though there are contemporaneous annotations applied by MW to Premier's invoice they do not obviously lead to a deduction of £30,000; and the deduction is not the subject of further explanatory witness evidence. There is, however, evidence of internal disagreement about how MW should approach the invoice. On 4 April 2018 Mr Goundry emailed Mr Schoenhofer and others submitting "payment 7", which was for payment of invoice 957. Mr Schoenhofer queried the invoice, asking for details of "times per gate records" and saying "Nothing is urgent. Every application has to get checked and assessed properly." It was in response to this query about gate records that Mr Goundry replied "M+W Site Supervisor has signed off against timesheets as accurate." This provoked the retort from Mr Schoenhofer that "I do not care of what they signed off at all! Please check against gate records." Mr Goundry replied that he would "double check the clocks against the sign offs again." He said they would have a walk off site if they were not able to pay that week; and he pointed out that there was no reference to site clocks in the original sub-contract, which he described as "very basic". Mr Goundry then went back to Premier explaining MW's spreadsheet showing timesheet hours and turnstile records and pointing out widespread discrepancies between the two. It appears that there had been either a meeting or a discussion between Mr Goundry for MW and Mr Warren and Mr Chestney for Premier on 9 April 2018, which is referred to in an email sent to them by Mr Goundry the following day. The net result appears to have been that on 9 April 2018 Mr Goundry sent to the same MW distribution list as before a revised Payment for their approval and action stating "we have made our assessment based on the data available and agreed an on account reduction with Premier Engineering subject to final checks." Mr Goundry sent Premier the turnstile data from January 2018 to 5 April 2018 with his email to Mr Warren and Mr Chestney on 10 April 2018.

- These exchanges and Mr Demase's email of 13 April 2018 support the conclusion that the reduction of invoice 957 was by reference to turnstile data, but no further inference about how the deduction was calculated can safely be drawn. It is probable, and I find, that the episode surrounding this invoice and payment contributed to the difficulties to which I have referred and the agreement that Premier should install the biometric clock. It should be noted, however, that invoice 957 did not cover the Easter weekend and therefore did not cover the hours for John Bell and others that became a bone of contention. Mr Bell's timesheet for the week ending 6 April 2018 was included in the materials supporting invoice 961, which MW paid in full on 26 April 2018. Precisely how and when it was agreed that Premier would install the biometric clock and that it would be used for verifying timesheets does not appear from the evidence, but I infer that it occurred after MW had asked Premier to check their timesheets against the turnstile data over the Easter weekend and by about 10 April 2018 when Premier ordered the biometric clock. This fits broadly with the discussions and deduction from the invoiced sum on invoice 957 and the problems that Premier experienced with its workforce to which I have just referred. I find that Premier's opposition to the use of gate data was fixed by the time that the biometric clock was ordered and was the reason for it being installed. The internal discussion involving Mr Schoenhofer also indicates that, at that stage, he required Premier's timesheets to be checked properly and deductions to made as dictated by objective evidence.

- Mr Schoenhofer's position altered during the week before Saturday, 14 April 2018, because of his appreciation of Premier's need for cash flow. Early on 14 April he wrote to Mr Demase and to senior management in the M+W group describing a solution that he regarded as "workable but unfavourable". After describing how Premier's payment terms had been reduced from 14 days to 10 days because of ever-increasing demands for manpower and how this was just about doable if Premier issued its invoices on Fridays, he continued:

"So we decided on Tuesday this week that we pay now every invoice without assessment as is on-account and do our checks afterwards.

I am not at all happy with that solution as we already can foresee following problem: workers at Premier are paid weekly according their timesheets. There are considerable differences between timesheets and their working hours on site. Tim presented them to Premier's managing director who promised better supervision. We also provide them now with our gate records on a weekly basis. It's hard to cut their invoices afterwards as they already have paid now their workers before we come back with our assessment. If they do not change (increase) their productive hours on site we will bring Premier in a very uncomfortable situation or we just accept their invoices as they are.

