B e f o r e :

JUDGE SWAMI RAGHAVAN

JUDGE GUY BRANNAN

____________________

Between:

| |

JTI ACQUISITIONS COMPANY (2011) LIMITED

|

Appellant

|

| |

- and -

|

|

| |

THE COMMISSIONERS FOR HIS MAJESTY'S REVENUE AND CUSTOMS

|

Respondents

|

____________________

Representation:

For the Appellant: John Gardiner KC and Michael Ripley, Counsel, instructed by RPC LLP

For the Respondents: Elizabeth Wilson KC and Rebecca Sheldon, Counsel, instructed by the General Counsel and Solicitor to His Majesty's Revenue and Customs

____________________

HTML VERSION OF DECISION�

____________________

Crown Copyright ©

CORPORATION TAX – whether FTT correct to hold loan had unallowable purpose under sections 441 and 442 CTA 2009 – yes – appeal dismissed

DECISION

Introduction

- This is an appeal against a decision of the First-tier Tribunal (Tax Chamber) ("FTT") published as JTI Acquisitions Company (2011) Limited v HMRC [2022] UKFTT 166 (TC) ("FTT Decision").

- The appellant is a UK company and part of Joy Global, a multinational group which was headquartered in the US at the relevant time, and whose business is surface mining machinery. In 2011 Joy Global acquired another US-headed equipment group for $1.1bn using the appellant, a newly incorporated company, as the acquisition vehicle. The acquisition was part funded by an intra-group $550m borrowing by the appellant on which it paid arm's length interest. The appellant sought to apply debits in respect of that loan interest but HMRC denied them on the basis of the "unallowable purpose" rules in s441/s442 of the Corporation Tax Act 2009 ("CTA"). Those rules apply when a company becomes a party to a loan relationship and where its main or one of its main purposes for being a party to the loan relationship is to secure a tax advantage for itself or another. Where the rules apply, the deduction of loan interest by the loan debtor, that would otherwise arise, is denied, but only insofar as it is attributable to the unallowable purpose on a just and reasonable basis.

- The FTT agreed with HMRC that the unallowable purpose rules applied and that all of the loan relationship debits in respect of the interest paid should be denied. The appellant now advances eight grounds of appeal against the FTT Decision, some with permission of the FTT and the remainder with permission of the Upper Tribunal. At its heart the appeal largely turns on the proper statutory approach to be taken when considering the purpose for which the appellant was a party to the loan. The appellant argues the legislation requires the requisite purpose to be ascertained purely from the perspective of the borrowing entity. Where, as here, a company borrows at arm's length to make a commercial acquisition, it is submitted that no question of unallowable purpose can arise. HMRC consider the ascertainment of purpose requires consideration of all the facts and circumstances. That may include, in a group structuring context such as the present, asking why a particular taxpayer entity was chosen to be a party to the loan as opposed to another. Essentially, HMRC contend, as the FTT held, that the appellant was inserted into the acquisition structure for the purpose of obtaining a UK tax deduction for the loan relationship debits.

Law

- Given the centrality of the above issue of statutory interpretation it is convenient to turn to those provisions in s441 and s442 first. Those provide as relevant:

"441 Loan relationships for unallowable purposes

(1) This section applies if in any accounting period a loan relationship of a company has an unallowable purpose.

…

(3) The company may not bring into account for that period for the purposes of this Part so much of any debit in respect of that relationship as on a just and reasonable apportionment is attributable to the unallowable purpose.

…

(5) Accordingly, that amount is not to be brought into account for corporation tax purposes as respects that matter either under this Part or otherwise.

(6) For the meaning of "has an unallowable purpose" and "the unallowable purpose" in this section, see section 442.

442 Meaning of "unallowable purpose"

(1) For the purposes of section 441 a loan relationship of a company has an unallowable purpose in an accounting period if, at times during that period, the purposes for which the company—

(a) is a party to the relationship, or

(b) enters into transactions which are related transactions by reference to it, include a purpose ("the unallowable purpose") which is not amongst the business or other commercial purposes of the company.

(2) If a company is not within the charge to corporation tax in respect of a part of its activities, for the purposes of this section the business and other commercial purposes of the company do not include the purposes of that part.

(3) Subsection (4) applies if a tax avoidance purpose is one of the purposes for which a company—

(a) is a party to a loan relationship at any time, or

(b) enters into a transaction which is a related transaction by reference to a loan relationship of the company.

(4) For the purposes of subsection (1) the tax avoidance purpose is only regarded as a business or other commercial purpose of the company if it is not—

(a) the main purpose for which the company is a party to the loan relationship or, as the case may be, enters into the related transaction, or

(b) one of the main purposes for which it is or does so.

(5) The references in subsections (3) and (4) to a tax avoidance purpose are references to any purpose which consists of securing a tax advantage for the company or any other person."

18. S.476 CTA 2009 provides that for the purposes of Part 5 CTA 2009 (which includes ss.441-442) "tax advantage" has the meaning given by s.1139 of Corporation Tax Act 2010 ("CTA 2010"). Insofar as material, s.1139(2) CTA 2010 provides:

'"Tax advantage" means—

(a) a relief from tax or increased relief from tax,

…

(c) the avoidance or reduction of a charge to tax or an assessment to tax,

(d) the avoidance of a possible assessment to tax, . . .

- Section 302 elaborates on the meaning of being of a "loan relationship" and also on the meaning of a company "being a party to" a loan relationship:

302 "Loan relationship", "creditor relationship", "debtor relationship"

(1) For the purposes of the Corporation Tax Acts a company has a loan relationship if—

(a) the company stands in the position of a creditor or debtor as respects any money debt (whether by reference to a security or otherwise), and

(b) the debt arises from a transaction for the lending of money.

(2) References to a loan relationship and to a company being a party to a loan relationship are to be read accordingly.

- Under s304(1) "related transaction" is defined "in relation to a loan relationship" as meaning "any disposal or acquisition (in whole or in part) of rights or liabilities under the relationship". Section 304(2) provides that disposal and acquisition include cases "where rights or liabilities under the loan relationship are transferred or extinguished by any sale, gift, exchange, surrender, redemption or release."

FTT Decision / Background

- The FTT made detailed findings on the circumstances surrounding the issue of the loan notes. These were drawn principally from the documentary evidence comprising the relevant legal agreements in connection with the loan relationship and e-mail and other correspondence involved in the structuring of the financing scheme as well as the short statement of agreed facts. It also heard evidence from Mr Michael Olsen who had held various executive roles within the Joy Global group including, at the relevant time, CFO of Joy Global Inc. and one of the directors of the appellant. The FTT did not accept material aspects of his evidence in relation to the acquisition and financing structure that the group adopted preferring to give weight to the contemporaneous documentary evidence (setting out a number of excerpts from his cross-examination to illustrate the areas where it had reservations ([94]- [103]). The rejection of various parts of Mr Olsen's evidence, where the appellant submits that evidence was not challenged, is itself submitted to be an error of law (under Ground 8).

- In this section we briefly summarise the basic findings in relation to the borrowing and the main topics the FTT made findings on for the purpose of putting the subsequent grounds of appeal into context.

- As mentioned in the introduction, the appellant was part of Joy Global group, whose business was manufacturing mining machinery and equipment. At the relevant time in 2011 the parent company, Joy Global Inc. ("JGI") was in the US but the group had significant operations around the world including in Australia, South Africa, and the UK. The group wished to expand its product line for surface equipment business and advice in an investment bank (Merrill Lynch) presentation of 6 April 2011 suggested the acquisition of LeTourneau Technologies Inc ("LTT") (a US company owned by another US company Rowan Companies Inc. ("Rowan"). On 13 May 2011, JGI entered into an assignable stock purchase agreement with Rowan to acquire LTT for $1.1billion.

Global tax planning idea

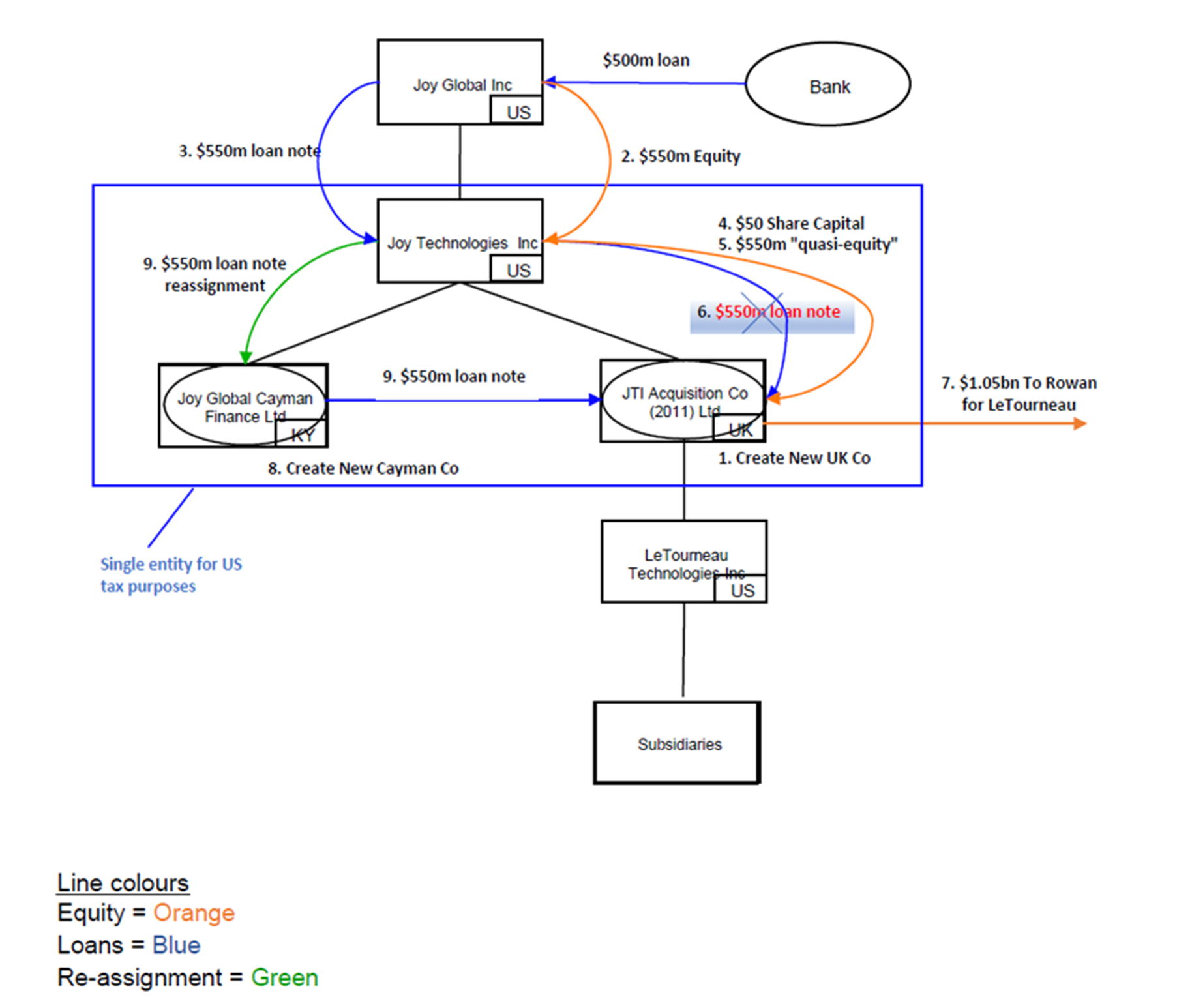

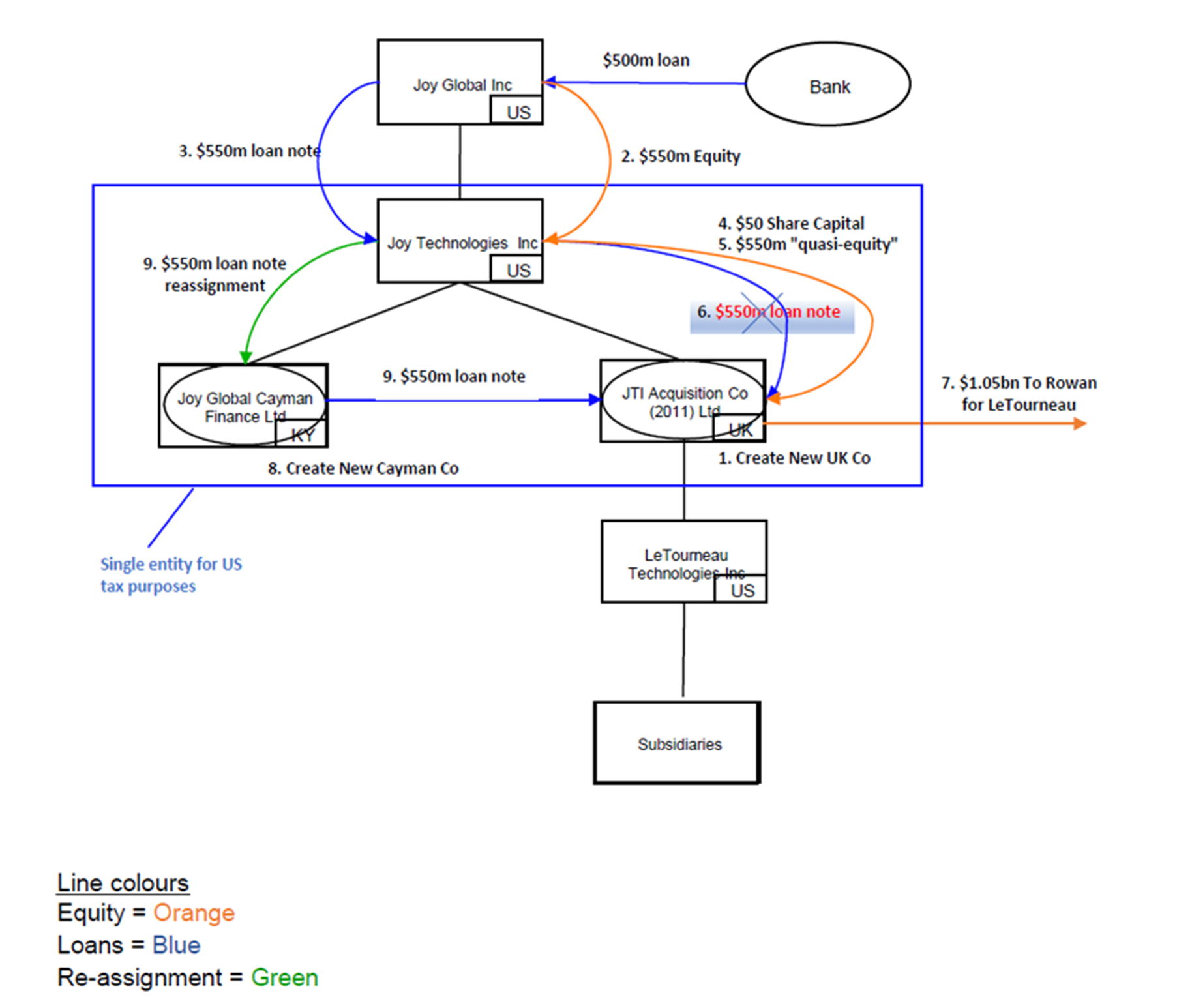

- On 2 June 2011 Deloitte made a presentation to Joy Global containing, what came to be known in subsequent correspondence within the group and with its advisers, as the "9 step plan" (it was originally 10 steps but the first step was not referred to in subsequent discussion of the plan and the FTT referred to this as step 0 so as not to disturb the numbering). At various points this plan was also referred to as "the Skinny". The plan is visually represented in appendix 1. The appellant accepts that it has never been disputed that Deloitte were involved in advising on the UK and US tax position and that they put a proposal that envisaged a UK loan relationship debit on the borrowing costs of a loan without any matching taxable receipt in the US. (The appellant thus hoped and expected to receive loan relationship debits on the interest payable under loan notes (and that it would be in position to surrender them by way of group relief)). The proposed steps, which were subsequently implemented, were as follows:

(1) JGI borrows $500m from third party bank (step 0)

(2) Joy Technologies Inc. ("JTI") (this was a US entity immediately below JGI in the group's corporate structure) forms a new UK Limited company (step 1)

(3) JGI contributes $550m to JTI (step 2)

(4) JGI loans £$550m to JTI in exchange for an interest-bearing note (step 3)

(5) JTI contributes $50m to UK Ltd as equity (step 4)

(6) JTI transfers $500m to UK Ltd in exchange for dollar denominated non-interest bearing note, referred to as "quasi equity" (step 5)

(7) JTI loans $550m to UK Ltd (a loan which was a quoted Eurobond, listed in the Channel Islands, in order to avoid UK withholding tax) (step 6)

(8) UK Ltd acquires LTT for $1.1 bn cash (step 7)

(9) JTI forms Cayman Islands Finance company with election to treat it as disregarded entity for US income tax purposes (step 8)

(10) JTI contributes a $550m note receivable from UK Ltd to the Cayman Island Finance company (step 9).