I just can give advice to have at least a close look on their presence at site as we would been forced to cut their invoices if differences between invoiced hours and hours according gate records remain that size we have seen on previous application. And with the on account payment pattern now, we would create a huge problem for them retrospectively or we just accept."

I return to this email at [67] below.

- On 14 April 2018 Mr Chestney met Mr Demase. The product of their meeting was a document entitled "Pay Basis for Premier Craft", which Mr Demase sent to Mr Chestney the same day as "the payment basis we discussed." He asked Mr Chestney to have his management get back to him by Sunday 15 April 2018 so he could present it to his higher management the following day.

- The first two pages of the document set out what shift hours would be, what breaks would be permitted, and the basis on which Premier employees would be paid e.g. the Monday-to-Thursday dayshift would be for a total of 11 hours paid work with employees being paid straight time for 7 ½ hours work and time and a half for the overtime. Although stated in terms of what Premier's men would do, this section of the document also served to record the shift patterns that MW required to be worked, which had been the subject of earlier discussions with Mr Donnelly, MW's construction and piping manager from about mid-March 2018. The rates at which Premier would be paid had been established by the 12 February 2018 document and Premier had been billing in accordance with those rates since then as agreed: they were not set out again in the 14 April 2018 document. The third page of the document included a series of conditions, some of which referred to payment of Premier's employees but some of which went further and regulated dealings between Premier and MW. Specifically, conditions D to I stated:

"D. Because Premier has work both on the site and off site on M&W's storage facility, Premier will have installed, at their cost, and operating by Monday April 16th a biometrics' reader outside the M&W gate to scan all employees in in the morning and evening. In addition they will maintain a manual signed timesheet to back up all records. All data collected by the biometrics report shall be provided to M&W for each invoice period.

E. Any additional overtime requests above the standard hours above will have to be authorized by the M&W Piping Construction Manager or his delegate.

F. Premier will manage all breaks and insure the craft is back to work immediately following any break period.

G. Premier Management and Supervisors will be responsible for maintaining quality workmanship, insuring a high productivity for the craft they are supervising and shall maintain discipline among its entire workforce.

H. Premier must maintain qualified supervisors and qualified craft.

I. Premier shall submit invoices on or before the close of business each Monday following the week worked."

- MW points out that there is no reference to turnstile data in the document. That is consistent with the context in which the discussions were held, namely that Premier had made clear their opposition to using turnstile data and it had been agreed that the biometric clock would be used instead. As recorded in Condition D this was, at least in part, because Premier had to carry out work both within and outside the turnstile perimeter, which both parties recognised and accepted. Because Premier was not prepared to go ahead on the basis of turnstile data, another independent source of verification was required to protect both Premier and MW. Condition D set out the basis upon which the parties would go forward, namely signed timesheets and biometric data. While rejecting subjective intention as an aid to interpretation, I agree with Mr Warren's evidence that because MW had suggested putting in the biometric clocks, Condition D was as clear as day. And I accept Mr Chestney's evidence that "the whole point of the exercise was to come to an agreement where turnstile data was not included." Viewed objectively and in the context of the discussions and agreements that had taken and were taking place, there was no mention of turnstile data because they were not to be included in the material for verifying Premier's hours and invoices.

- In his witness statement Mr Chestney said that Mr Demase instructed Premier during the meeting on 14 April 2018 to install the electronic clocking system on site to ensure that hours recorded on the timesheets were not wildly wrong. For the reasons set out above, I do not think that Mr Chestney is right in this part of his evidence. The agreement that Premier would install the biometric clock came earlier and was reflected in the document for that reason. Mr Chestney and Mr Demase were involved in the process of formalising that agreement and other features of the working relationship in writing.