- The UK company and Cayman company were "check the box" entities for US Federal tax purposes. In other words, transactions between them were regarded for US tax purposes as transactions within one US tax entity so had no consequence. That meant, as the FTT explained at [161]:

"…the Appellant was treated as a US branch of the US parent. If the Appellant were to make any profits, from a US tax perspective, those UK profits would be treated as US profits."

- The role of the Cayman Islands company in the structure put forward by Deloitte's advice stemmed from a concern that interest would be disallowed under the UK's anti-arbitrage rules (contained at the time in Part 6 of the Taxation (International and Other Provisions) Act 2010 ("TIOPA")). Deloitte's advice addressed the risk of the rules applying noting, amongst other points, that a condition in the rules was satisfied as the appellant company would be considered a "hybrid entity" as it was disregarded for US tax purposes yet was also a person under UK law. The attraction of having interest paid to a Cayman tax resident entity would be the access that gave to a particular exemption to interest rate disallowance in s.246(2) TIOPA generally known as the "haven exemption". That applied where the interest rate payee was not liable to tax by reason of the tax law not taxing income or gains (as it did in the Cayman Islands).

- As regards the rate of interest, no issue arose regarding whether that was arm's length. The appellant highlights that followed from the fact that on 30 July 2012, HMRC entered into an Advanced Thin Capitalisation Agreement ("ATCA") under s218 TIOPA 2010 which confirmed that the interest arising on the loan notes was allowable for the purposes of Part 4 TIOPA 2010 provided that the appellant met the conditions for leverage and interest cover.

- The appellant surrendered the loan relationship debits arising on the $550m loan note to other group companies by way of group relief, thereby reducing their UK corporation tax liabilities.

- Essentially, the appellant was seeking a UK tax deduction for its loan relationship debits in relation to the acquisition of a US corporation. The interest paid by the appellant was not subject to tax in the US (because of the US "check the box" rules) or the UK (or, of course, in the Cayman Islands). Nonetheless, JGI obtained a US tax deduction for the interest paid on its external $500 million borrowing but there was no taxable receipt for US purposes in relation to the financing of the appellant's acquisition. It was common ground that any US tax advantages obtained from this structure were irrelevant for the purposes of s441/442.

- The FTT noted the e-mail discussion between Mr Olsen and Patrick O'Brien (Group VP of Tax) over the options regarding Deloitte's fee quote regarding Mr O'Brien's opinion as "significant in ascertaining the true purpose for which the group bought into the Deloitte scheme". One of the tax reasons for securing the UK tax advantage was Mr O'Brien's advice that the "anticipated income tax savings in the UK would be approximately 13 times" the Deloitte fee quote. (The other tax reason for Mr O'Brien's recommendation that the higher fee package should be selected related to the package encompassing obtaining the ATCA) ([152(7)]).

- On 6 June 2011, Mr O'Brien communicated the global tax planning idea, including the 9-step plan, to Joy UK's CFO with an email that explained "With the acquisition of LeTourneau we have identified an acquisition structure that will provide Joy UK with some fairly substantial prospective tax savings." ([42])

- The FTT set out further details of the implementation of the steps including that:

(1) The appellant was incorporated on 8 June 2011 with two of the UK directors, and Mr Olsen as directors.

(2) The board met on 20 June 2011 to approve the share allotment and borrowing and assignment of the purchase agreement.

(3) The appellant entered into a loan agreement on 21 June 2011 and the appellant took over the rights and obligations of JGI as purchaser of LTT on 22 June 2011.

- The FTT made detailed findings about the formulation of the board pack for the meeting which took place on 20 June 2011. There was, for instance, a suggestion from JGI's tax function that a document entitled "Tax Planning Matrix" (the "Tax Planning Matrix") should not go into the board pack. That was a document that had been prepared by Mr O'Brien which included the 9-step plan and calculations of the net reduction in income tax based on assumed interest rates and tax rates in the US and the UK and which showed the UK tax saving as $6.875m ([55] to [62]).

- The FTT also set out details of a memo dated 16 June 2011 addressed to the appellant's directors from JGI's President and CEO (Ted Doheny) ("the Doheny memo") which asked them, in relation to their contemplation of the benefits of the LTT acquisition "to consider [the] transaction on its own merits only and not give consideration to any broader benefits that may be derived by the group of the companies owned by [JTI]". The FTT later made findings to the effect that the Doheny memo and withdrawal of the Tax Planning Matrix were concerned with creating the appearance the board "were given leave to make a fully informed decision to proceed with the acquisition" and "to remove the transparent record that securing a tax advantage was a driver for implementing the Deloitte scheme" ([152(10)(11)]). It concluded there was "no genuine decision-making" at the UK level, the decision-making being at the JGI level. These findings of fact feature as one of the three main areas challenged under Ground 8.

- The FTT also made findings in relation to matters occurring after the acquisition which it considered relevant to the question of the purpose for which the appellant became party to the borrowing. For instance in an explanation to an insurer's enquiry regarding the new legal structure a statement that the structure was "set up from a tax planning perspective" ([79]), mention of the acquisition saving tax in the UK in presentations later that year to the JGI Board ([80][81]), and to concerns regarding the appellant needing to maintain good governance by undertaking board meetings "and preserve the tax benefits" ([82]).

- We discuss the detail of the FTT's reasoning, as necessary in our discussion below. In summary, having noted the transactions resulted in a tax advantage in the form of "freestanding" loan relationship debits (in the sense of being unmatched by any taxable receipts and no adverse US tax or Cayman Island tax consequences) the FTT went on to consider the question of purpose.

- Explaining it was giving more weight to the documentary evidence rather than Mr Olsen's evidence, the FTT made a number of findings it considered specifically relevant to purpose (at [151]). It concluded in essence that the real decision had been taken at JGI level and that "their object in implementing the Deloitte scheme was to bring into existence the loan relationship to which the [appellant] would be a party, thereby securing a UK tax advantage by generating the free-standing loan relationship debits for the UK members of the JGI group". That was an unallowable purpose. It considered ([167]) that "the Deloitte scheme was bolted on to the LTT purchase agreement, for no other reason but to obtain the UK tax advantage".

- Mr Olsen's evidence advanced a number of business purposes for the appellant being a party to the loan relationship: "critical mass" (i.e. the UK entity's ability to generate cash to repay the debt), synergy (the business case for acquiring LTT), diversifying borrowing, repatriation of income, and ease of incorporation. The FTT did not however accept that any of these established a business or commercial purpose, explaining its reasons at ([155] to [166]).

- The FTT's conclusion was thus that the unallowable purposes rules did apply: securing a tax advantage was the main purpose of the appellant being a party to the loan relationship. On its interpretation of the law (which the appellant challenges under Ground 6) the question of attribution did not arise. The FTT considered however that even if it was wrong in that view, and that the issue of attribution was relevant, then the loan relationship debits on the facts here were wholly attributable to an unallowable purpose.

- The FTT accordingly dismissed the appellant's appeals against the closure notices HMRC had issued in respect of the appellant's returns for accounting periods in each of the years from 31 October 2012 to 31 October 2015. These had been amended to disallow the debits claimed by the appellant in relation to interest payable under the loan notes.

Grounds of appeal

- The appellant argues the FTT:

(1) Failed to apply ss.441-442 CTA 2009 to the issue of the loan notes by the appellant (as reflected in the issues agreed by the parties) and instead sought to ascertain the purposes of the whole group for entering into a whole series of transactions, which were not the target of the statutory provision.

(2) Misapplied the concept of a "tax advantage" for the purposes of ss.441-442 CTA 2009 with the result that the FTT was not properly focussed on any UK tax advantage to the exclusion of any US tax advantage.

(3) Applied an erroneous approach to identifying what were the appellant's purposes of entering into the loan relationship.

(4) Erred in its approach to determining whether the tax advantage was a "main" purpose of entering into the loan relationship.

(5) Misunderstood the purpose of the loan relationship unallowable purpose rule and thereby gave it a scope which was contrary to Parliament's intention.

(6) Misunderstood the structure of ss.441-442 CTA 2009 and thereby wrongly determined when the question of attribution arose.

(7) Erred in its approach to the question of attribution.

(8) Erred in its approach to the evidence and reached findings of facts which were erroneous in law. The key areas challenged were the FTT's finding that i) there was no genuine decision-making by the appellant, ii) that there was no bona fide commercial or business purpose for the appellant being party to the loan relationship and iii) that the acquisition would otherwise have been in the US.

Central points of statutory interpretation

- As Mr Gardiner's submissions helpfully articulated, the points raised in the above series of grounds, in particular Grounds 1 to 5, largely revolve around three key questions of statutory interpretation of ss 441 and 442 which we address in turn:

(1) Are the existence of the company (here the appellant) and the loan relationship "givens" in the analysis of the purpose for which the company is a party to the loan relationship?

(2) Are commercial asset purchases bought with borrowing at arm's length outside the scope of ss 441 and 442?

(3) Is the use to which the proceeds of the borrowing are put to determinative?

(1) Existence of company and loan relationship are "givens"

- The appellant's central proposition here is that the provisions in ss441 and 442 presuppose that the appellant is party to a loan relationship and ask what was the loan relationship; what was its purpose?

- A proper recognition of the function of s441, in Mr Gardiner's submission, was fundamental to his interpretation. It defined the subject matter; the words "a loan relationship of a company" presuppose the existence of a company and the existence of a loan relationship of that company. While s442 then told you the meaning of the unallowable purpose, it did not tell you the subject matter which one had to examine to ascertain whether the loan relationship had an unallowable purpose or not.

- Ms Wilson, for HMRC, submitted there was nothing on the statutory words to support such limitations and that the case-law, which made clear the purpose test is subjective, also set out an approach of looking at all the circumstances.

Discussion

- Although Mr Gardiner put his case using the terminology of "givens" he was clear the question of whether such "givens" existed was a matter of resolving the parties' competing statutory interpretations. In our view, the key provision for interpretation appears in s442, where s442 asks whether the purposes "for which" the company "is a party" to the loan relationship included an "unallowable purpose". Did that encompass looking at why the particular company, as opposed to another company was a party, or was it restricted to the purpose for which the company was a party in the sense of the reason why the particular company entered into the borrowing? In other words, did the provision focus on what the company was borrowing money for, how was the borrowing deployed and what it did with the proceeds of the borrowing? The contrast, as Mr Gardiner's submissions helpfully highlighted, was between the questions "what was the purpose of entering into that loan relationship by the appellant?", on the one hand, and "why was the appellant a party to loan relationship as opposed to someone else?", on the other.

- As well as highlighting s441's role, as outlined above, in framing the operation of the subsequent provisions, Mr Gardiner pointed to a number of textual features in the drafting of s442(1) to show the provisions were aimed at the taxpayer company's (i.e. the appellant's) purposes:

(1) The opening words of s442(1) refer to "the purposes for which the company … is a party to the relationship, or… enters into [a related transaction]". Mr Gardiner explains that unless the taxpayer company has given authority to another person, it is that company itself which has to make itself a party to a loan relationship or enter a related transaction. The natural inference is that it is the company's purposes which are relevant.

(2) The tail words of the same provision refer to "the business or commercial purposes of the company". That, it is submitted, indicates Parliament was only concerned with the commercial purposes of that company.

(3) The above is further reinforced by s442(2), which deals with a company where part of its activities are non-UK. The statute states that the business and other commercial purposes "of the company" do not include the purposes of that part. If the drafter was concerned with the purposes of other companies in the corporate group (or indeed any other persons), then this provision, Mr Gardiner submits, would make little sense.

- We reject the appellant's statutory interpretation. The purpose of ss 441 and 442, provisions drafted in expansive terms, is to prevent tax avoidance by the use of loan relationships, as more specifically described therein. It seems to us that it would defeat Parliament's intention if an over-compartmentalised and narrow interpretation, such as that advocated by Mr Gardiner, were to be adopted. There seems no reason why, on the words of the statute, such a restrictive meaning should be given to what are, after all, ordinary English words.

- In our view, the natural reading of s442 and the words "the main purpose for which… the company is a party to a loan relationship…" invite the straightforward question "why are you a party to the loan relationship?" That enquiry readily accommodates being able to stand back and ask, where relevant, why that company in particular (as opposed to someone else) was a party to the loan relationship. Were there intended to be limits on the scope of what could be considered in assessing the relevant purpose, we would expect those limits to be specifically articulated.

- In answering the question "what is the main purpose for which the taxpayer company is a party to the loan relationship" there is nothing in s441 or s442 which precludes consideration of why the taxpayer company (as opposed to someone else) is a party to the loan relationship. That might be because it is relevant to the company's purpose because, as Ms Wilson submitted, in the formulation "for which a company is a party" the "is" includes implicitly "is" or "becomes". Therefore, it was permissible to ask what is the company's purpose in becoming party to the loan relationship? But equally it could be because it goes to answering the question of "the purpose for which" the company is a party to the relationship.

- We note the drafting specifically poses the question of the purpose for which a person "is a party" to the loan relationship when it could, for example, have focussed on the purpose of the borrowing. We raised this point with Mr Gardiner. His response was that this terminology reflected the need to clarify (given the multiple parties that could arise in a loan relationship) that it was the taxpayer company's purpose which was relevant. We do not accept that analysis. First, as a matter of drafting, s 441 (1) and s442 (1) both use the formulation "the loan relationship of a company has an unallowable purpose" (our emphasis). Neither provision focuses exclusively on the company's purpose. Second, Mr Gardiner's response does not, address the point we raised. Whereas the legislation could have focussed purely on the question what was the purpose of the loan relationship from the taxpayer company's point of view (whichever side of the loan relationship the party was on), it instead asks why the taxpayer "is a party" to the loan relationship (which on a natural interpretation covers both the question of why the taxpayer undertook the borrowing but also questions of why the taxpayer as opposed to someone else was a party).

- Mr Gardiner quite properly drew our attention to s302 CTA (see [5] above), which sets out what is meant by being party to a loan relationship. We do not consider that takes the relevant arguments any further in that it is just as consistent either way with each of the parties' competing interpretations. The provision clarifies that being a party to a loan relationship means standing as creditor or debtor. It thus leaves open the question of whether one can ask "why are you, as opposed to someone else, a party (simply clarifying this could mean a party as a creditor or debtor)?"

- We also reject the appellant's case on the significance of s441. In common with the drafting style common throughout all kinds of legislation, it sets out an overall proposition, and also the consequences of that proposition, but then leaves the task of defining certain key concepts to other provisions. So, while the provision indicates the consequences of a loan relationship of a company having an unallowable purpose, and the means by which debits are apportioned between those which give rise to debit and those which do not, it does not tell you anything more about what an unallowable purpose means. That is provided for by s442.

- As Ms Wilson's oral submissions pointed out, s441 has to refer to a company and a loan relationship because without there being a company and a loan relationship the provisions are not even applicable.

- As regards the drafting features Mr Gardiner relies on, (at [31] above) as a starting point it is important to recognise there is no dispute that s442 may cover consideration of the taxpayer's company's purpose in being a party to the loan relationship. The dispute is over whether: 1) when considering that company's perspective, wider facts beyond what the loan was used for may be taken into account; and 2) a wider perspective may in any event be taken because the legislation concerns "the purpose for which" the company is a party (as opposed to asking what is the company's purpose). In other words, the points do not assist the appellant because there is no dispute that one can and should consider the company's purposes. None of the drafting points go further to say that, in assessing that company's purpose, the tribunal is precluded from looking at the wider circumstances.

- So, as regards Mr Gardiner's first two points there is no indication in the statutory wording that when assessing the company's purposes it will be irrelevant to consider the circumstances in which the company was chosen to enter into the relationship, or the parent company or group benefit-related reasons for that company entering into that relationship. That is not the same as saying another company, or "the group's purpose" is viewed as determinative. Rather, the other company's / group's perspective is relevant to the taxpayer company's purpose because it informs the determination of the particular taxpayer company's purpose.

- In relation to the third point, s442(2) still serves a clear function in stopping a company relying on out of charge commercial and business activities to effectively dilute an unallowable purpose irrespective of what view is taken of the meaning of "the purpose for which a company…is a party to".

- In addition, none of the appellant's drafting points are inconsistent with the natural reading of s442 that we have outlined above (which allows for considering why it was that the particular company was chosen to be a party).

- There are also other features of the provisions which would tend to point against the limitations on scope the appellant suggests being the correct approach. As Ms Wilson submitted, s442(5) (tax advantage for another person) (at [4] above) indicates one must be able to look outside the company in order to ascertain purpose. It would be strange if, in a case where the advantage was an advantage to someone else, that in assessing the company's purpose to secure that advantage to another person, facts pertaining to that other person nevertheless had to be ignored. Those facts might include the reasons why the company was set up which in turn might inform the company director's understanding of their purpose. As Ms Wilson said this is a "strong indicator that all facts are on the table". Indeed, in this case, the benefit of the loan relationship debits were surrendered by the appellant to other group companies by way of group relief.

- Our preliminary conclusion on the statute wording is that there is no particular support for the appellant's position that, under s441 and s442, the tribunal is prevented, in ascertaining the purpose "for which" the company "is a party" from considering the wider facts and circumstances surrounding the establishment of the company. That may include why the appellant was a party to the loan relationship as opposed to someone else.