- Mr Chestney promptly sent the document to Mr Warren, describing it as "the proposal as discussed today." Mr Warren approved it the same day and asked Mr Chestney to action it on Premier's behalf. On 15 April 2018 Mr Demase commended his document for agreement in an email which recognised Premier's need for cashflow, stating that Mr Warren had been drawing on his own resources to fund payroll and stating that "if we are to keep moving forward with Premier we need to take action as soon as possible." Mr Meakin forwarded that email and the document to Mr Lakeman and Mr Schoenhofer recommending the proposal and adding "we don't have much time to go, and Premier are a key part of our success." Their actions show that both Mr Chestney and Mr Demase thought that their discussions were to be endorsed by others and were not the final word or agreement between the parties. Though they were agreed, what they produced was described as a "proposal" for agreement by their employers, MW and Premier.

- Things then went quiet. There is no documentary or witness evidence of MW's higher management (Mr Schoenhofer and Mr Lakeman) considering or formally approving the 14 April 2018 Basis of Pay document: neither Mr Schoenhofer nor Mr Lakeman gave evidence. Equally, there is no documentary evidence of MW going back to Premier formally or expressly to confirm agreement of the terms set out in that document. Mr Meakin's witness statement refers to internal MW discussions over the following days; but there is no documentary evidence or record to substantiate his evidence on the point, which would be surprising if his evidence were correct given MW's free use of emails and the significance of the issues being discussed. There is email evidence from 16 April 2018 which shows that MW were still recording turnstile data which it interpreted as showing that Premier's labour were not working within the turnstile perimeter for their full shifts and that "a good number were clocking off early but being claimed for full shifts": but that is not the same as senior management discussions of the 14 April 2018 document or its terms. I am not satisfied that there were any such discussions before 1 May 2018; if there were, nothing was done as a result of them. Mr Warren agreed in cross-examination that Mr Chestney "would have" kept him informed of continuing discussions between the parties in mid to late April but, in my judgment, it was apparent from his answers that he had no actual recollection of any such discussions. His evidence does not persuade me that there were any discussions between the parties between 15 April 2018 and 1 May 2018. I am not satisfied that there were any. I deal with the discussions on 1 May 2018 at [81] below.

- From 14 April 2018 MW stopped supplying turnstile data to Premier and Premier, when it had it, started supplying biometric data to MW.

Payment of invoices

- On 19 April 2018 MW paid Premier's invoices 959 and 960 (collected together as Certificate 8). Invoice 959 had been submitted on 3 April 2018 and was in the sum of £308,012.50 for labour. Invoice 960 had been submitted on 6 April 2018 and was in the sum of £58,206.08 for materials. I deal with materials invoices at [67] below. The documents disclose at least part of the history of this application and how these invoices came to be paid in full. There are contemporaneous markings on MW's copy of Invoice 959 which would mark it down to £219,633.38. As with contemporaneous annotations on other invoices, these appear to have been made on the basis of turnstile data. No alternative basis for them has been suggested. However, MW's Sub Contract Payment Request was signed off in the full amount for each invoice by Mr Goundry and Mr Purcell. It was also signed as authorised for payment by Mr Lakeman on 11 April 2018. A Payment Notice in the full amount of each invoice was produced and signed on behalf of Mr Purcell which said that the date for payment was 18 April 2018. On 11 April 2018 Mr Goundry sent an email attaching the documentation for the payment to be made on account to Mr Schoenhofer and two others, referring to "our discussions on site today" and requesting approval as payment was due on 18 April 2018. Mr Schoenhofer replied:

"Approved

But please have now a look on all previous applications and conduct an accurate assessement [sic] on them. We do have gates to use the data for crosschecking the timesheets of our suppliers."

- This evidence supports the inference that MW took the deliberate decision to pay Premier's invoice in full and in the knowledge that there was turnstile data that (a) would support MW in seeking to apply deductions from the interim payment and (b) would not support the terms of the Payment Notice or the approval and authorisation of payment in full. That special arrangements for payment of Premier's invoices were in place is also supported by an email sent by Mr Schoenhofer to Mr Meakin and Mr Lakeman on 19 April 2018 in which he said that he had told them the previous Saturday (i.e. 14 April 2018) that payment of Premier's invoices should follow a process under which "we pay on account and assess afterwards." On 10 May 2018 Mr Winthrop emailed Mr Schoenhofer, copying others within MW, that "the project team has made the decision to make the on account payment to push the project forward in the interim and for the redress to be made later against the biometric information provided

." In the light of this evidence and the evidence internal to MW's certification documentation, which shows contemporaneous annotations before payment was made, I find that MW took the deliberate decision to which I have referred at the start of this paragraph. Specifically, I find that (contrary to what Mr Schoenhofer said in his email of 19 April 2018) MW carried out its assessments before paying Premier's invoices.

- MW's treatment of Invoice 961 followed the same pattern as for invoice 959. It was submitted by Premier on 13 April 2018. The documents are collected under Payment Certificate 9. The invoice was for labour and was in the sum of £351,387.50. Premier's invoice was subject to contemporaneous annotations that would have marked it down from the invoiced sum of £351,387.50 to £247,110.28. Despite this, the invoiced sum was approved for payment by Mr Goundry and Mr Purcell and authorised for payment by Mr Lakeman on 18 April 2018. A Payment Notice for the invoiced sum without deduction was signed by Mr Purcell and payment of the full sum was made on the due date, 25 April 2018.

- Payment Certificate 10 covered Premier's invoice 962, which was submitted on 17 April 2018 for labour in the sum of £340,532.50. Contemporaneous annotations would have reduced the amount owed to £275,388.76. The worksheets had been signed off by Mr Rumsey including specific agreements for bonus payments. The invoiced sum was approved for payment in full by Mr Goundry and Mr Purcell and, on 18 April 2018, Mr Lakeman authorised it for payment in full, the date for payment being 2 May 2018. A Payment Notice for payment of the invoiced sum was signed by Mr Purcell and dated 18 April 2018. The full invoice amount was paid on 3 May 2018.

- Payment Certificate 11 covered invoices 964 (£366,610.00 for labour) and 965 (£51328.61 for materials), both of which were dated 24 April 2018. Invoice 964 has contemporaneous annotations that would reduce it to £265,777. The timesheets have examples that show Mr Rumsey (who signed them) checking and making adjustments. Despite the contemporaneous annotations, the invoice sums were approved for payment by Mr Goundry and Mr Purcell and authorised for payment by Mr Meakin (though his signature is missing). A Payment Notice for the whole invoiced sums was dated 3 May 2018 and was signed by Mr Meakin. The full amount was paid on 10 May 2018.

- Payment Certificate 12 covered invoice 967 which was dated 2 May 2018 in the sum of £266,012.50. Contemporaneous annotations would reduce that sum to £218,860. There is evidence of Mr Rumsey specifically authorising entries on the timesheets. Despite the contemporaneous annotations, the full invoice sums were approved for payment by Mr Winthrop (an MW quantity surveyor) and Mr Purcell and authorised for payment by Mr Meakin on 9 May 2018. He also signed a Payment Notice for the full invoiced amount on 9 May 2018. It was paid in full on 16 May 2018.

- Payment Certificate 13 covered Premier's invoice 968 which was for labour in the sum of £220,272.50 and dated 9 May 2018. The due date for payment was stated to be 24 May 2018. The invoice says "see attached supporting timesheets and biometric clocking report" but it appears that full biometric data was not supplied as Mr Goundry emailed Mrs Braithwaite, Premier's office and account manager, on 10 May asking for "the biometric data in [sic] a shift by shift basis in excel format for the full week", which he later explained was "required to substantiate the invoice." After a delay in provision of the requested biometric data, Mrs Braithwaite asked MW if Premier could be paid 70% of its invoice with the outstanding 30% being paid on presentation of the data. Premier's invoice was subject to contemporaneous annotations which would reduce it to £187,615.41. Mr Rumsey was responsible for signing off the timesheets and there is evidence of him specifically authorising particular payments. Mr Winthrop and Mr Purcell approved and on 17 May 2018 Mr Meakin authorised £154,190.75 for payment, which is 70% of the invoiced total. Mr Meakin also signed the Payment Notice in that sum, referring to Mrs Braithwaite's request for payment of 70% as explanation of the reduction. The Payment Notice was dated 17 May 2018. The due date for payment was stated to be 23 May 2018 and the payment of the 70% was made on 25 May 2018. This is the first occasion where the invoice refers to biometric data and according to Mrs Braithwaite (whose evidence I accept) it was the first invoice supported by biometric data. It was for work carried out in the week ending 4 May 2018 and MW relied upon the absence of biometric data to justify reducing its payment. Apparently the outstanding 30% was not subsequently paid, although Mrs Braithwaite supplied additional information on 16 May 2018. There was no suggestion by MW to Premier that the sum due to be paid should be reduced by reference to the contemporaneous annotations or turnstile data.