Case-law on facts and circumstances

- The above interpretation, which allows for all the facts and circumstances to be considered in the analysis of the appellant's purpose in being a party to the loan relationship, (including the reasons why a particular entity was chosen within a group structure to undertake borrowing to make an acquisition) also accords with the approach the Upper Tribunal took in BlackRock Holdco 5 LLC v HMRC [2022] UKUT 199 (TCC). The appellant there ("LLC5"), a UK resident entity, that was created and used by the BlackRock group of companies as part of an acquisition structure for buying part of Barclay's investment management business, sought loan relationship debits on interest it paid on $4 billion of loan notes which it issued in return for a loan it received from its parent ("LLC4"). An issue arose as to whether any loan relationship debits arose in the first place because of transfer pricing (whether an independent lender acting at arm's length would have made the loans to LLC5 on the same interest terms as LLC4 did). The Upper Tribunal allowed HMRC's appeal against the FTT's decision which had found in favour of the taxpayer on that issue but went on to consider, if it were wrong on the transfer pricing issue, the applicability of the unallowable purpose provisions regarding LLC5's entitlement to the loan relationship debits.

- In relation to that, the Upper Tribunal considered (at [180][181]) that the FTT's findings showed that LLC5 was only included in the structure in order to take tax benefits for the Group. The evidence was that "Absent those tax benefits LLC5 would not have existed…." Earlier at [168], the Upper Tribunal had held that:

"… the FTT was "entitled to examine 'all the circumstances' when deciding LLC5's purposes in entering into the Loans. This included the evidence leading up to the creation and registration of LLC5…."

- We were not persuaded by Mr Gardiner' attempts to downplay the case's significance. Although as he pointed out, the Upper Tribunal's reasoning was obiter (because the case was decided on the transfer pricing issue), as the Upper Tribunal explained (at [101])), it had the benefit of full argument on the "Unallowable Purpose Issue" and dealt with the relevant facts and legal issues in detail at [103] to [200] of its decision. He also portrayed the taxpayer's failure on the unallowable purpose issue before the UT as arising because the arrangements clearly amounted to an avoidance scheme: the appellant was borrowing to acquire preference shares that were worthless (because the entity above, LLC4, had far more shares thus diluting the preference shares' value).

- While we agree with depiction of the facts it does not however take away from the Upper Tribunal's reasoning for upholding the FTT's conclusion that LLC5 had a tax advantage purpose as one of its main purposes. Mr Gardiner's point amounts to saying the Upper Tribunal could have reached the same decision but by applying his narrower test (i.e. from LLC's viewpoint there was clearly a tax avoidance motivation because it was borrowing money to get an essentially worthless asset). The Upper Tribunal could have reached its decision on that basis, but did not do so. It specifically endorsed the approach of looking at the reasons why the appellant was included in the acquisition structure as part of the analysis of all the facts and circumstances.

- The approach, of looking at all the facts and the whole of the evidence, is also reflected in the Upper Tribunal's summary of the various propositions (which were not in that case disputed by the parties) relevant to ascertainment of a person's purpose under the unallowable purpose provisions as set out in Kwik-Fit Group Ltd and others v HMRC [2022] UKUT 314, (see [83(2)]).

(2) Are commercial asset purchases bought with arm's length borrowing out of the scope of the ss441 and 442 provisions?

- The appellant's other fundamental proposition, which it argues results in multiple errors on the FTT's part, and which HMRC dispute, is that where there is a purchase of commercial assets with arm's length borrowing the question of an unallowable purpose can never arise. This is on the basis the rules ss 441and 442 do not target interest relief for genuine commercial purchases.

- In our judgment, this argument, which is advanced as a point of statutory interpretation, must be rejected too. The first point is that there is nothing in the words of the provisions which supports this view. While the legislation contemplates at the outset the company will have commercial or business purposes those will clearly not preclude the finding of an unallowable purpose. There is no carving out or privileged treatment for purchases of commercial assets with arm's length borrowing from the legislation's acknowledgment that a purpose of securing a tax advantage may nevertheless be found amongst the company's business or commercial purpose. That in no way means the countless situations where commercial assets bought with borrowing, and where a deduction is sought for the interest on the borrowing, fall foul of the rules. The answer will normally be that the purpose for which the company is a party to the borrowing is not to secure the deduction (even if the company knows that will be the effect, and that is the effect). The question of whether such a purpose exists will ultimately turn on the particular facts.

- The lack of statutory support for the appellant's proposition, is also borne out, as Ms Wilson submitted, by the case-law. The Court of Appeal's reasoning in Travel Document Service and another v HMRC [2018] EWCA Civ 549 well illustrates the fact-sensitivity of the question of purpose despite the situation being one where it is accepted that there are commercial reasons at play. The case concerned the application of particular provisions within the unallowable purpose provisions to certain share arrangements, which through the use of, for instance a derivative, had the economic effect of the cashflows of a loan (the provisions appeared in Chapter II of Part IV of FA 1996 ss 91A to 91G which is headed "Shares treated as loan relationships"). The facts concerned shares the appellant ("TDS") held in another company ("LGI"). These shares were acknowledged as being held for commercial reasons. The scheme involved, firstly, a total return swap over those shares (which meant debits and credits could be brought into account under the loan relationship rules) and, secondly, novations. These had the effect of devaluing the shares. The desired result (assuming the appellant was correct in its argument that there was no unallowable purpose) was a significant debit. It was common ground that one of the main purposes for which the appellant entered into the swap and the novations was to secure a tax advantage.

- At [39], Newey LJ identified the question as "whether the purposes for which TDS held shares in LGI during the currency of the Swap included an "unallowable purpose" within the meaning of paragraph 13 of schedule 9 to FA 1996" (the predecessor provisions to ss441 and 442). The Court of Appeal upheld the FTT's conclusion that securing a tax advantage became a main purpose of holding the shares during the currency of the swap. That was despite the evidence of the fact that TDS continued to have ordinary business reasons for owning the LGI shares and that there "was no question of TDS having had the tax advantage in mind when it acquired the shares".

- This reasoning is not consistent with there being a hard and fast rule that, where the borrowing is used to buy a commercial asset, a finding of unallowable purpose must be precluded as of necessity. If there was such a rule the Court of Appeal's answer to the question in respect of TDS "why are you a party to this loan relationship?" (which on the particular circumstance of the deemed loan relationship rules would translate to "why are you holding the shares?") would necessarily have been "for business reasons". Instead, the Court of Appeal's approach reveals the answer to that question was dependent on the facts.

- The Upper Tribunal's decision in Kwik-Fit is another example of a case where the commercial basis for the borrowing did not close down further analysis of the relevant purposes. The facts concerned a reorganisation which sought to access losses that were otherwise trapped within a group entity. The reorganisation increased the interest income which the trapped losses could then shelter. The increased deduction for the debtor entities could then be set against the entity's profits or group relieved. The reorganisation entailed variously changing the parties on existing loans (which were acknowledged to have commercial purposes), increasing the interest rates and the entering into of new loans. The Upper Tribunal upheld the FTT's conclusion that the debtor appellant entities' debits should be denied because the appellants were parties to the loan for an unallowable purpose. That was the case even where it was accepted certain loans had been entered into for commercial reasons and that the new interest rates were arm's length.

- Mr Gardiner sought to distinguish the case, depicting it as one where the interest on loans was increased without any additional new borrowing which produced a new commercial asset. However, if there was a definite rule that an arm's length borrowing used for a commercial asset could never give rise to an unallowable purpose, it is difficult to reconcile this with the Upper Tribunal's decision: the fact the loans were accepted to have been entered into for commercial reasons ought to have been conclusive, but it was not.

- Mr Gardiner also relies on the dictum of Cross J in IRC v Kleinwort Benson [1969] 2 Ch. 221 (which was also discussed in Kwik-fit). That gave the example of a trader buying goods for £20, selling them for £30, with the intention of bringing the £20 as a deduction for tax purposes. Cross J explained:

"…one may say that he intended from the first to secure this tax advantage. But it would be ridiculous to say that his object in entering into the transaction was to obtain this tax advantage."

- The Upper Tribunal in Kwik-fit did not take issue with the view as far as it went but pointed out the obvious purpose of the trader in that simple example was to turn a profit. It also considered that beyond serving as a reminder that intention should not be conflated with purpose, the dictum did not lay down any principle of general application. The taxpayers in Kwik-fit sought to argue that a person cannot have a purpose to secure a tax advantage – such as deduction of interest - which followed inherently from the operation of the legislation, but the Upper Tribunal's treatment of the dictum would stand equally against there being a general principle that borrowing in respect of purchases of commercial assets must prevent the finding of an unallowable purpose.

(3) Is the use of what the borrowing is put to determinative?

- Mr Gardiner's oral submissions emphasised the need to focus on the use to which the borrowing was put. The proposition overlaps to some extent with both the points above (i.e. that the analysis precludes looking to the wider circumstances, and the second that once it is established the borrowing was used to acquire a commercial asset one need enquire no further).

- We recognise the use to which the borrowing is put is relevant. Newey LJ described it as follows in his summary of the relevant propositions in Travel Document Service (at [44]iv) (he referred to use of the shares because it will be recalled the provisions there concerned shares which were treated as loan relationships):

"When determining what the company's purposes were, it can be relevant to look at what use was made of the shares. As the Upper Tribunal (Barling J and Judge Charles Hellier) noted in Fidex v HMRC [2014] UKUT 454 (TCC), [2015] STC 702 (at paragraph 110):

"what you do with an asset may be evidence of your purpose in holding it, but it need not be determinative of that purpose. The benefits you hope to derive as a result of holding an asset may also evidence your purpose in holding it".

- However, the above also makes explicit that the question of use is not determinative. We accordingly reject the appellant's third proposition of statutory interpretation. The lack of a hard and fast rule here is also entirely consistent with our rejection of the earlier propositions the appellant argues for. Instead, a wider-ranging and fact-sensitive enquiry of all the circumstances is called for and the fact a commercial asset is acquired may be relevant, but is not the end of the analysis.

Extra-statutory aids to construction

- The appellant advances a number of extra-statutory materials in support of its interpretation. In particular the appellant relies on the following extracts from ministerial assurances given at the time of the predecessor provisions in paragraph 13 Schedule 9 FA 1996 (at Hansard Common Debates 28 March 1996 Columns 1190-1193):

"Paragraph 13 of the schedule disallows tax deductions to the extent that tax avoidance is the main motive behind a loan relationship. We have been told of concerns that this could be interpreted as preventing companies from getting tax relief for legitimate financing arrangements. I am happy to offer a reassurance that this is not the intention of the legislation. …

We have been asked whether financing – which, for example, is to acquire shares in companies, whether in the United Kingdom or overseas, or is to pay dividends

– would be affected by the paragraph. In general terms, the answer is no, but the paragraph might bite if the financing were structured in an artificial way.

It has been suggested that structuring a company's legitimate activities to attract a tax relief could bring financing within this paragraph – some have gone so far as to suggest that the paragraph might deny any tax deduction for borrowing costs. These suggestions are clearly nonsense. A large part of what the new rules are about is ensuring that companies get tax relief for the cost of their borrowing.

…

Provided that companies are funding commercial activities or investments in a commercial way, they should have nothing to fear. If they opt for artificial, tax-driven arrangements, they may find themselves caught."

- The appellant also relies on a joint HMT/HMRC Discussion paper from 2007 on "Taxation of the foreign profits of companies" (in particular paragraph 5.1 and 5.2 ) for the proposition that the regime for interest relief is intended to encourage the acquisition of UK holding companies owning subsidiaries with foreign profits. That paper refers to the Government considering "whether interest relief for the costs of funding foreign activities and profits should continue to be allowed in the UK…."

- And finally, we were also taken in the course of the hearing to HMRC's Corporate Finance Manual guidance at CFM38170 setting out points when ss441 and 442 would not apply. In particular, it states in relation to "double-dipping" (obtaining the same relief twice):

"S441-442 will not normally apply to loan relationship debits:

• simply because a company is able to obtain relief for the same expenditure or loss on the borrowing to which the debits relate in more than one jurisdiction. However, S441-442 would apply where the structure that has been adopted has one or more non-commercial features (so that the loan relationship can be said to have an unallowable purpose) and/or where, taking account of the overall position of the company or group, relief for interest and other finance costs might otherwise be available more than once in the UK in respect of the true economic costs of the borrowing;"

- We agree with Ms Wilson that none of the above materials shed light on the proper construction of ss441 and 442. The ministerial statement gave no assurances for companies opting for artificial tax-driven arrangements. The fact the statement dismissed the fear that tax deductions for borrowing costs would be denied, or that companies funding commercial activities or investments in a commercial way, had nothing to fear is easily reconcilable with the position that the provisions would only bite when securing a tax advantage was one of the main purposes, but would not if the purposes were commercial. The statement certainly does not require the rules of interpretation to ss440 and 441 the appellant advances. As for the discussion paper, this post-dates the enactment of the legislation and is an expression of the government's understanding of the regime. It is not capable of assisting the interpretation of the words of ss440 and 441 and its terms are too general to support an interpretation that the interposition of a UK holding company into an acquisition structure for the main purpose of obtaining a UK tax deduction was intended to fall outside of the unallowable purpose provisions. Similarly, the HMRC manuals, at best, can only amount to an expression of HMRC's views on the law. Those views, as might be expected, leave open the possibility of different views being taken on the facts and do not support the appellants' case that there are rules which carve out a special treatment for arms' length acquisitions of commercial assets whatever the circumstances.

Conclusion on statutory interpretation arguments:

- In conclusion we reject the appellant's three fundamental arguments on the statutory interpretation of ss441 and 442. That means:

(1) A tribunal is able to, and should, look at all the facts and circumstances in determining the "main purpose for which the company is a party to the loan relationship….". That consideration of purpose may include examining the reasons why that particular company (as opposed to another) was chosen to be a party to the loan relationship. That is because those reasons may inform the company's purpose in being a party to the loan relationship. It is also because such reasons fall within the words "main purpose for which the company…is a party" (while the loan relationship is referred to as being "of the company" in s441(1) and s442(1), the wording of those provisions is such that the purposes in question need not necessarily be those exclusively of the company- see [37] above).

(2) There is no rule that, as a matter of law, the unallowable purpose provisions are inapplicable to arm's length finance costs for a commercial acquisition.

(3) The use to which the borrowing is put is relevant to the purpose of the borrowing, but not determinative.

Did the FTT err in its application of the law?

- The above conclusion means that, as we identify when examining Grounds 1 – 5 in particular below, a number of the errors which the appellant contends were made by the FTT are not made out. Mr Gardiner singled out [135] of the FTT's decision for sustained criticism. There the FTT rejected the "givens" argument i.e. that the legislation assumed as a "given" that the company in question was a party to the loan relationship. It follows however from our conclusions above that the FTT was right to reject the argument. The FTT agreed with HMRC that the argument was "an entirely made-up principle" stating "the 'givens' relied on have no statutory basis". That may reflect that the arguments Mr Gardiner put to us about the particular role of s441 were not made as in such clear terms as they were before us. We acknowledge that those arguments amount to a particular reading of the statutory provisions. So, for our part, we would not express the rejection of the appellant's argument as entirely lacking any statutory basis. Rather we consider that HMRC's less restrictive statutory interpretation of the words "purposes for which the company…is a party" which permits consideration of all the facts and circumstances is the better one and one which better reflects Parliament's intentions.

- With the benefit of the legal analysis above we now address the particular Grounds 1 to 5 to identify which points fall away and to deal with any points which remain.

Ground 1 – failure to focus on the appellant's purpose(s) for the borrowing

- Under this ground the appellant argues the FTT was wrong to reject the "givens" argument and secondly, that the two "guiding principles" which informed the FTT's fact-finding were wrong.

- The first of those points falls away given our conclusion above. As to the two "guiding principles", the FTT derived them from Lord Pearce's observations in Brebner, noting at [144] and [145] that those observations were "in relation to identifying the purpose for the relevant act in a corporate context". Lord Pearce's observations were that:

"the object is a subjective matter to be derived in this case from the intentions and acts of the various members of the group. And it would be quite unrealistic and not in accordance with the subsection to suppose that their object has to be ascertained in isolation at each step in the arrangements.'

- The FTT continued:

"146. I take from Lord Pearce's observation two guiding principles for my findings of fact in relation to the 'unallowable purpose' test. First, whilst the nexus of the unallowable purpose test is anchored to the act of the Appellant in issuing the $550m loan notes, thereby entering into the loan relationship, it would be 'unrealistic', and not in accordance with subsection 442(1)(b) to suppose that the object of the directing minds of the Appellant has to be ascertained in isolation at each step in the arrangements. Subsection 442(1)(b) clearly anticipates a scheme or arrangements involving interrelated transactions. Subsection 442(1)(b) therefore applies to the related transactions in the Deloitte scheme, and the object of Step 6 which brought into existence the loan relationship is to be found by reference to the overall scheme. Subsection 442(1)(b) states as follows:

'… the purposes for which the company …

(b) enters into transactions which are related transactions by reference to it, …

147. Secondly, the object (i.e. the purpose) is 'a subjective matter to be derived from the intentions and acts of the various members of the group'. In the instant case, the directing minds were not confined to the three directors of the Appellant who were supposedly the decision makers approving the resolution that made [the appellant] a party to the loan relationship. As a corollary of the first guiding principle, the object of the directing minds necessarily included the key personnel who were directing the affairs of JGI and JTI in relation to the interconnected transactions in the 9-step 'Skinny', which had come to assume an organisational status as being an integral group plan encompassing Step 6."