- Premier submitted no invoices between 10 May and 1 June 2018. Between 1 and 11 June 2018 it submitted 9 invoices totalling over £2.5 million. The 9 invoices comprised 5 for labour 4 for materials. The periods covered by the labour invoices were the week ending 11 May 2018 to the week ending 8 June 2018. This hiatus is the exception to the general rule that Premier billed promptly in its pursuit of cashflow. The reason for the hiatus has not been explained in evidence. Despite the hiatus in submitting invoices, the labour invoices were supported by signed timesheets that were generally dated by MW at or soon after the relevant period of work.

- The first labour invoice in sequence is invoice 971, which was for labour during the week ending 11 May 2018 in the sum of £477,677.50. It was dated 1 June 2018 and attached timesheets and biometric data. It is covered by Certificate 16. Contemporaneous annotations would reduce the invoiced amount to £351,309.68. It was approved for payment in full by Mr Winthrop and Mr Purcell and was authorised for payment in full by Mr Meakin on 14 June 2018. Most of the timesheets are signed by Mr Rumsey and his signature is dated 12 May 2018. Mr Meakin signed the Payment Notice in the full invoice amount with payment stated to be due on 20 June 2018. Payment was made in full on 19 June 2018.

- This sequence of invoices being subject to contemporaneous annotations reducing the invoiced sum but being approved and paid in full comes to a halt with invoice 972. It was dated 1 June 2018 and was for labour during the week ending 18 May 2018 in the sum of £511,672.50, with a payment due date of 16 June 2018. It attached timesheets and the biometric clocking report. Most but not all of the timesheets were signed on behalf of MW and Mr Rumsey did most of the signing with evidence that some adjustments were made. The contemporaneous annotations marked it down to £395,911.23. There is nothing intrinsic and no explanatory evidence to distinguish the annotations on this invoice from those on previous invoices; and MW says they were made by Mr Winthrop, who did not give evidence. There is also a summary sheet comparing hours recorded on timesheets with hours recorded on the turnstile records and identifying a shortfall by reference to turnstile data of approximately 29%. On the information available to the Court it is not possible to reconcile these calculations precisely with the reductions applied by the contemporaneous annotations, but they are similar where comparisons can be made, which provides support for the conclusion that the contemporaneous annotations were made by reference to turnstile data. Mr Winthrop and Mr Purcell approved payment in this reduced sum, which was authorised by Mr Meakin on 19 June 2018 with a stated final date for payment of 20 June 2018. £395,911.23 was included as part of a payment made on 26 June 2018. The payment is covered by Payment Certificate 19. Premier have told the Court that no Payment Notice or supporting documents showing the breakdown of payments or allocation to invoices was received in respect of the payment made on 26 June or the two later payments on 4 and 11 July 2018 to which I refer below and that requests for information about the breakdown went unanswered. Although not formally in evidence, I accept that information, which was not contradicted by MW.

- Invoice 973 was dated 1 June 2018 and was for labour during the week ending 25 May 2018 in the sum of £488,425, with a payment due date of 16 June 2018. It attached timesheets and the biometric clocking report. Most but not all of the timesheets were signed on behalf of MW: Mr Rumsey did most of the signing with evidence that some adjustments were made. The contemporaneous annotations marked it down to £384,074.15. There is nothing intrinsic and no explanatory evidence to distinguish the annotations on this invoice from those on previous invoices. Mr Winthrop and Mr Purcell approved payment in this reduced sum, which was authorised by Mr Meakin on 19 June 2018 with a stated final date for payment of 27 June 2018. £384,074.15 was included as part of a payment made on 4 July 2018. The payment is covered by Payment Certificate 20.

- Invoice 977 was dated 7 June 2018 and was for labour during the week ending 1 June 2018 in the sum of £439,447.50, with a payment due date of 22 June 2018. It attached timesheets and the biometric clocking report. The timesheets were signed on behalf of MW by Mr Rumsey with evidence that some adjustments were made: his signatures were dated 1 June 2018. I have not identified a copy of the invoice with contemporaneous annotations. Mr Winthrop and Mr Purcell approved payment of £360,581.23, which was authorised by Mr Meakin on 19 June 2018 with a stated final date for payment of 28 June 2018. £360,581.23 was included as part of a payment made on 4 July 2018. The payment is covered by Payment Certificate 21, the documentation for which appears to be incomplete.

- Invoice 980 was dated 11 June 2018 and was for labour during the week ending 8 June 2018 in the sum of £481,110, with a payment due date of 26 June 2018. It attached timesheets and the biometric clocking report. There are contemporaneous annotations which would reduce the invoice to £359,394.60: MW say these annotations were made by Mr Winthrop. There is also a summary sheet, in the same format as the sheet noted in relation to invoice 972 above, comparing hours recorded on timesheets with hours recorded on the turnstile records and identifying a shortfall by reference to turnstile data of approximately 31-32%. Once again, on the information available to the Court it is not possible to reconcile these calculations precisely with the reductions applied by the contemporaneous annotations, but they are similar where comparisons can be made, which provides support for the conclusion that the contemporaneous annotations were made by reference to turnstile data. The timesheets were signed on behalf of MW by Mr Rumsey, who dated his signature as 8 June 2018: the timesheets provide evidence that some adjustments were made. Mr Winthrop and Mr Purcell approved payment in the reduced sum of £359,394.60, which was authorised by Mr Meakin on 19 June 2018 with a stated final date for payment of 27 June 2018. £359,394.60 was included as part of a payment made on 4 July. The payment is covered by Payment Certificate 22.

- In summary:

i) Between 12 April and 20 June 2018, MW made payments against 8 Premier Invoices for manpower (957, 959, 961, 962, 964, 967, 968, 971). Of those:

a) Payment of invoice 957 on 12 April 2018 was reduced by £30,000 by reference to turnstile data;

b) Payment of invoice 968 on 25 May 2018 was reduced by 30% because of Premier's failure to provide biometric data;

c) Otherwise all invoices were paid in full despite the fact that MW internally carried out contemporaneous checks against turnstile data which, if relied upon, would support reductions in payment against the sums claimed in the invoice.

ii) From invoice 959 onwards, viewed objectively, the parties relied upon biometric data where it was supplied (and, in the case of invoice 968, where it was not) as objective support for Premier's timesheets and invoices;

iii) Again, viewed objectively, neither MW nor Premier referred to or relied upon turnstile data as evidencing or showing the correct amount to be paid on account after 12 April 2018, when invoice 957 was paid in the reduced sum by reference to turnstile data;

iv) After 20 June 2018, MW's response changed. There were 4 invoices for manpower against which payments were made between 26 June and 4 July 2018 (972, 973, 977, 980). For three of these (972, 973, 980) the reductions matched the contemporaneous annotations, which were based on turnstile data. No copy of invoice 973 with any markings on it has been disclosed; but I infer that the same approach was probably adopted and that the reduction was by reference to turnstile data;

v) Payment by MW of Premier's invoices up to and including invoice 971 had been prompt. Payment of the subsequent invoices was delayed. This coincided with the mechanical works that MW required of Premier moving towards their close.