- As regards the reasoning underpinning the FTT's first guiding principle, in agreement with the appellant, and as HMRC recognise, the FTT misinterpreted the reference to "related transactions" because it did not appear to appreciate the term was further defined in s304 (see [6] above). The "related transactions" contemplated were not any related transactions in a generic sense but those of the particular company's (i.e. the appellant's) disposal or acquisition of the loan relationship.

- The parties however dispute the materiality of this error. We take the appellant's case as suggesting the FTT's error of interpretation was material: Mr Gardiner submitted the error was taken by the FTT to say the tribunal could look at anything that was thought to be related to the borrowing by the appellant as a matter of fact (and therefore that all the transactions in the 9 step plan were relevant).

- We disagree. The upshot of the FTT's error of interpretation of "related transactions" was that it thought it could consider all the facts and circumstances in ascertaining the purpose. That was the guiding principle it effectively adopted in its fact-finding. That was ultimately entirely consistent with the approach required by the legal principles we have outlined above. Thus, any error in the FTT's interpretation of "related transaction" was not material to the FTT's decision, because applying the correct legal principles, it would have needed to have adopted the approach of taking into account all the facts and circumstances anyway. It does not impugn the facts the FTT went on to find and that error alone does not warrant any interference with the FTT's decision.

- For similar reasons, even if the appellant were right in its submission that the FTT was wrong to rely on Brebner (because that case concerned different anti-avoidance provisions to do with transactions in securities and where the provision specifically referred to "two or more transactions in securities"), the error would not be material. The guiding principle comprised the correct one of looking at all the facts and circumstances surrounding the loan relationship, not just the transaction which was the loan relationship. (The appellant's submission on Brebner not reading across also appears inconsistent with the Court of Appeal's view in Travel Document Services that Brebner "concerned a comparable issue" in terms of ascertaining purpose.)

- As for the FTT's second guiding principle, the appellant argues the FTT took from Brebner that a tribunal should look beyond the company's decision-makers to ascertain the purpose. That was wrong, it was submitted, as the relevant purpose was that of the company. We agree with Ms Wilson however, that read in context the FTT was saying (at [147]) that consideration of other "directing minds" outside of the company was relevant to ascertaining the purposes of the directing minds of the company. The FTT's subsequent discussion of cases (Garforth v Tankard Carpets [1980] 53 TC 342 and Vodafone Cellular Ltd v Shaw [1997] STC 734) highlighting the likelihood that the purposes of a company within a group may include purposes beyond those of the particular company show the FTT was looking at the issue from the perspective of the particular company viz the appellant. It was not suggesting that what the directing minds of other entities thought was relevant purely in its own right. It also follows from our analysis that the words "the main purpose for which" the company "is a party to" the loan relationship are capable of including the question why the company (as opposed to another) was chosen, and that the purposes of others outside the appellant's legally constituted decision-makers might be relevant.

- In our view, both guiding principles effectively amounted to the FTT saying it should not restrict itself to looking simply at the loan relationship or what the directors said about their purposes in isolation but rather ascertain the purpose for which the company was a party to the loan relationship with the benefit of facts from the wider context of the company's borrowing. The FTT was correct to adopt that approach.

Ground 2 – failure to focus on UK tax only

- There is no dispute that the "tax advantage" referred to in ss441 and 442 (as defined in s1139 CTA 2010) is confined to UK taxes. (As the appellant's skeleton argument explained, under ss1118(1) and 1119 CTA 2010 for the purposes of the Corporation Tax Acts where "tax" is not defined as being either corporation tax or income tax, it means either of them).

- The FTT explained at [137]:

"137. It is common ground that section 442 is concerned with UK tax only, and the US tax implications are not directly relevant. However, the loan notes issued by the Appellant to its immediate US parent JTI would have been inter-company debts being caught by the anti arbitrage rules. The UK tax advantage as identified in the form of those free-standing loan relationship debits to be surrendered as group relief would have been circumvented if there had been no Cayman Islands company to function as the receiver of the $550m loan notes assigned by JTI as the original lender. Nor would it have been attractive to Joy Global as a group if the Appellant and the Cayman Islands company were not check-the-box companies so as to eliminate any downside to the group's US tax position."

- The appellant acknowledges the FTT noted it was common ground that s442 was concerned with UK tax only. The appellant argues however that the FTT erred in making findings which impermissibly failed to separate out the UK tax motives from motives related to US taxes. In particular, fundamental to its reference to "free-standing" loan relationship debits ([131(12)], [137][153]) and the finding that the appellant had the main purpose of securing "free-standing loan relationship debits", was the absence of a US tax charge. Similarly, that absence of US tax charge, in Mr Gardiner's submission, drove the FTT's finding that the transactions would have been unattractive to Joy Global if the US tax position had been different.

- We disagree the FTT erred as suggested. The FTT maintained a clear focus from beginning to end on the question of whether there was a UK tax advantage, the judge stating at the outset at [136], that she was:

"required to make findings of fact to identify if there was a UK tax advantage being secured by virtue of the Appellant entering into the loan relationship in the context of the Deloitte scheme."

- The judge's conclusion on the question of tax advantage was expressed as follows:

"141. I conclude therefore that by being party to the loan relationship, the Appellant secured a UK tax advantage for other UK group companies…"

- That reflected the FTT's earlier finding at [132] that a tax advantage was secured by the appellant being party to the loan relationship. This was expressed purely in terms of the UK tax position. There the FTT explained:

"…Since the Appellant was a holding company without any trading profits, the debits were surrendered as group relief to other UK group companies which had taxable profits. The loan-relationship debits therefore resulted in 'a relief from tax' for other UK group companies (i.e. 'any other person' as defined by subsection 442(5)). The group relief arising from the loan relationship debits was 'a resulting benefit' following the implementation of the Deloitte scheme; the group relief was the 'increased' extra; its availability was 'a favouring circumstance' putting the UK group companies in 'a better position' by reducing tax liabilities."

- As the FTT appreciated, in its intervening analysis, the Deloitte scheme did take account of the foreign tax position in both the US and the Cayman Islands. The FTT noted at [138]:

"Whilst the tax advantage was localised in the UK, the Deloitte scheme worked essentially due to the two new cross-jurisdictional entities being created, each jurisdiction chosen for the particular features in their respective tax regimes."

- The FTT rightly identified the Deloitte scheme as the "context" in which it made its findings and it was correct to do so. As discussed above, the enquiry under ss441 and 442 permitted consideration of all the circumstances and asked why the appellant (as opposed to another entity) was chosen to be a party to the loan relationship. Understanding the Deloitte scheme, with its regard to the tax position in other jurisdictions, was a key part of understanding the genesis of the appellant's role. The findings the appellant challenges, that the debits were "free-standing", and that the transaction would have been unattractive to Joy Global if the US tax position had been different were all made as part of the findings concerning the context in which the appellant became a party to the loan relationship. As the appellant itself pointed out before us, it was not disputing (before the FTT) that loan relationship debits amounted to a "tax advantage" for the purposes of the unallowable purpose provisions. Accordingly, nothing turned on the fact that the transactions were structured in order to avoid a US tax charge, but that fact did provide the context for understanding the wider arrangements which had given rise to the appellant's existence.

- We conclude no error of law is made out by this ground.

Ground 3 - failure to recognise that acquisition of LTT was purpose of borrowing

Ground 4 – failure to apply the right approach to determining whether the tax advantage was a "main" object

- It is convenient to consider these grounds together, given the overlap in the challenges the grounds make to the FTT's approach.

- Under Ground 3 the appellant argues the FTT failed to identify that the "startlingly obvious" purpose that the appellant was borrowing money for was to fund the acquisition of LTT. The FTT's approach was wrong, a point which is reiterated under Ground 4. That was because, as alleged under Ground 1, the FTT ought not to have been focussing on the corporate group's choice to use a UK holding company to make the acquisition but rather should have concentrated on the appellant's purpose in borrowing the money. The appellant also makes the point under Ground 4 that given an ordinary tax deduction for financing costs on borrowings incurred on a commercially-driven purchase cannot reasonably be said to be the purpose of business expenditure for a commercial purpose it necessarily cannot be a "main" object of such a transaction.

- Given our conclusions on those legal propositions above, all these aspects of the errors alleged in Grounds 3 and 4 fall away.