- On the face of the invoices and documents collected together under Payment Certificates, there is no explanation for MW's varying approach to making interim payments to Premier on the basis of its submitted invoices, and no explanation was proffered by MW. However, Mr Schoenhofer's email of 14 April 2018 helps to make sense of the varying approach to payments and of evidence which emerged during the trial which is otherwise perplexing.

- MW's defence of the claim based on hours worked by Premier rests substantially upon spreadsheets compiled by Mr Gillam over time. Originally MW intended to introduce these materials as evidence from another witness; but when that witness' evidence was ruled to be inadmissible, Mr Gillam was drafted in at the last moment. For present purposes, the relevant feature of Mr Gillam's evidence was that from April 2018 until Premier went off site he was asked by the commercial or QS department of MW on a weekly basis to compare Premier's timesheet data with the turnstile data. He would be given the Premier timesheets and, after completing the analysis, would give the data to Mr Winthrop. This was, so far as he was concerned, an entirely normal internal transaction which he would routinely expect to do knowing that it was part of the process for checking the subcontractors' claims for payments. This evidence raises the question why the data he was providing was not used as the basis for adjusting Premier's payments.

- Mr Meakin had given evidence before Mr Gillam. When asked in relation to invoice 967 why on 9 May 2018 when signing the Payment Notice he did not use the turnstile data to make the interim valuation, his response was that MW wanted to keep payments to Premier going but reserved their position this being a reference to the terms of the Payment Notices saying that the payment was "on account and subject to final checks". He accepted that the ticks applied by MW to Premier's timesheets would be to confirm that the people were on site. His evidence was that, when the payments were made they were not made in the belief that Premier were entitled to the money but in the belief that MW would claw it back later and that MW were paying them simply to keep them on site. Although his evidence carried a suggestion that MW told Premier that was what they were doing, I reject any such suggestion. Mr Meakin accepted, correctly in my judgment, that Premier would have left site if they had known that was the basis upon which their accounts were being valued.

- Mr Rumsey accepted that on a normal job he would expect to be in a position to check timesheets and to have real input rather than rubber stamping; but he downplayed the significance of his signing timesheets by saying that he did not have either the knowledge or the resources to enable him to make an informed judgment about the validity of the timesheets. He said that the Project was a failing job and he had to bring it home on time, so he had to use "some strange methods to keep everything oiled and greased and moving along smoothly to where we need to be." He said it was a volatile site and he was signing the timesheets to keep the peace. He later said that he expected the timesheets to be checked further down the line, and that what he was doing was "keeping the peace". He said that he did this of his own initiative and not because he was told to do it by someone else. His evidence remains material in this context even though I do not accept that he routinely did no more than rubber stamp either the hours claimed by Premier or the claims for site incentives and bonuses. Specifically, I do not accept that his endorsement of site incentives and bonuses marked on timesheets was mere rubber-stamping. Despite this, I accept that Mr Rumsey was aware of a need to keep the peace with Premier, though the evidence does not disclose precisely how that awareness percolated to him.

- Mr Goundry, who approved a number of invoices for payment, said that he was aware that the MW supervisor who signed the timesheets did so for record purposes only and pushed the question of checking further down the line. He initially said that he may have had some involvement in checking the data but said it was for others to download the information. Later, he accepted that he either had or could have had the turnstile data available to him. And, in answer to the Court, he said that he was aware of a decision or a policy taken by others to pay Premier on their applications simply to keep them on site. There was also a recurrent theme, echoed by Mr Goundry and Mr Lettice, that the relevant people at MW didn't have the time or the resources to check things properly.

- Drawing these strands together, Mr Schoenhofer's email of the 14 April 2018 refers to a decision taken the previous Tuesday, which was 10 April 2018, to pay Premier's invoices in full. It left open what the ultimate outcome might be, the alternatives being to try to claw back monies later on the basis of turnstile data which was always available to them or simply to accept the invoices. The decision was taken because MW knew that if they challenged Premier's invoices on the basis of turnstile data, Premier would leave site, which was a risk that MW could not afford to take, until about the very end of June 2018 when Premier's contribution to the work was coming towards its end. The imperative of keeping Premier on site underpins Mr Schoenhofer's email and provides the context for what happened between the parties. In my judgment it explains MW's suggestion of the biometric clock, which could be suggested on the basis that it (and not the turnstile data) would provide independent verification. Mr Schoenhofer's email therefore supports a conclusion that the installation of the biometric clock was decided on or about 10 April 2018 on the basis that it would be the source of independent verification for Premier's timesheets.