- However, the appellant also argues that:

(1) Even if it was correct to evaluate the purpose by reference to all the transactions, the acquisition of LTT (step 7 in the 9-step plan) was clearly the main purpose. The FTT had found the funds were intended for the acquisition, were required for that purpose and so deployed. Mr Gardiner also submitted that the FTT's finding at [160] that the parent company's borrowing was commercial ought to have been conclusive that the appellant's borrowing was to acquire LTT. (Ground 3)

(2) The FTT's decision was flawed by comparing the actual transaction with a hypothetical transaction under which JGI itself made the acquisition because as a matter of fact JGI's agreement envisaged the later assignment to a holding company. (Ground 4)

- To the extent these matters challenge the FTT's approach, we have already discussed why i) the use to which funds were put, while relevant, was not determinative, ii) the fact the borrowing is used to acquire a commercial asset on arm's length terms does not close off further analysis and iii) that the fact a person intends to do something should not be conflated with the person having a purpose to do that thing (this was the point at which the Upper Tribunal in Kwik-fit thought the dictum in Kleinwort Benson was directed – see [60] above). The FTT clearly was apprised of the acquisition; it was included in the 9-step plan and there is nothing in its reasoning to suggest it ignored the fact of the acquisition. The FTT's ultimate conclusion was however that the purpose for which the appellant was party to the loan relationship was to secure the tax advantage of the debits.

- To the extent the appellant's arguments in essence challenge the FTT's evaluation of purpose in the light of the facts, they overlap with the appellant's challenge under Ground 8 that the FTT made findings contrary to the evidence, including its finding that there was no bona fide commercial or business purpose for the appellant being party to the loan relationship and also the point, also made under Ground 8, that in the absence of the loan relationship debits LTT would have been acquired by Joy Global in the US. We will accordingly address the points when dealing with Ground 8.

Ground 5 – the FTT failed to identify the purpose and intended scope of the unallowable purpose rule

- Under this ground, the appellant argues the FTT misinterpreted the unallowable purpose provisions. Those provisions do not target interest relief for commercial purchases or penalise companies which benefit from a mismatch in the relevant foreign tax rule. The approach the FTT adopted would mean every borrowing by a UK company to fund a purchase, where the UK company was chosen in the expectation of a tax deduction will fall foul of the unallowable purpose provisions.

- This error is addressed by our previous rejection of the appellant's interpretation of the provisions and the significance of the aids to statutory construction they rely on. From that analysis it is clear that interest relief incurred for a commercial purpose will usually and certainly not inevitably fall outside the rule. It will depend on the facts. It is also clear from what we have said under Ground 2 that the FTT's conclusion that the appellant had a purpose to secure a tax advantage was not dependent on the absence of a US tax charge. Moreover, as we have discussed, the extra-statutory materials relied on do not preclude the interpretation we have adopted.

- The FTT's approach resulted in a fact-sensitive conclusion that the main purpose for which the appellant was a party to the loan was to secure a UK tax advantage. It does not follow that in every situation where a UK company is chosen with the expectation of a tax deduction that will mean there is an unallowable purpose. There is no dispute that knowledge of the tax consequences will not equate to purpose (nor will an intention to claim a deduction). Whether there is such a purpose will depend on what the tribunal makes of any evidence advanced to show the requisite purpose and in respect of the taxpayer being a party for commercial reasons.

- The need to ascertain, not only that there was a tax advantage purpose, but that it was a main purpose should not be overlooked. In seeking to understand the limits of the unallowable purpose rules, we explored with Ms Wilson how the rules would apply to the familiar situation where a corporate group, having decided to make an acquisition for entirely commercial reasons, chose to fund the acquisition using debt. That was on the basis debt funding would result in a deduction for loan interest whereas if the acquisition was funded using equity (a share for share exchange) no deduction would arise. It would, on the face of it, seem remarkable if such a legitimate debt vs equity comparison meant the acquisition debt fell foul of the unallowable purpose rules. Ms Wilson acknowledged that this situation could result in the company having a purpose of securing a tax advantage but emphasised that the key question remained whether such purpose was the main purpose for being a party. So, in a situation where for instance a UK holding company was chosen to acquire a UK group and the debt route was chosen it would be open to the tribunal to consider that securing the tax advantage of deduction, although a purpose was not a main purpose. Whether something is a main purpose for which the company is a party to the loan relationship will also be a matter turning on the precise facts.

- Standing back, the outcome resulting from the FTT's approach is one which falls squarely within the scope of the provisions. The FTT found here that securing the tax advantage was the main purpose of the appellant being a party to the borrowing, rejecting the evidence there was a commercial purpose to being a party. In other words, the acquisition of LTT was "parked" in the UK not for commercial reasons, but in order to obtain loan relationship debits. Any disquiet at this result stems from an erroneous assumption that the reasons why a taxpayer is chosen to make the acquisition are ruled out of consideration, or that the use of the borrowing to buy a commercial asset is determinative, without regard to the wider circumstances in which that borrowing occurs. Those strictures are not at all apparent however from the legislative formulation Parliament has chosen to enact in s441 and s442.

Ground 6 – failure to appreciate when the question of attribution arises

Ground 7 - approach to question of apportionment

- As set out at [4] above, s441(3) prevents the company from bringing into account "so much of any debit in respect of [the loan relationship] as on a just and reasonable apportionment is attributable to the unallowable purpose".

- Both these grounds concern the question of how the FTT approached that attribution and we deal with them together. They have only become relevant, given our dismissal of the other grounds of appeal as discussed above.

- Ground 6 concerns the FTT's legal interpretation of ss441 and 442 that no question of attribution arose where, as here, securing a tax advantage was found to be the main purpose ([179]). The FTT considered the issue of attribution would only arise "if the Appellant established that the tax avoidance purpose is not the main purpose, or one of the main purposes…"([127]). That reasoning, which was undertaken on the FTT's own initiative, as neither party had argued for it, was based on the particular terms of the rewrite of the unallowable purpose provisions FA 1996 into ss 441 and 442 CTA 2009.

- The FTT went on nevertheless to express its views on a just and reasonable attribution on the assumption it was wrong on its view that attribution was not necessary. In that part of its decision it concluded the whole of the debits were attributable to an unallowable purpose. In essence its reasoning was that the appellant would not otherwise have existed in the first place were it not for the tax advantage purpose.

- This is the subject of the appellant's Ground 7 where it is argued the FTT erred in its approach to attribution. It is submitted first that the FTT failed to focus on the appellant's purpose for the borrowing rather than on the group's purpose for the 9 step transaction and second that it erred by failing to recognise the statutory intention must have been to ensure that the appellant received its deduction for funding costs just as any other taxpayers incurring interest on finance used for ordinary commercial expenditure would.

- HMRC's position is that it is unnecessary for us to consider Ground 6 on the basis the appellant's appeal cannot succeed in any event under Ground 7. We consider it should be addressed. If the appellant is right then the FTT will have made an error of statutory interpretation, the correction of which ought to be made transparent, even if the error did not change the result.

- The FTT's explanation of what burden lay on the appellant and that attribution was not necessary if that burden was met centred on the third condition in 442(4) being a negative condition i.e. that the appellant had to establish that securing the tax advantage was not the main purpose or one of the main purposes. Accordingly:

"… if the Appellant cannot establish the negative condition to the requisite standard, then the tax avoidance purpose is an 'unallowable purpose' for section 441 purposes. The fact-finding tribunal is not required to find positively that the tax avoidance purpose was the (or a) main purpose for which the Appellant entered into the transaction in question. In other words, the statutory wording of section 442 does not require a positive case to be established that the tax avoidance purpose was the (or a) main purpose for section 441 to apply. It is a matter of burden, to be discharged by the Appellant, in satisfying the negative condition."

- The FTT's reasoning for why the attribution test in 441(3) was not relevant, where the appellant had not met the burden described above, appears to result from its view that s442 did not require a positive finding that the tax avoidance purpose was the, or a, main purpose. That contrasted with the parties' formulation of the issues for resolution which did require such a finding in order to determine the issue of attribution. The FTT summarised its view as follows (at [127]):

(1) If the appellant fails to meet the burden under subsection 442(4), then the attribution issue falls away.

(2) If the appellant establishes that the tax avoidance purpose is not the main purpose, or one of the main purposes, then the attribution issue follows.

- We find the FTT's reasoning difficult to follow. The essence appears to be that if the burden was not met, only the tax avoidance purpose was at play and therefore there was nothing to attribute. However, that seems to rest on an incorrect assumption that a main tax avoidance purpose would rule out there being other purposes whether main or not. Conversely, it seems the FTT considered where the burden was met, there would, by definition, be a non-tax avoidance purpose at play giving rise to the need for an attribution between that and any tax avoidance purpose. However, in that situation there would not be an unallowable purpose so the provisions would not even apply in the first place.