- As part of the decision to pay Premier's invoices in full, it was also decided that MW should continue to monitor Premier's timesheets internally against turnstile data from mid-April 2018 with a view to clawing back monies later. This is the effect of Mr Gillam's evidence and the presence of the contemporaneous annotations on the invoices that I have described. It is also confirmed by an email sent from Mr Winthrop to Mr Lakeman (copied to Mr Gillam) on 4 June 2018 in which he listed the labour invoices for the three weeks ending 11, 18 and 25 May 2018 (invoices 971, 972 and 973) and said:

"

suggest we do our final analysis today utilising our turnstile records prior to sending the letter to give Roy an indication as to where we are on deductions beyond the £96k currently held."

The £96k equates to the £30,000 deducted on payment of invoice 957 and the c. £66,000 deducted on payment of invoice 968. In the event, MW chose to pay the first of these three invoices (971) in full and to reduce payment of the latter two (972 and 973) by reference to their turnstile data analysis.

- Mr Meakin said that he had conversations with Mr Warren in April 2018 during which he told Mr Warren what they were doing (i.e. paying invoices as claimed with the intention of clawing back overpayments later.) I reject that evidence. MW did not tell Premier what they were doing and, with the exception of an email on 1 May 2018, to which I refer below, there was no further mention of turnstile data between the parties to alert Premier to what was happening. This was, I find, because Premier were still indispensable to MW and they knew that Mr Warren would leave site if he got wind of such a plan. It was only at the end of June 2018 that MW felt able to switch from paying on the basis of Premier's invoices supported by timesheets and biometric data to reintroduce reductions based upon turnstile data. Until then, the only reduction that was made after invoice 957 was by reference to the absence of biometric data. How Mr Schoenhofer's decision not to cut Premier's invoices was disseminated through MW does not appear, but it clearly was known and understood by those who were responsible for approving and authorising payment of Premier's invoices. It is the only credible explanation for their authorising payments that they believed to be contradicted by turnstile data, which went against the grain of how MW treated all its other subcontractors.

- Nor does it appear clearly from the documents who took the decision to start cutting payments against Premier's invoices again (though it must almost certainly have been Mr Schoenhofer) or how that decision was disseminated within MW. There is, however, an overwhelming inference that the decision was taken on the basis that Premier were now dispensable. What does appear from the documents is that on 14 June 2018 Mr Winthrop was asking Premier to supply biometric data and asking for confirmation that biometric data was being used as the basis of the invoice rather than timesheets, to which Premier replied sending the requested data and stating that the biometric data did not include special deals and incentives given by MW management to the workers. On 20 June 2018, when sending payments for approval to Mr Schoenhofer, Mr Winthrop referred to MW having made their assessment of timesheets by reference to turnstile data. It appears that this submission formed the basis for the payments subsequently made on and after 26 June 2018.

- For the reasons I have given, it was essential for MW that Premier should not understand that MW was making its payments with a view to clawing back large sums later when Premier had paid its workforce on the basis of the signed timesheets. Neither Mr Chestney nor Mr Warren knew what was happening and, if they had done, the response would have been immediate. This contributes to my conclusion that Mr Chestney did not say to Mr Rumsey that it did not matter whether he signed timesheets or not as they (meaning people further down the line in MW) were going to check them on the turnstiles. If anything like that was said, it was said before the decision to install the biometric clock and was no longer applicable after that.

- MW's treatment of materials invoices showed a different pattern. Typically, the invoices would be accompanied by a summary schedule of invoices and the underlying invoices themselves. The typical pattern is for there to be annotations on the summary schedules, which are normally either ticks or short explanations for disallowing an item: